Here is what you need to know on Thursday, July 3:

The trading action in financial markets turns subdued early Thursday as investors gear up for the key June employment report from the US, which will feature Unemployment Rate, Nonfarm Payrolls and wage inflation figures. The US economic calendar will also offer weekly Jobless Claims data and the Institute for Supply Management's (ISM) Services Purchasing Managers' Index (PMI) report for June.

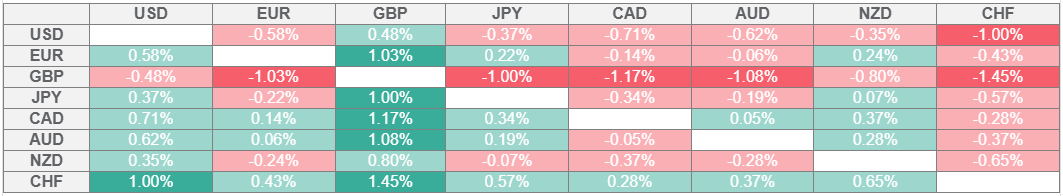

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

After starting the day on a bullish note on Wednesday, the US Dollar (USD) lost its recovery momentum in the American session to end the day with small gains. The data published by Automatic Data Processing (ADP) showed that employment in the private sector declined by 33,000 in June. This reading followed the 29,000 increase recorded in April and missed the market expectation of +95,000 by a wide margin. Financial markets in the US will close early on Thursday and remain closed on Friday in observance of the July 4 holiday. The USD Index stays relatively quiet in the European morning and moves up and down in a tight range below 97.00. Meanwhile, House Republicans are yet to approve US President Donald Trump's tax-cut and spending bill.

EUR/USD moves up and down in a tight range at around 1.1800 after posting marginal losses on Wednesday.

GBP/USD stabilizes near 1.3650 after suffering large losses on Wednesday. UK government bonds and Pound Sterling came under heavy selling pressure during the European session on Wednesday after British finance minister Rachel Reeves seemed visibly upset during PMQs as Prime Minister Keir Starmer refused to guarantee that she would remain in her position until the next election. Later in the day, Starmer said that Reeves would remain chancellor "for a very long time to come," easing concerns over a political turmoil.

USD/JPY edges slightly higher early Thursday but stays below 144.00. Bank of Japan (BoJ) Board Member Hajime Takata said on Thursday that Japan is close to achieving BoJ's price target but hasn't fully achieved it yet, so it needs to maintain an accommodative monetary policy.

Gold extended its recovery into a third consecutive day on Wednesday. XAU/USD stays in a consolidation phase above $3,350 in the European morning on Thursday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.