Altseason On Hold As Bitcoin Dominance Set For Surge – Details

The altseason, one of the most anticipated events of the crypto bull market, may potentially remain on hold following recent insights by some prominent market analysts. Notably, the current crypto cycle has shown little progress toward a true altseason, with Bitcoin Dominance holding strong, signaling a continued preference among investors for the leading cryptocurrency over alternative digital assets.

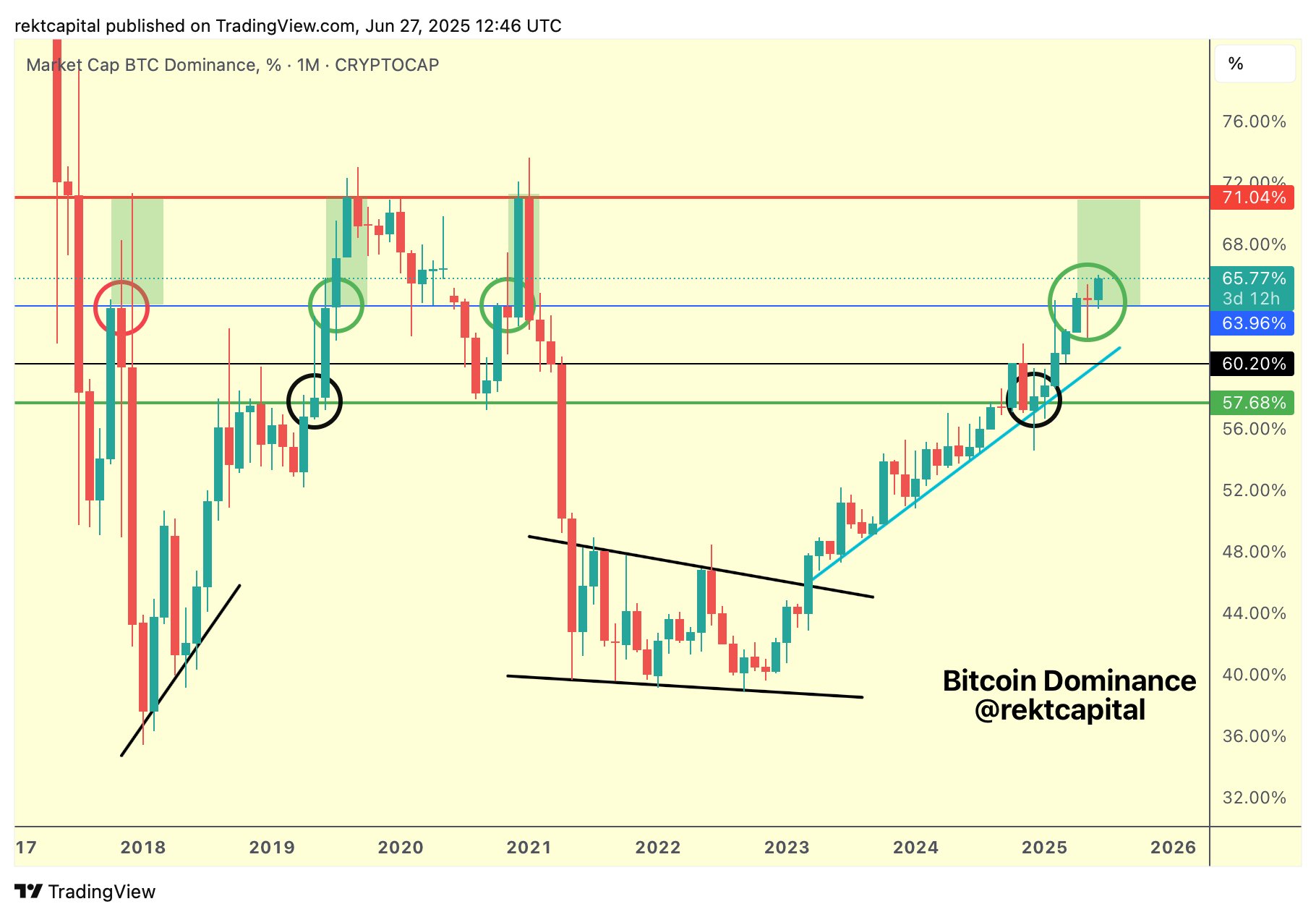

Bitcoin Dominance Tipped To Hit 74%, Altseason Remains Elusive

In an X post on June 27, renowned market analyst with X username Rekt Capital projected the Bitcoin Dominance (BTC.D) to experience a steady rise to 74%. Following Bitcoin’s price dip in the early last week, the analyst highlighted a successful retest of the 64% dominance level noting that, historically, such retests are typically followed by a continued rise without meaningful pullbacks until the 71% mark.

Notably, this market insight suggests Bitcoin is likely to keep attracting a massive influx of investment suggesting an altseason may be a distant concept for the present market cycle. For context, the altseason defines a period in the bull cycle when altcoins outperform Bitcoin. It is generally indicated by a fall in Bitcoin Dominance indicating a shift in investors capital from the market leader to other cryptocurrencies.

The altseason has been a major talking point in recent months as some analysts citing the staggering increase in altcoins in past recent years as a major obstacle to replicating the feat seen in 2017 and 2021. Meanwhile, other analysts have argued against this logic stating that while a broad-based altseason may be less likely, a more selective version, featuring strong performances from specific projects, remains on the table. Meanwhile, another popular market expert with X username Daan Crypto has highlighted the altcoin market’s struggling performance since 2024. The analyst explains that altcoins has been stuck in a sideways structure over the past eighteen months, lacking the clear bullish momentum seen in the Bitcoin market. According to Daan Crypto, the key resistance level for the altcoin market lies around the $1.27 trillion mark, a high from earlier in 2024. A confirmed breakout above this level could signal renewed investor appetite for altcoins and push the structural momentum needed for an altseason to begin.

Crypto Market Overview

At the time of writing, the total crypto market cap is valued at $3.24 trillion following a 0.08% gain in the past day. As the market leader, Bitcoin currently holds a market dominance of 64.9%. The remaining 35.1% is accounted for by the altcoin market which is presently valued at $1.11 trillion.