Renewed interest in Decentralized Finance boosts Ethereum’s TVL, Bitcoin DeFi case

- The DeFi market's total value locked adds over $34 billion within three months, suggesting increased demand for DeFi protocols.

- Ethereum dominates the DeFi market, accounting for 57% of the TVL at $69.25 billion.

- Rising institutional demand for Bitcoin could catalyze breakthroughs in BTC DeFi.

With the Bitcoin (BTC) price creating a new all-time high on Thursday, the cryptocurrency market is witnessing renewed interest from investors, especially in the Decentralized Finance (DeFi) space. The total value locked (TVL) on the DeFi market has increased by over $34 billion within the last three months as investors shift their focus to the utility of digital assets, rather than relying solely on simple capital gains.

The shift highlights a sign of increased maturity among investors, which could further boost demand for DeFi services. On the other hand, the increased institutional interest could boost Bitcoin’s inclusion in DeFi services.

Ethereum dominates the DeFi growth story

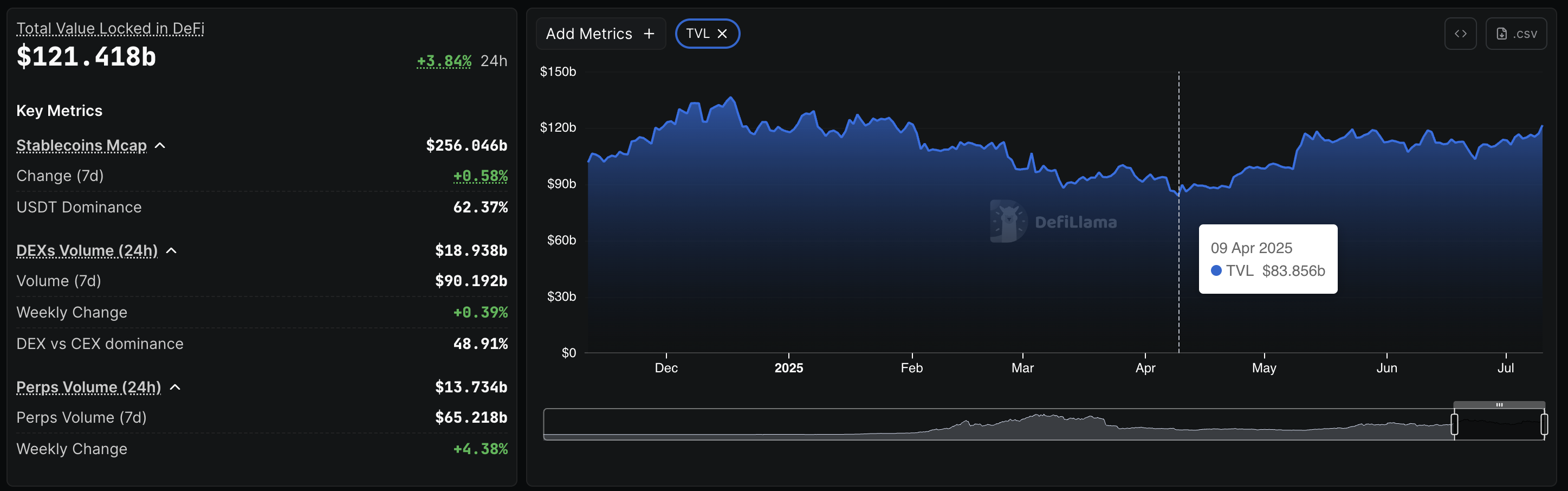

The DeFi market’s total value locked (TVL) represents the US Dollar value of digital assets locked across all protocols. DeFiLlama’s data indicates that the market’s TVL stands at $121.41 billion, having risen from the year-to-date low of $83.85 billion on April 9. Inflows of over $34 billion in the last three months highlight renewed interest in DeFi services.

DeFi TVL. Source: DeFiLlama

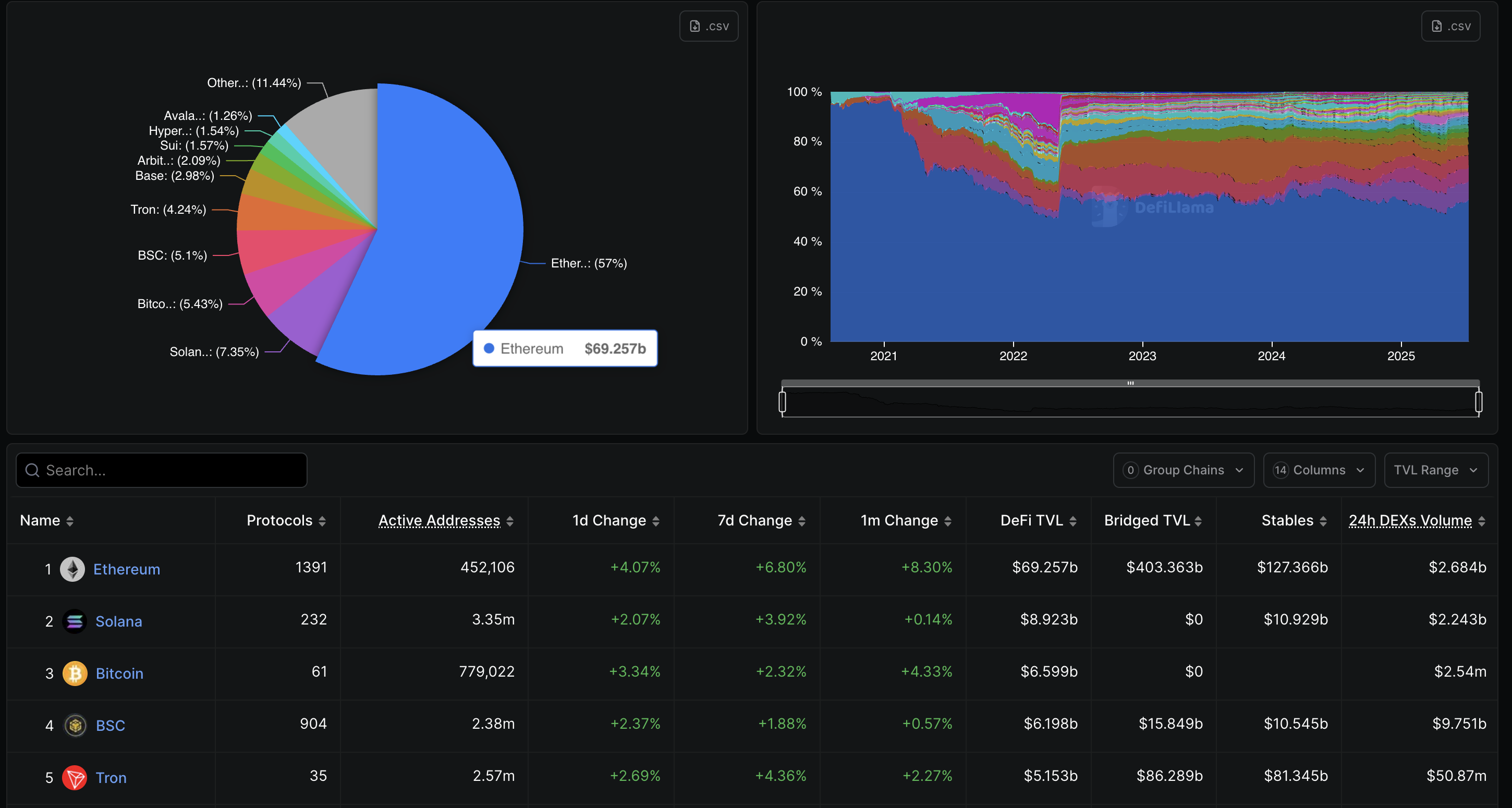

Ethereum holds $69.25 billion in TVL, up from $44.04 billion on April 9, accounting for a 57% share of the market TVL. This translates to $25 billion of inflow for Ethereum out of the total $34 billion inflow seen across all protocols.

Ethereum TVL share. Source: DeFiLlama

Investors could find the push from Ethereum Exchange-Traded Funds (ETFs) issues for staking as the next catalyst. With institutions entering the fray, massive inflows could further boost TVL. According to SoSoValue, as of July 9, the total ETH held by the US spot Ethereum ETFs accounted for $11.84 billion.

Institutions could unlock the Bitcoin DeFi case

Bitcoin, worth over $2.21 trillion, holds a 64.63% market share based on valuations. Despite a short-term decline in dominance, Bitcoin is worth more than all the altcoins combined.

BTC dominance chart.

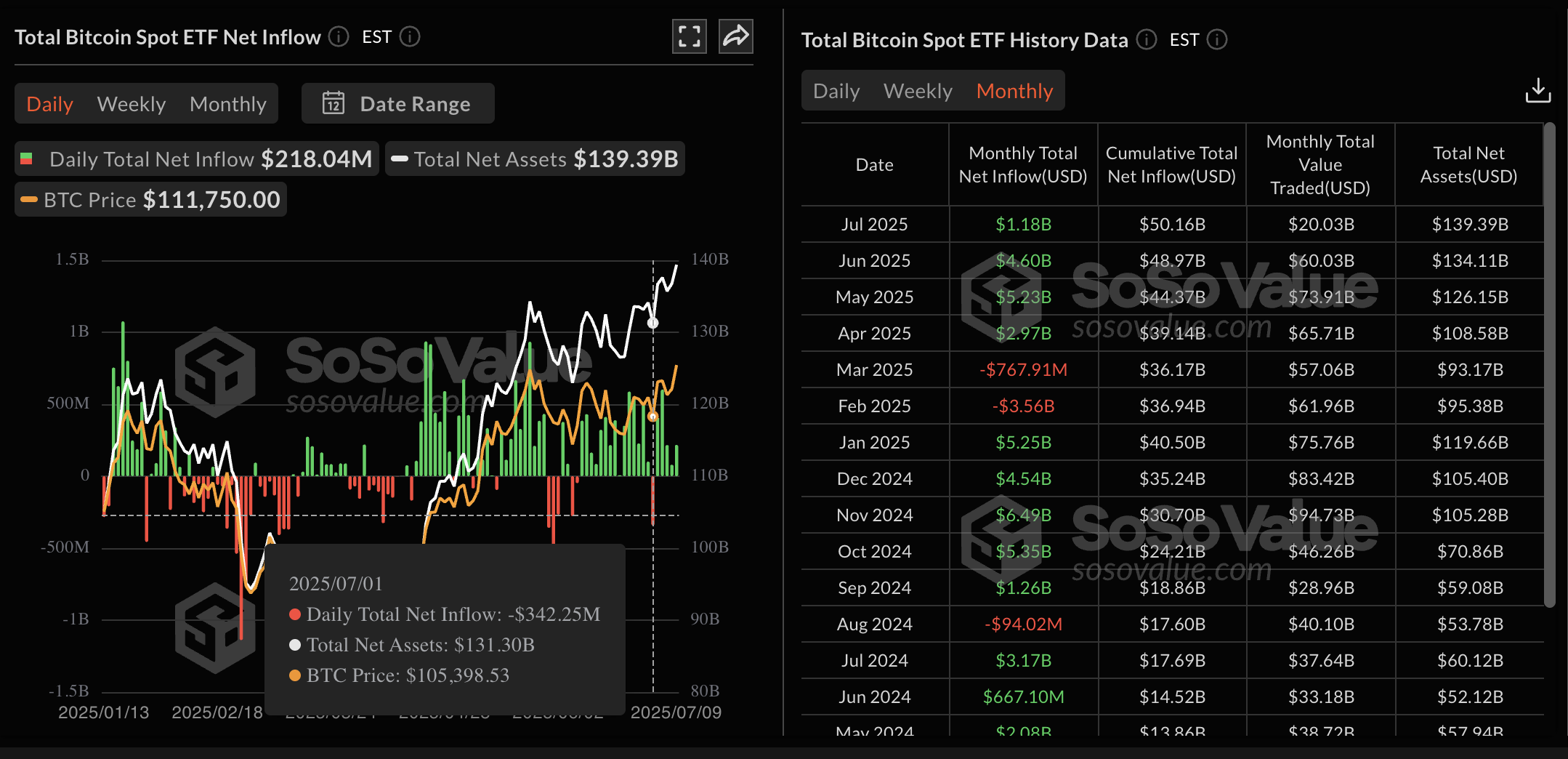

As a digital store of value, the increased institutional appetite for Bitcoin has driven a net inflow of $14.90 billion in 2025 so far. As of July 9, the US spot Bitcoin ETFs held $139.39 billion worth of BTC. It is worth noting that since June 9, the US spot Bitcoin ETFs have recorded just a single day of outflow, amounting to $342.25 million on July 1.

Bitcoin ETF netflows. Source: SoSoValue

However, Bitcoin’s expanding use case merges into the DeFi space with staking and other features. DeFiLlama data shows that Bitcoin holds a TVL of $6.59 billion, the third largest in the segment.

A push similar to Ethereum staking by ETF issuers for Bitcoin could boost its DeFi market share. If the authorities greenlight staking and/or DeFi services for ETF issuers, a potential massive inflow could undermine Ethereum’s dominance.