Cardano Price Forecast: ADA eyes further gains amid rising Open Interest, bullish bets

- Cardano extends bullish momentum on Thursday, gaining over 40% in the last ten days and nearing a critical resistance level.

- Derivatives data shows an increase in long positions aligning with the rising Open Interest, which inches closer to a record high.

- The technical outlook indicates a bullish bias as Cardano gains momentum.

Cardano (ADA) ticks higher by over 7% at press time on Thursday, reclaiming the $0.80 mark and hitting a new over one-month high. Both the increasing bullish bets on Cardano and the ADA Open Interest crossing $1.40 billion reflect the upbeat sentiment among derivative traders. The technical outlook suggests a boost in bullish momentum that could potentially drive Cardano to the $1 milestone.

Bulls up the ante as Cardano Open Interest nears record high

In crypto market derivatives, Open Interest (OI) refers to capital held by active perpetual contracts of an asset. A spike in OI reflects increased interest in a coin among the derivatives traders, leading to heightened capital flow.

CoinGlass’ data shows the ADA OI surge 16.30% over the last 24 hours, reaching $1.44 billion, nearing its all-time high of $1.50 billion set on January 18.

Typically, leverage-driven activity results in sharp fluctuations in the swap price compared to spot market values. To offset the imbalance, bulls pay positive funding rates and vice versa.

At the time of writing, OI-weighted funding rate stands at 0.0219% suggesting increased buying activity among traders.

ADA Derivatives data. Source: Coinglass

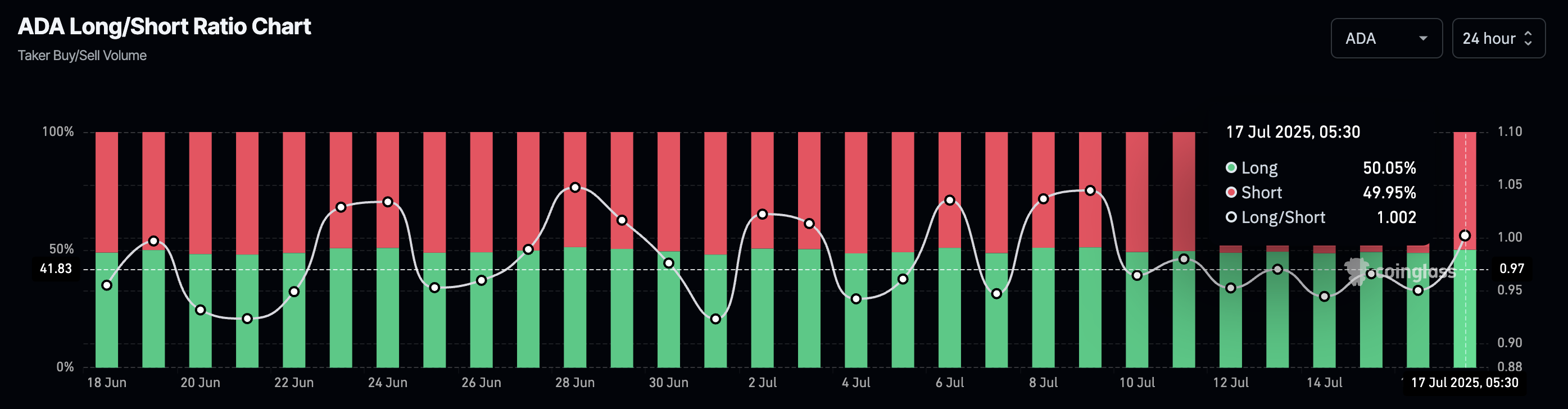

The Taker buy/sell volume indicates that the long position holds 50.02% of the taker volume, up from 48.72% on Wednesday, resulting in a long/short ratio of slightly over 1. An increase in bullish bets is evident, as evidenced by the rising long positions over the last 24 hours.

Taker buy/sell volume. Source: Coinglass

Cardano targets $1 as bullish momentum increases

Cardano appreciates over 7% on the day, surpassing the $0.80 mark. At the time of writing, ADA hits the 50% Fibonacci retracement level at $0.8233, drawn from the December 3 peak of $1.3264 to the April 7 low of $0.5110.

A decisive daily push above this level could stretch the bullish run in Cardano to the 61.8% Fibonacci level at $0.9214. If the uptrend sustains momentum, ADA could reclaim the $1 milestone.

The 200-day, 100-day, and 50-day Exponential Moving Averages (EMAs) witness an uptick, increasing the chances of bullish crossovers and a Golden Cross. The dynamic average lines, at $0.6894, $0.6760, and $0.6581, respectively, would act as support levels in the event of a bearish reversal.

The Relative Strength Index (RSI) reads 79 on the daily chart, indicating increased buying momentum and skewing into the overbought zone. Investors must remain cautious as overbought conditions could result in a reversal.

Still, the Moving Average Convergence/Divergence (MACD) indicator displays a positive trend in the MACD and signal lines, which are above the zero line. From the same line, green histogram bars regain strength, suggesting increased bullish momentum.

ADA/USDT daily price chart.

On the downside, a reversal in Cardano from the 50% Fibonacci retracement level at $0.8233 could extend the declining trend toward the 200-day EMA at $0.6894.