Solana price rebounds backed by staking ETF launch, DeFi Dev's $100 million offering for SOL purchase

- Solana rebounds, reclaiming the $150 support underpinned by institutional interest and demand.

- REX-Osprey Solana + Staking ETF becomes the first of its kind product to trade in the US.

- DeFi Development Corp announces a $100 private convertible note offering to purchase SOL.

Solana (SOL) is showing signs of extending its recovery, following a 4% increase to trade at $153 on Wednesday. This uptick in price comes amid key adoption milestones, including the launch of the first Solana staking Exchange Traded Fund (ETF) in the United States (US).

Interest in SOL appears to be steady, according to CoinGlass data on the futures Open Interest (OI), which averaged approximately $7 billion on Wednesday. Open interest is the value of all the futures and options contracts that have not been settled or closed. It can be used to gauge market sentiment, with a steady increase indicating growing risk appetite.

Solana Futures Open Interest | Source: CoinGlass

Solana staking ETF starts trading in the US

REX Shares and Osprey Funds' REX-Osprey Solana + Staking ETF (SSK) began trading on the Cboe exchange, becoming the first of its kind financial product to be listed in the US.

Anchorage Digital was selected as the exclusive custodian and staking partner for the ETF product, licensed under the Investment Company Act of 1940. Unlike the 12 Bitcoin spot ETFs operating in the US, which require the fund issuers to hold the underlying assets, the new product requires the custodian to hold the underlying digital asset.

Since Anchorage Digital is the only regulated bank in the US with the authority to provide custody and staking services for digital assets, it will fill the gap, according to CoinDesk.

The Solana staking ETF offers investors indirect exposure to SOL, along with the opportunity to contribute to the network's functionality through staking smart contracts. Staking provides additional yield as a reward for securing the Solana protocol.

"The launch of crypto staking ETFs marks a win for consumers and a significant step forward in full access to the crypto ecosystem," CEO and co-founder of Anchorage Digital, Nathan McCauley, said.

DeFi Development to purchase $100 million worth of SOL

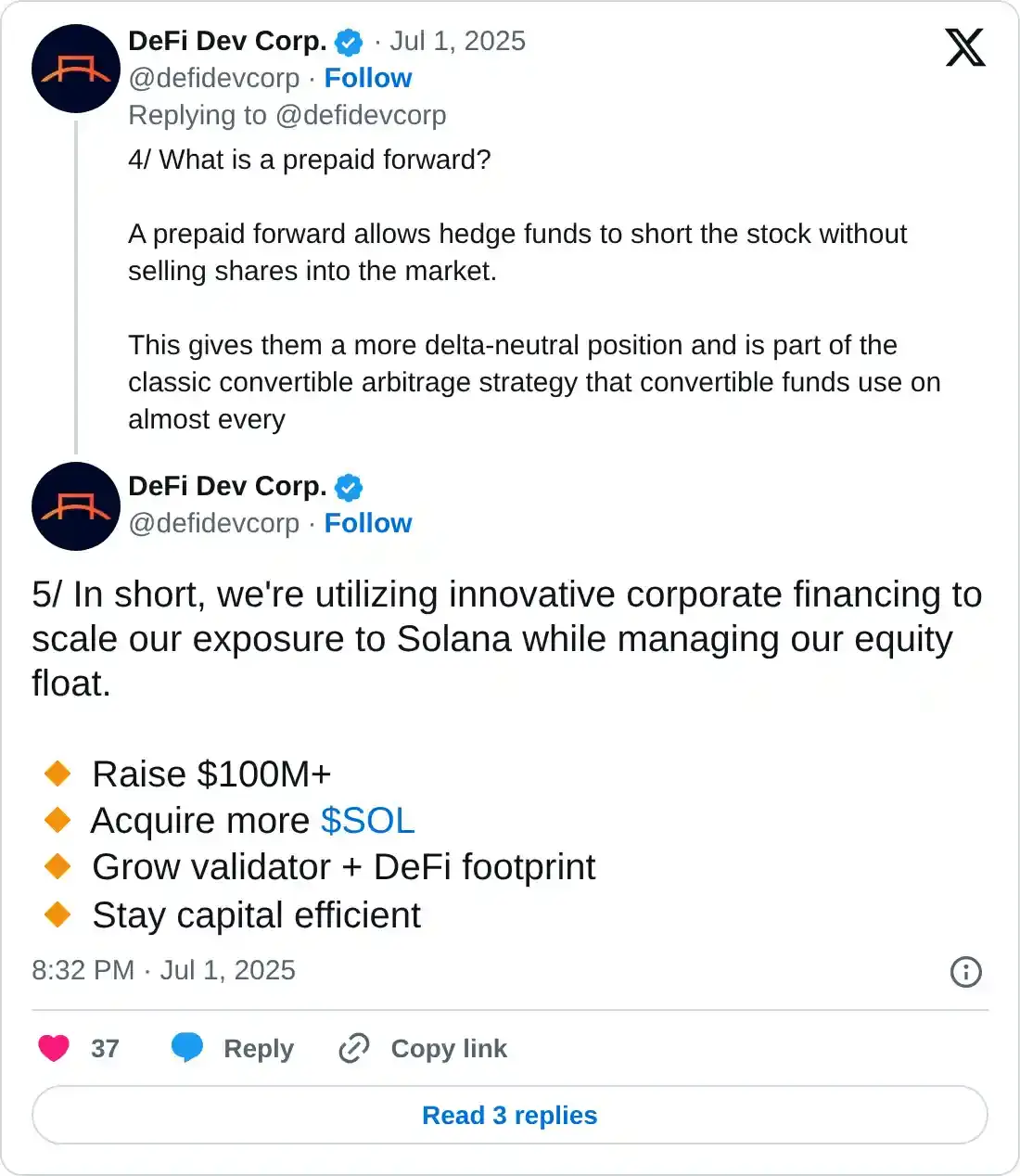

DeFi Development Corp (DFDV) has announced a $100 million private convertible note offering as part of a corporate treasury strategy to purchase and accumulate SOL.

The convertible senior note, due in 2030, is targeted at qualified institutional investors, according to GlobalNewswire. DeFi Dev said that there is an option for an additional $25 million aggregate principal amount of the convertible notes. This would push the total amount raised to $125 million.

Part of the fund would be used to repurchase shares of the company's common stock, with the remainder of the proceeds used for general purposes, including the accumulation of SOL.

Institutional interest in Solana remains relatively high this year despite price fluctuations. On Tuesday, Bloomberg analysts Eric Balchunas and James Seyffart revised the odds of Solana spot ETF approval upward to 95% before the end of the year. If approved by the US Securities and Exchange Commission (SEC), investors could gain access to a wide selection of options, allowing for the indirect trading of SOL on stock exchanges without the need to purchase the underlying digital asset.

Technical outlook: Solana extends recovery

Solana's price is currently trading at around $153, holding above the 50-day Exponential Moving Average (EMA) at $151. The Relative Strength Index (RSI) uptrend, now above the midline, underscores the recovery from support tested at $144 on Tuesday.

The uptrend could extend further, with Solana achieving a daily close above the 100-day EMA resistance at $154. If the RSI maintains the trend toward overbought territory, a break above the 200-day EMA at $159 could follow, thereby expanding the bullish outlook by almost 18% to the hurdle probed at $187 in late May.

SOL/USDT daily chart

Still, with resistance at the 100-day EMA ($154) not yet broken, traders may temper their expectations and prepare for a potential reversal below the support at $150, as indicated by the 50-day EMA.

If potential profit-taking and changing market dynamics accelerate the decline, the areas at $144 and $125 could come in handy to absorb the selling pressure.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.