Here is what you need to know on Thursday, July 17:

Following Wednesday's volatile action, the US Dollar (USD) gathers strength against its rivals early Thursday. In the second half of the day, the US economic calendar will feature weekly Initial Jobless Claims data and the Retail Sales report for June. Later in the American session, several Federal Reserve (Fed) policymakers will be delivering speeches.

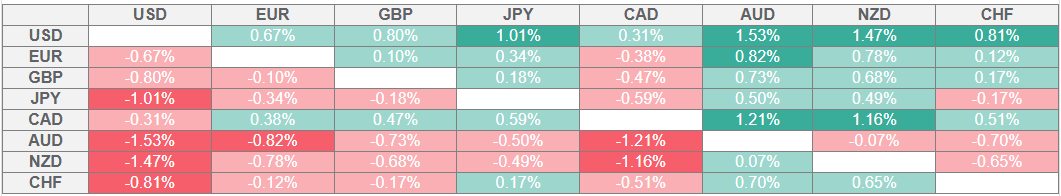

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Citing multiple sources with direct knowledge of the matter, CBS News reported on Wednesday that United States (US) President Donald Trump asked Republican lawmakers whether he should fire Federal Reserve (Fed) Chairman Jerome Powell. With the immediate reaction to this headline, the USD came under renewed bearish pressure and the USD Index closed in the red to snap a four-day winning streak. Later in the day, Trump noted that they were very close to a trade agreement with India and added that a deal could also be reached with Europe. Early Thursday, the USD Index gains about 0.5% on the day at around 98.70 and US stock index futures trade mixed.

The UK's Office for National Statistics (ONS) reported in the European morning on Thursday that the ILO Unemployment Rate ticked up to 4.7% in the three months to May from 4.6%. Other details of the report showed that Employment Change was up 134,000 in this period, compared to the 89,000 increase recorded previously. Following a quiet Asian session, GBP/USD edges lower after this report and trades below 1.3400.

EUR/USD stays on the back foot after posting modest gains on Wednesday and fluctuates below 1.1600. The Eurostat will release revisions to June Harmonized Index of Consumer Prices data later in the session.

The data from Australia showed that earlier in the day that the Unemployment Rate rose to 4.3% in June from 4.1%. The Full-Time Employment declined by 38.2K in this period. AUD/USD stays under heavy selling pressure following the disappointing employment report and trades at its lowest level in three weeks near 0.6460, losing about 1% on the day.

After registering large losses on Wednesday, USD/JPY reverses its direction and gains more than 0.5% on the day at around 148.70 on Thursday. Japan’s Deputy Chief Cabinet Secretary Kazuhiko Aoki reiterated that he is concerned about the foreign exchange market movements, including speculative moves.

Gold benefited from falling US Treasury bond yields and closed in positive territory on Wednesday. XAU/USD struggles to hold its ground early Thursday and trades below $3,330.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.