Bitcoin Correlation To Altcoins Is Collapsing: A Warning Sign?

Data shows Altcoins are breaking away from Bitcoin’s lead. Here’s what that could mean for the market, based on historical trends.

Altcoins Are Witnessing A Fast Drop In Correlation To Bitcoin

In a new post on X, analytics firm Alphractal has discussed how the Correlation between Bitcoin and the altcoins has changed recently. The Correlation is an indicator that keeps track of how tied together the prices of any two assets are. The metric can take on both positive and negative values. In both cases, some relationship exists between the assets, but the relative movement in their prices is different.

When the indicator has a positive value, it means one asset is reacting to movements in the other by moving in the same direction. The closer is the metric to 1, the stronger is this relationship. On the other hand, it being under zero suggests a negative correlation exists between the assets: they are moving in opposite directions. In this case, the extreme point lies at -1.

If the Correlation is sitting exactly at zero, it suggests no relationship exists between the two prices at all. In statistics, this condition corresponds to the variables being independent.

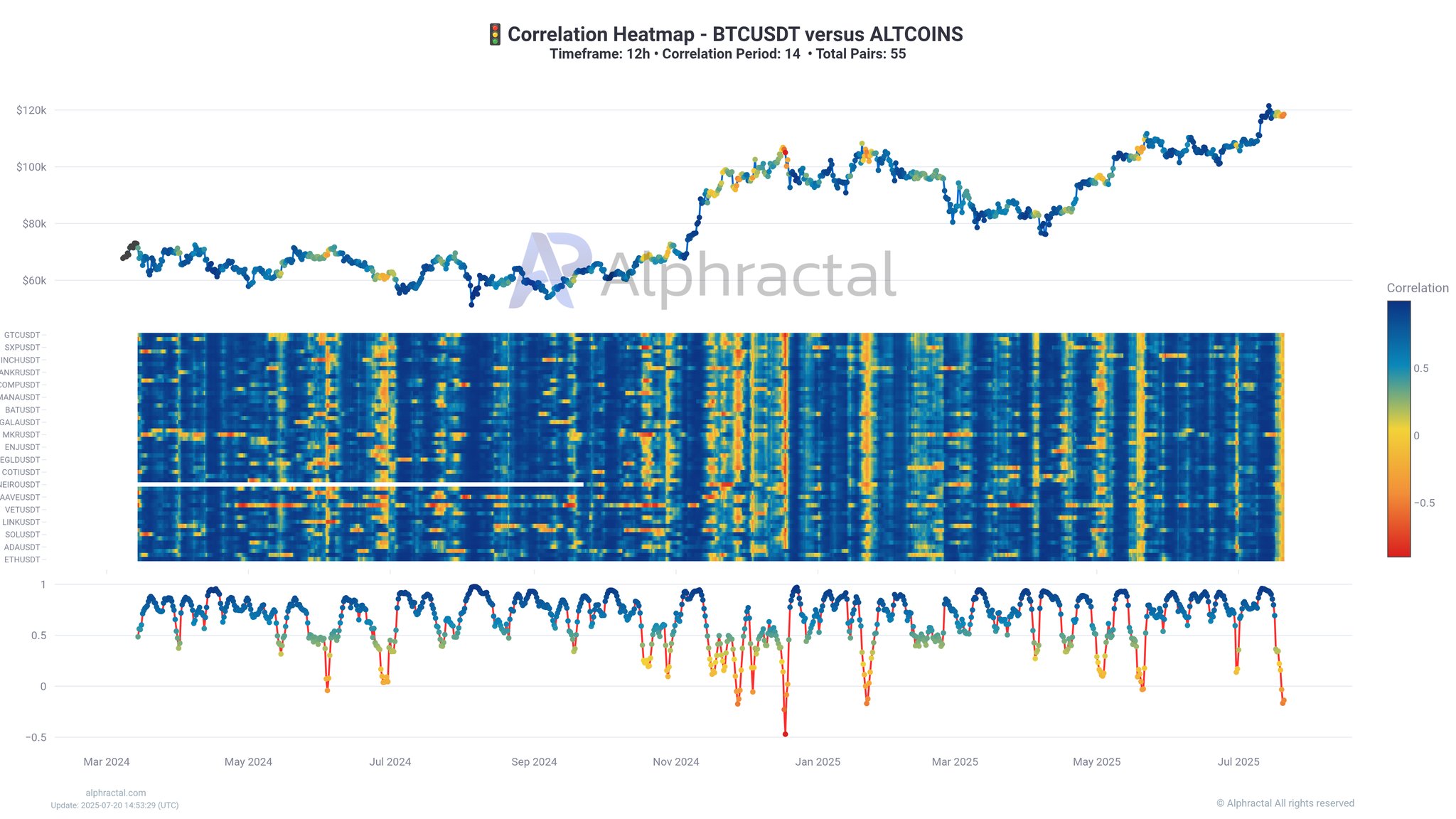

Now, here is the heatmap shared by Aphractal that shows the trend in the Correlation between Bitcoin and the various altcoins in the sector:

As is visible above, the Correlation between Bitcoin and the different altcoins was close to 1 just earlier, but the indicator has seen a quick decline since then. The average value of the indicator for the two has now dipped toward the zero level and has even turned slightly negative.

This change would suggest that while the altcoins were closely following the footsteps of the original cryptocurrency before, they are now following a chart that’s more or less independent. This trend, however, may not actually be a positive sign for the sector. “Historically, low correlation is a red flag,” explains the analytics firm. “It often precedes periods of high volatility and mass liquidations — whether from shorts or longs.”

From the chart, it’s apparent that the last time the Correlation between Bitcoin and the altcoins plunged to zero was back in May, and what followed was a price jump for the asset. In January, the same trend marked the market top instead.

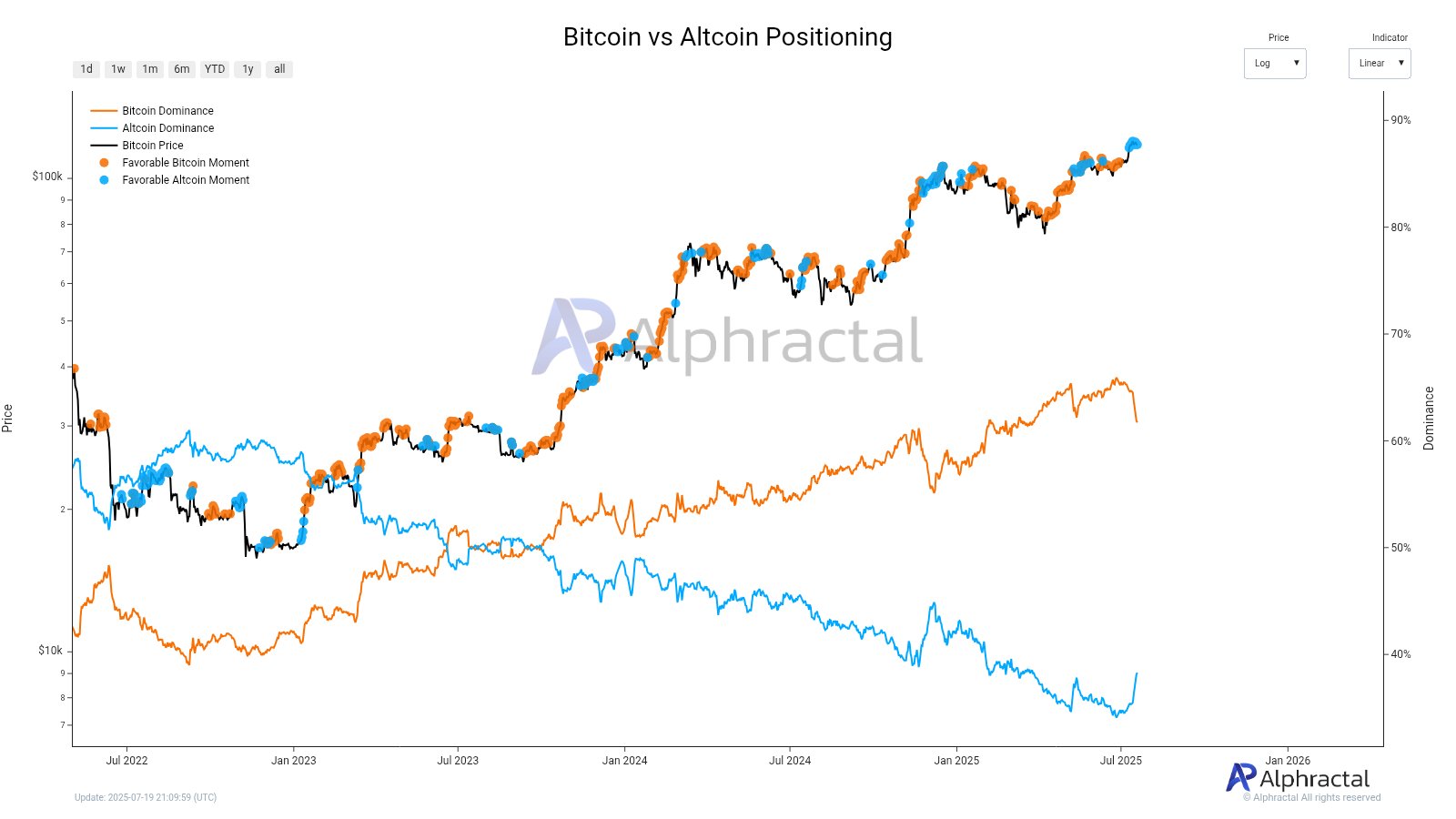

The latest low Correlation between BTC and the alts has come as various assets have broken out and market dominance has seen a shakeup.

“Altcoins have been outperforming Bitcoin in recent days, with daily signals suggesting it’s been more profitable to stay positioned in altcoins rather than BTC,” notes Alphractal.

BTC Price

At the time of writing, Bitcoin is trading around $118,000, down more than 2.5% in the last week.