Ethereum Price Forecast: ETH is 'heading higher' as demand outpaces supply: Bitwise

Ethereum price today: $3,720

- Ethereum is "heading higher" despite rallying over 160% in the past three months, according to Bitwise's Matt Hougan.

- ETH treasuries and ETFs have accumulated 32 times more ETH than the amount of newly issued supply since mid-May.

- ETH suffers rejection near $3,800 as overbought RSI could spark decline toward key support levels.

Ethereum (ETH) trades near $3,700 on Tuesday but could continue its bullish run over the next year with a potential $20 billion buying pressure from crypto treasuries and exchange-traded funds (ETFs), according to Bitwise CIO Matt Hougan.

Ethereum demand outpaces supply, trend could accelerate over the next year

Ethereum is "heading higher," despite already rising by over 160% since April, noted Bitwise CIO Matt Hougan in a note to investors on Tuesday.

The prediction comes amid sustained buying pressure from Ethereum treasury firms and US spot ETH ETFs. Several public companies, including SharpLink Gaming (SBET), BitMine (BMNR), and Bit Digital (BTBT), have launched crypto treasuries focused on ETH over the past two months, with combined holdings of over 840,000 ETH at the time of publication.

During the same period, US spot Ethereum ETFs had posted over $5 billion in net inflows. Since mid-May, both entities have amassed over 2.83 million ETH, which is 32x more than the amount of newly issued supply during the period.

"In the short term, the price of everything is set by supply and demand, and right now, there is more demand for ETH than supply," wrote Hougan.

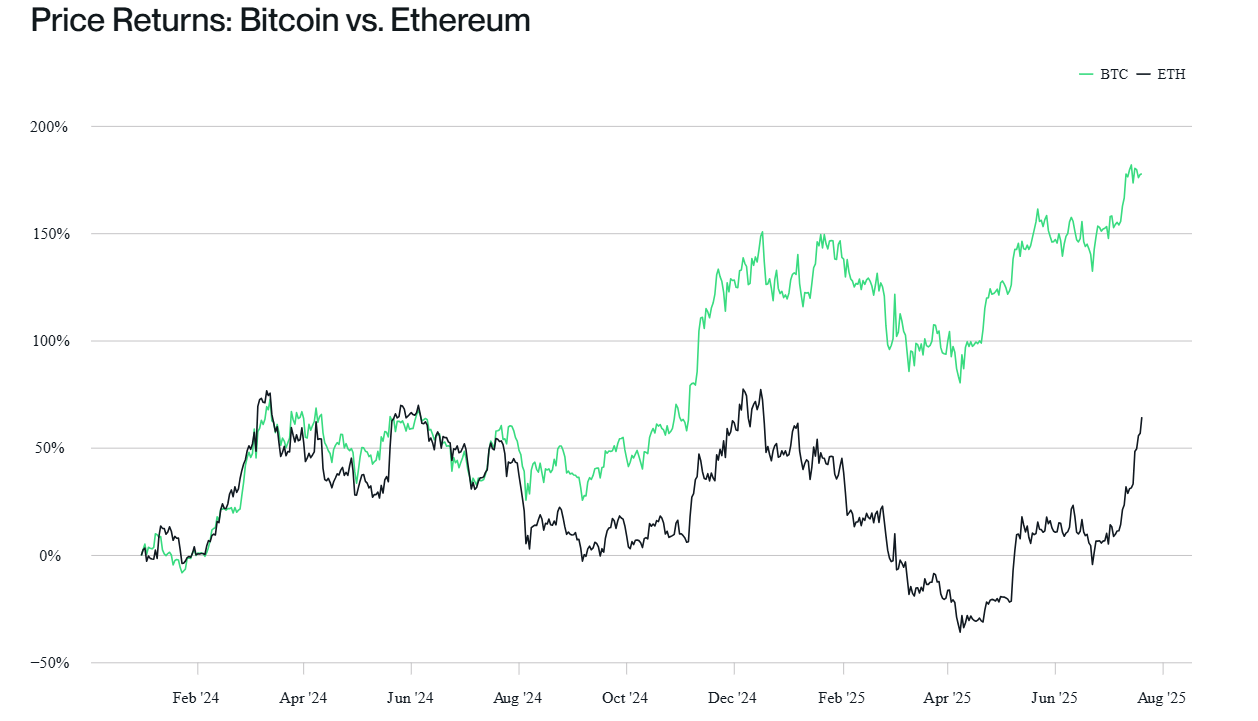

The Bitwise CIO highlighted that ETH treasury companies and ETFs could buy $20 billion worth of the top altcoin over the next year — 7x more demand than the projected supply of newly issued ETH. This could see ETH break its underperformance of Bitcoin, which has surged more than 155% over the past year, upon a 5x increase in demand over supply.

Ethereum significantly underperformed Bitcoin over the past two years, struggling to post sizable long-term gains while BTC continued to surge to new all-time highs.

BTC vs. ETH Returns. Source: Bitwise

"With all the excitement surrounding stablecoins and tokenization — which are primarily built on Ethereum — we think that will change, and that we'll see billions in flows in the next few months," added Hougan.

Meanwhile, ETH ETFs recorded $296.5 million in net inflows on Tuesday, extending their streak to twelve consecutive days of positive flows, per SoSoValue data.

Ethereum Price Forecast: ETH suffers rejection near $3,800 amid overbought RSI

Ethereum saw $144.72 million in futures liquidations in the past 24 hours, according to Coinglass data. The total amount of long and short liquidations reached $110.61 million and $34.12 million, respectively.

After an extended bullish run over the past two weeks, ETH is facing a rejection at the resistance near $3,800. The move follows sustained overbought conditions in the Relative Strength Index (RSI) and Stochastic Oscillator (Stoch), which increases the chances of a short-term pullback. If the RSI declines below its moving average line and retreats from the overbought region, ETH could decline toward the support at $3,470.

ETH/USDT daily chart

Further down, ETH could find support near the $3,200 and $2,850 key levels — strengthened by the 14-day and 50-day Exponential Moving Averages (EMAs), respectively.

On the upside, ETH has to recover the $2,800 level and overcome a descending trendline resistance to complete the target of a bullish pennant that dates back to May 8.

A recovery of these levels could see ETH test the critical resistance near $4,100, which has been defended by bears all through 2024.

A daily candlestick close below $2,850 will invalidate the thesis and potentially send ETH toward $2,500.