Pi Network Price Forecast: PI test crucial support level amid bullish RSI divergence

- Pi edges lower to retest a crucial support level as it decouples from the broader market recovery.

- PI token unlocks and increasing balance on CEXs boost selling pressure.

- A large investor acquired PI worth over $2 million in the last three days.

Pi Network (PI) edges lower by 2% at press time on Tuesday, failing to join the bandwagon of altcoins fueled by Bitcoin (BTC) reaching record high levels. The increasing supply pressure on Centralized Exchanges (CEXs) and the token unlocks fuel the declining trend in PI token, resulting in a retest of the $0.4460 support level. A confident, large investor adds over $2 million in PI tokens amid the declining trend, while technicals signal a bullish divergence.

Pi Network’s rising selling pressure

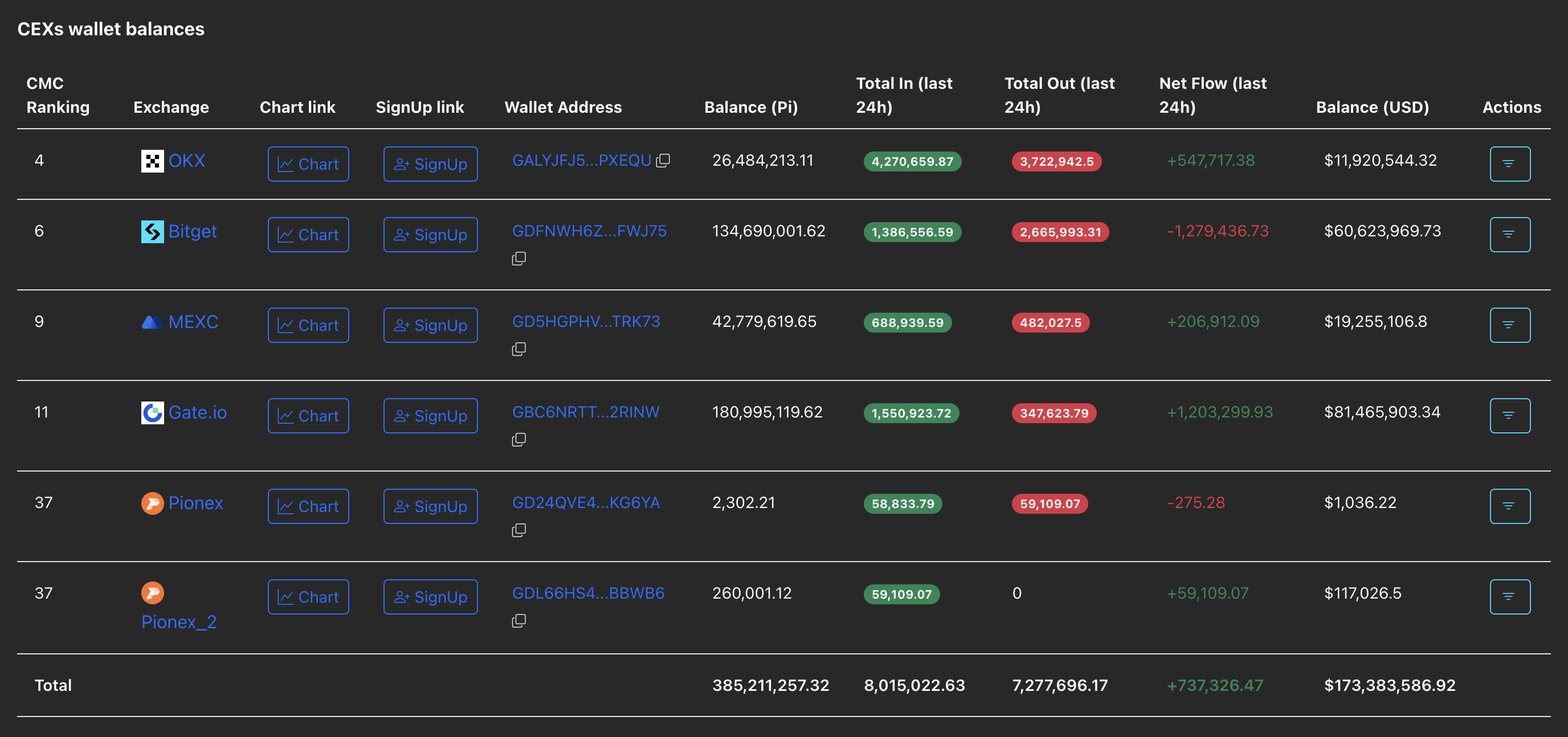

CEXs' wallet balances of Pi Network refer to the amount of PI tokens deposited on exchanges, which could be set to be sold. An increase in the CEXs' balances highlights increased deposits as selling pressure rises.

PiScan data shows a net increase of 737,326 PI tokens over the last 24 hours, while the total PI available on listed exchanges amounts to 385.21 million PI.

CEXs wallet balances. Source: PiScan

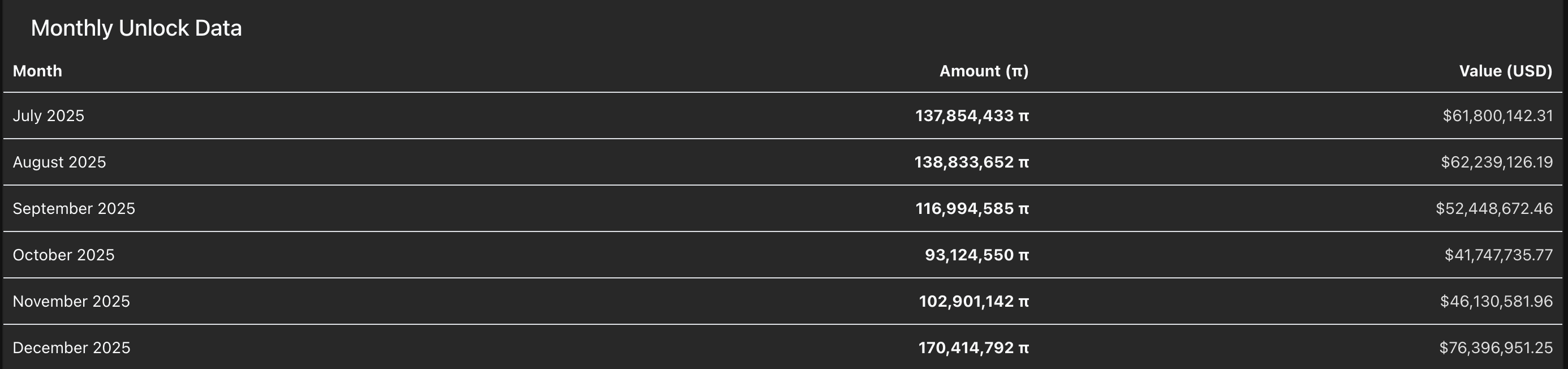

Amid this, the PI token unlocks in July are the largest until October 2027, as previously reported by FXStreet. The data shows 137.85 million PI tokens to be unlocked in the rest of July, almost equal to the August monthly unlock of 138.83 million PI tokens.

PI token unlock statistics. Source: PiScan

As selling pressure grows, a bearish domination over the Pi Network is possible.

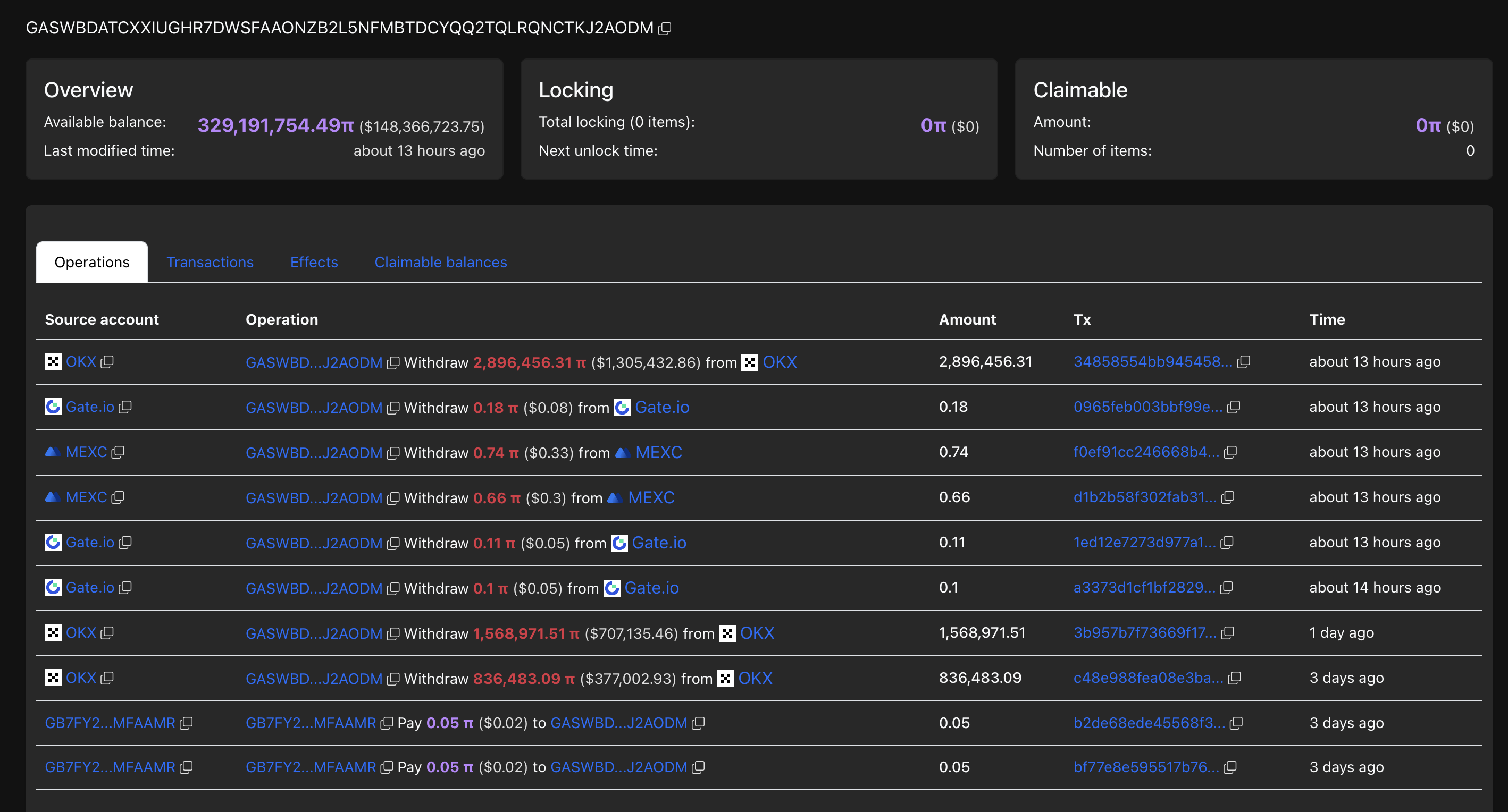

Large investor remains confident in Pi Network

Amid the overhead pressure, a confident whale has acquired 5.30 million PI tokens for $2.38 million over the last three days. Typically, large investors acquire undervalued coins at discounted prices, anticipating a reversal, while retail investors offload them.

Whale account balance. Source: PiScan

Pi Network risks further losses as pressure builds over a crucial support level

Pi Network drops below the $0.500 psychological level after briefly reclaiming it last week with an Adam and Eve pattern breakout on the 4-hour price chart. The declining trend hits the $0.446 support level on Tuesday, last tested on July 6, while a lower shadow candle displays the bullish effort to avoid further losses.

If PI marks a 4-hour candle close below this level, it could extend the declining trend to the $0.400 round figure last tested on June 13.

The Relative Strength Index (RSI) on the 4-hour chart reads 34, showing a divergence with the price action from the July 6 drop to 23.

Still, the Moving Average Convergence/Divergence (MACD) and its signal line cross below the zero line, indicating a bearish trend. The rising red histogram bars indicate increasing bearish momentum.

PI/USDT daily price chart.

To reinforce a bullish trend, Pi Network must reclaim the $0.473 resistance level, last tested on Monday. A clean push above this level could extend the recovery run to the $0.500 psychological level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.