Pepe Price Forecast: PEPE eyes 20% rally as Open Interest hits record high

- Pepe price holds steady around the weekly level of $0.000013 on Wednesday, indicating potential for an upward breakout.

- Open Interest surges to a new all-time high of $1.02 billion and PEPE’s holders accumulation rises.

- The technical outlook suggests bulls are in control, with over 20% rally on the horizon.

Pepe (PEPE) price holds steady around the weekly level of $0.000013 at the time of writing on Wednesday, suggesting a potential rally may be on the horizon. Derivatives and on-chain data support the bullish thesis, as PEPE’s Open Interest (OI) reached record levels and holders’ accumulation increased. The technical outlook supports a positive outlook, with PEPE bulls aiming for a rally of over 20% in the upcoming days.

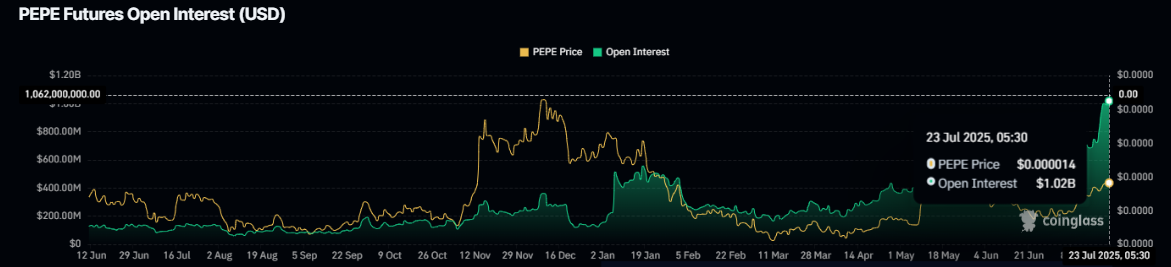

Pepe’s Open Interest hits record highs

Futures’ OI in Pepe at exchanges rose from $748.38 million on June 17 to $1.02 billion on Wednesday, a new all-time high, according to data from CoinGlass. Rising OI represents new or additional money entering the market and new buying, which could fuel the current PEPE price rally.

Pepe Futures Open Interest chart. Source: CoinGlass

Santiment’s Supply Distribution data supports a bullish outlook for Pepe, as the number of large-wallet holders (whales) is increasing.

The metric indicates that whales holding between 100,000 and 1 million (red line), 1 million and 10 million (yellow line), and 10 million and 100 million (blue line) PEPE tokens have been consistently accumulating since early July, with a net buying activity of 42.16 billion tokens, bolstering Pepe’s bullish outlook.

[11-1753256303379.00.37, 23 Jul, 2025].png)

Pepe Supply distribution chart. Source: Sentiment

PEPE Price Forecast: Bulls aiming for gains over 20%

Pepe on the weekly chart has retested its weekly support level at $0.000011 and rallied nearly 14% last week. As of this week, it hovers at around $0.000013 at the time of writing on Wednesday.

If PEPE continues its upward trend, it could extend the rally toward its 50% Fibonacci level at $0.000016, drawn from the all-time high reached n December at $0.000028 to the March low of $0.000005.

The Relative Strength Index (RSI) on the weekly chart reads 57, surpassing its neutral level of 50, which indicates bullish momentum is gaining traction. The Moving Average Convergence Divergence (MACD) indicator on the weekly chart showed a bullish crossover in early May, which remains in effect. The rising green histogram bars above its neutral zero line suggest that bullish momentum is gaining traction.

PEPE/USDT weekly chart

On the daily chart, Pepe price rebounded after retesting its previously broken descending trendline on Saturday, closing above the daily resistance at $0.000013 the next day. PEPE has been stabilizing around this level since then, and at the time of writing on Wednesday, hovers around the same daily level of $0.000013.

If the daily support at $0.000013 holds, it could extend the rally by 22% from this level toward its next daily resistance at $0.000016, which coincides with the weekly target mentioned above.

The RSI on the daily chart reads 68, which is slightly below its overbought level of 70, suggesting that the bulls still maintain control of the momentum. The MACD indicator on the same chart displayed a bullish crossover at the end of June, which still holds. However, the intensity of green histogram bars above its neutral zero line is decreasing, suggesting fading bullish momentum.

PEPE/USDT daily chart

If PEPE faces a pullback and closes below the daily support at $0.000013, it could extend the decline toward its next support at $0.000012.