Cardano Price Forecast: ADA recovery holds steady despite SEC halt on Grayscale GDLC approval

Cardano steadies near $0.58 on Thursday after rebounding nearly 8% the previous day.

US SEC puts Grayscale’s GDLC fund approval on hold for further review, triggering renewed uncertainty.

Derivatives data indicate a positive outlook, as bullish bets among ADA traders have reached their highest level in over a month.

Cardano (ADA) price is holding steady near $0.58 at the time of writing on Thursday after rebounding nearly 8% in the previous session. The recovery comes despite renewed regulatory uncertainty, as the US Securities and Exchange Commission (SEC) halted its approval of Grayscale’s Digital Large Cap (GDLC) fund for further review. However, derivatives data shows traders remain optimistic, with bullish bets on ADA reaching their highest level in over a month.

SEC halts Grayscale GDLC for review a day after approval

The US SEC announced on Wednesday that the Grayscale GDLC is being reviewed after its recent approval on Tuesday.

“This letter is to notify you that, pursuant to Rule 431 of the Commission’s Rules of Practice,17 CFR 201.431, the Commission will review the delegated action. In accordance with Rule 431(e), the July 1, 2025 order is stayed until the Commission orders otherwise,” said the letter from the US SEC.

The SEC continued that it would let the NYSE know “of any pertinent action taken by the Commission.”

Grayscale’s proposal to convert its GDLC into a spot ETF that holds a mix of five major cryptocurrencies, including Bitcoin (79.90%), Ethereum (11.32%), Ripple (4.99%), Solana (3.01%), and Cardano (0.78%), nearly $774 million in assets under management.

Despite renewed regulatory uncertainty, major cryptocurrencies held firm on Wednesday, buoyed by positive sentiment following Donald Trump’s announcement of a new US-Vietnam trade deal. Cardano rose nearly 8% that day and steadied near $0.58 during the early Asian trading session on Thursday.

Cardano’s derivatives data bullish bias

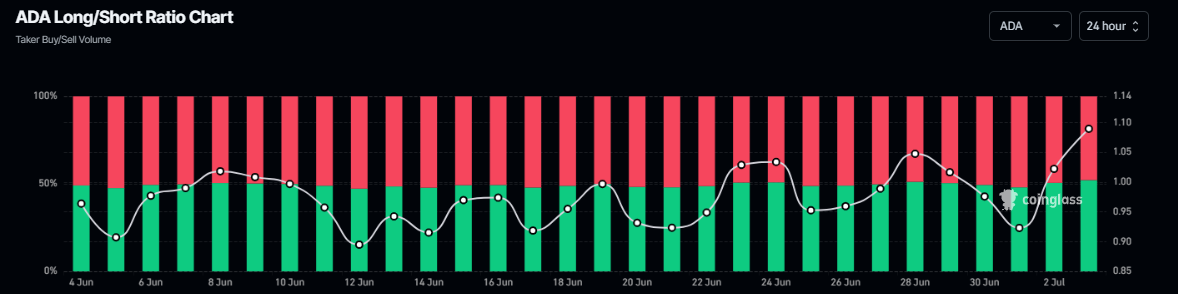

Cardano’s derivatives data shows traders remain optimistic. The Coinglass long-to-short ratio for ADA reads 1.10 on Thursday, the highest level in over a month. The ratio above one indicates that traders are betting on the asset price to rise.

Cardano’s long-to-short ratio chart. Source: Coinglass

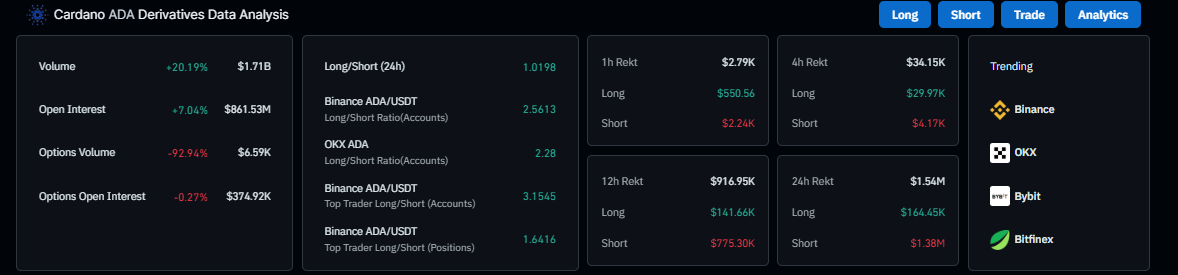

Additionally, the ADA Open Interest (OI) surged by 7.04% in the last 24 hours, reaching $861.53 million. An increased buying activity fuels the OI spike, suggesting heightened optimism surrounding Cardano.

Cardano derivatives data chart. Source: Coinglass

Cardano Price Forecast: ADA on the verge of a breakout

Cardano price is trading within a falling wedge pattern, which is formed by connecting multiple highs and lows with two trendlines. ADA recovered nearly 8% on Wednesday and is approaching its daily resistance level at $0.58 as of Thursday.

If ADA breaks above the daily resistance at $0.58, it could extend the rally toward its upper trendline boundary of the falling wedge pattern. A breakout above this pattern would extend the gains toward its June 11 high of $0.73.

The Relative Strength Index (RSI) on the daily chart reads 45, pointing upward toward its neutral level of 50, which indicates a fading of bearish momentum. For the bullish momentum to be sustained, the RSI must move above its neutral level.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart also displayed a bullish crossover on Sunday. It also showed a rising histogram bar above its neutral value, indicating bullish momentum and an upward trend.

ADA/USDT daily chart

However, if ADA faces a correction, it could extend the decline toward its next daily support at $0.49.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.