US Dollar Index advances ahead of the US Retail Sales release due on Thursday.

The US Dollar gains ground amid the increasing likelihood of the Fed maintaining its interest rates in July.

Trump announced plans to notify over 150 countries in a single letter about a forthcoming 10% tariff.

The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six major currencies, is retracing its recent losses from the previous session and trading around 98.50 during the Asian hours on Thursday. Traders will keep an eye on the US Retail Sales for June, followed by weekly Initial Jobless Claims and Philly Fed Manufacturing Index due later in the North American session.

The Greenback receives support from rising odds of the Federal Reserve (Fed) maintaining its benchmark overnight interest rate unchanged in the 4.25%-4.50% range at its July policy meeting, driven by the hotter-than-expected June inflation figures from the United States (US).

The US Bureau of Labor Statistics reported on Tuesday that the US Consumer Price Index (CPI) rose 2.7% year-over-year in June, matching market expectations. Core CPI came in at 2.9%, just below the 3.0% forecast but still notably above the Federal Reserve’s 2% target. On Wednesday, the bureau released US Producer Price Index (PPI) data, showing it remained unexpectedly unchanged in June, while core PPI rose 2.6% year-over-year.

Dallas Fed President Lorie Logan said on Tuesday that the Fed will probably need to leave interest rates where they are for a while longer to ensure inflation stays low in the face of upward pressure from the Trump administration's tariffs. Moreover, New York Fed President John Williams said late Wednesday that monetary policy is in the right place to allow the Fed to monitor the economy before taking its next decision.

The latest Fed Beige Book shows that while overall business activity remains healthy and inflation pressures are relatively subdued, underlying cost pressures are building, and business operators remain cautious.

US President Donald Trump said on Wednesday that he plans to send a single letter to over 150 countries, notifying them of a 10% tariff rate they will face. He emphasized that these are "not big countries" with limited trade ties to the US, unlike China or Japan. He also hinted the rate could rise to 15–20%, though he did not confirm any specifics. Regarding tariffs on Canada, he said it’s too soon to comment. A tariff deal with India, however, is very close.

US Dollar PRICE Today

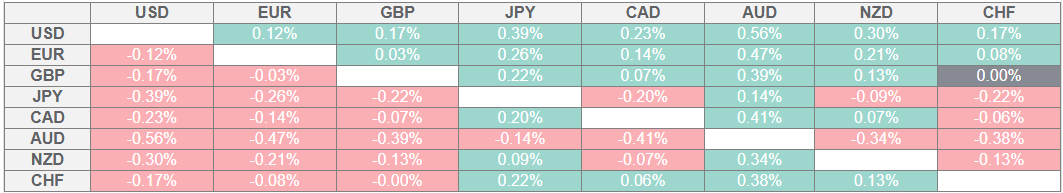

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.