EUR/USD pulls back from highs as investors await further US employment data

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

The Euro is pulling lower as the US Dollar bounces up from long-term lows.

A cautious Powell and strong US Job Openings have provided some support for the Greenback.

EUR/USD is under growing bearish momentum after rejection above 1.1800.

The EUR/USD pair posts moderate losses on Wednesday, trading near 1.1780 at the time of writing. The US Dollar (USD) is a tad firmer, following strong US employment data and an unyielding Federal Reserve (Fed) Chairman Jerome Powell, who maintained his "wait-and-see" stance at the European Central Bank's (ECB) Forum on Central Banking in Sintra.

The Euro (EUR) eased from multi-year highs at 1.1830 on Tuesday and is failing to return above 1.1800 on Wednesday. The broader trend, however, remains positive, with the pair consolidating gains after rallying nearly 4% in June and about 14% in the first half of the year.

The US Dollar, on the other hand, has been battered by market concerns about the impact of US President Donald Trump's sweeping tax bill on an already high US Government debt and the lack of progress in trade deals, which might lead to higher tariffs starting July 9.

Beyond that, the US President's attacks on the Chairman of the central bank, pushing him to ease monetary policy, have raised speculation about the independence of the Federal Reserve, and are eroding the US Dollar's status as the world's reserve currency.

In the macroeconomic front, US JOLTS Job Openings showed a larger-than-expected increment in June, endorsing Powell's cautious stance, and the ISM Manufacturing PMI improved beyond expectations, with the Production sub-index returning to expansion levels for the first time since February, and prices increasing. These figures have given a fresh boost to the US Dollar.

Eurozone data was also positive on Tuesday, as German manufacturing activity improved, and German unemployment increased less than forecasted. Additionally, the Eurozone Consumer Price Index (CPI) report confirmed that inflation remains steady near the ECB's target. All in all, supportive data for the Euro.

Eurozone Unemployment and a speech from European Central Bank (ECB) President, Christine Lagarde, will attract attention during the European session on Wednesday. In the US, the focus will be on the ADP Employment Change for June, which will frame Thursday's Nonfarm Payrolls (NFP) release.

Euro PRICE Today

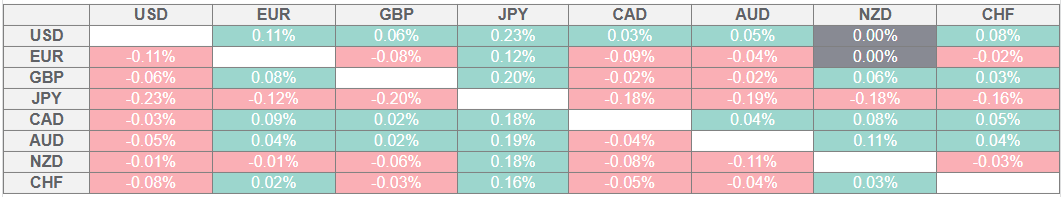

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Strong US data and a firm Powell give some air to the USD

Fed Chairman Jerome Powell dismissed the attacks from President Trump at his speech in Sintra and maintained that the central bank needs to "wait and learn more" about the potential impact of trade tariffs on inflation before cutting interest rates.

On Tuesday, the US Bureau of Labour Statistics reported a 7.769 million in the JOLTS Job Openings, beating expectations of a 7.3 million reading. These figures highlight the resilience of the labour market and leave investors looking to Thursday's Nonfarm Payrolls reading for more clues about the next Fed decisions.

The US ISM Manufacturing PMI advanced to 49.0 in June from 48.5 in May and beyond the 48.8 reading forecasted by market analysts. The Production subindex jumped to 50.3 from 45.4 in May, but the Employment index deteriorated unexpectedly, offsetting the positive impact of the report.

In the Eurozone, manufacturing activity improved somewhat in June, with the PMI edging up to 49.5 from the previous month's 49.4 reading. These figures are still within contracting levels, but they beat expectations of a steady 49.4 level and mark their highest reading in the last three years.

German unemployment change increased by 11K in June, below the 15K expected, and well below May's 34K increment. The jobless rate remained steady at 6.3% compared to expectations of an increase to 6.4%.

Preliminary Eurozone CPI figures for June confirmed steady inflationary pressures, with prices ticking up to 2% year-on-year, from 1.9%, and the core inflation steady at 2.3%.

Later on Wednesday, the Eurozone Unemployment Rate is expected to remain at 6.2% in May. ECB President Lagarde will speak again at the central bankers' summit in Sintra, but she is unlikely to say anything new regarding the bank's monetary policy plans.

The highlight today will be the US ADP Employment Change, which is expected to show a 95K net increase in June, following a 37K reading in May.

EUR/USD is on a bearish correction from multi-year highs above 1.1800

The EUR/USD is trimming gains, after rallying more than 2% in just over a week, reaching nearly four-year highs at 1.1830. The pair has been unable to confirm above 1.1800 and trades lower on Wednesday, as the US Dollar regains lost ground.

A look at the 1-hour chart shows a lower high at 1.1810 on Wednesday, which highlights the pair's softer momentum with the 14-period Relative Strength Index (RSI) indicator dipping into negative territory and a small Head & Shoulders (H&S) pattern in progress.

The neckline of the H&S pattern is at Tuesday's low at 1.1760. Below here, the measured target is at 1.1690, the June 27 low lies at 1.1680, and the June 26 low, at 1.1650. This area offers significant support for a bearish correction.

On the upside, immediate resistance is at the intra-day high of 1.1810 ahead of Tuesday's high at 1.1830. Above here, the 261.8% Fibonacci extension level of the June 26 to June 30 trading range is at 1.1850.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.