Crypto market tumbles as US missile strikes over Iran: SPX, VIRTUAL, and WIF lead the losses

- SPX6900 took a near 12% plunge on Tuesday as investors panic-sell due to rising Middle East tensions.

- Virtual Protocol nosedives to a crucial support, risking further losses with a potential breakdown.

- Dogwifhat faces massive downside risk as it cracks below a crucial support level.

The broader cryptocurrency market is trading in the red as the US steps into the Israel-Iran conflict. Bitcoin (BTC) trades below $105,000 at press time, while meme coins such as SPX6900 (SPX) and Dogwifhat (WIF) lead the market pullback alongside Virtuals Protocol (VIRTUAL).

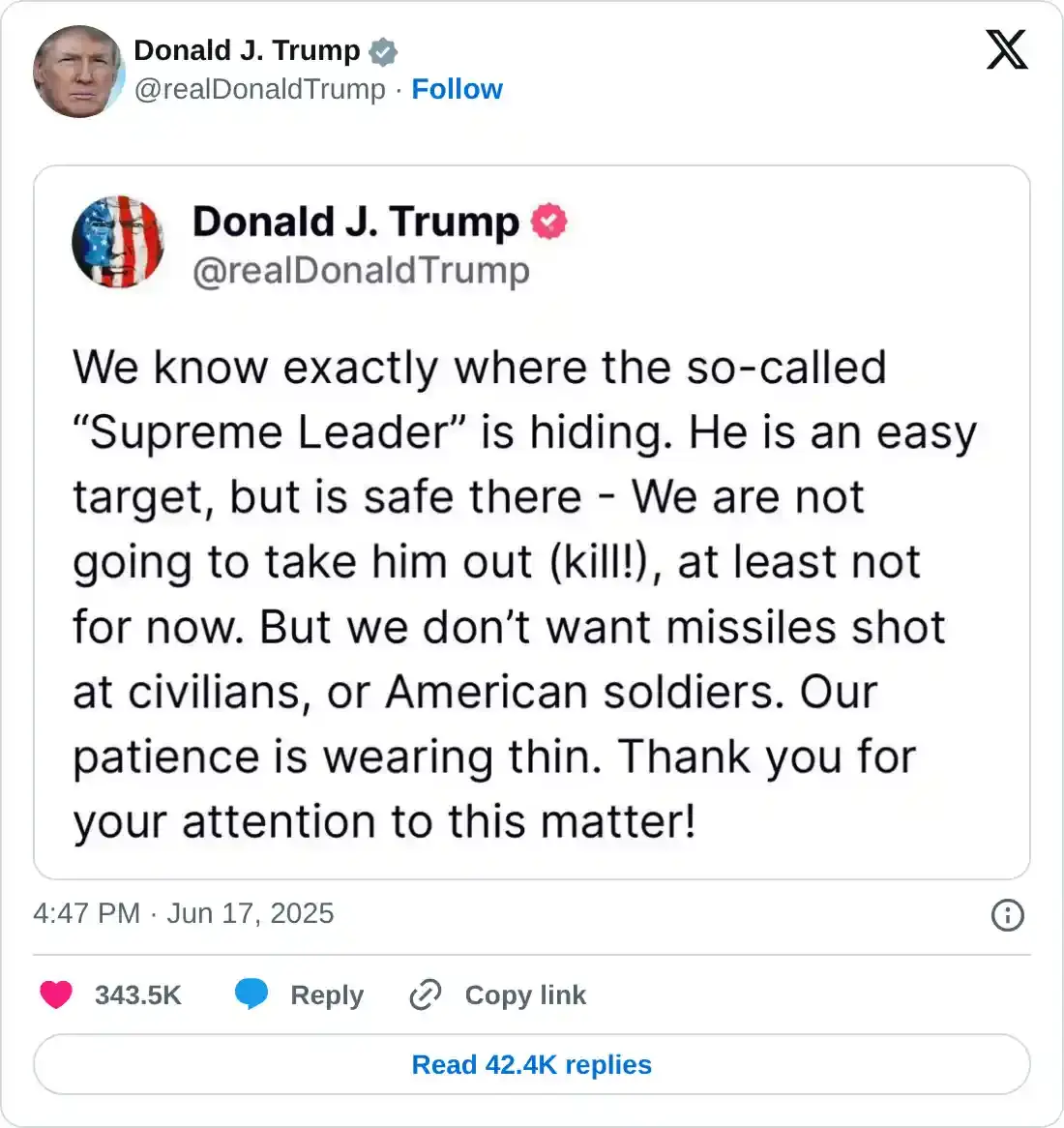

The US considers missile strikes on Iran

With a military leaning towards Israel, US President Donald Trump shares his intent of “UNCONDITIONAL SURRENDER” from Iran on Tuesday. In an X post, President Donald Trump boasted that the US knows the hideout location of Iran’s “Supreme Leader” but is not going to be taken out for now.

With the US patiently waiting on the sidelines while projecting military dominance, it offers Iran a chance to surrender and end the five-day-old war. Notably, the US President also shared that the US Air Force has achieved complete control over Iranian skies.

Amid such conditions, the Wall Street Journal reports that Trump is considering a range of options, including a potential missile strike on Iran. With the US on the brink of entering the Israel-Iran war, the global and cryptocurrency markets are on volatile grounds while crude oil prices continue to surge.

SPX6900 stands at a crucial crossroads

SPX recovers to trade in the green by over 4% at press time on Wednesday after a sudden 11.96% plunge the previous day. The meme coin takes hold at the 78.6% Fibonacci level at $1.28, drawn from January’s highest daily closing of $1.55 and year-to-date lowest closing of $0.29.

As the market pressure grows, a potential closing below the $1.28 support could extend SPX’s decline to the 50% retracement level at $0.92. The 50-day Exponential Moving Average (EMA) near the $1 psychological level could provide an intermediate cushion for a bounce back.

Tuesday’s downfall triggers a bearish crossover in the Moving Average Convergence/Divergence (MACD) indicator as it crosses below its signal line. A fresh wave of red histograms below the zero line indicates a bearish trend in action.

SPX/USDT daily price chart.

If the SPX holds its momentum and support floor at $1.28, it could rise towards its highest close ever at $1.61.

VIRTUAL nears key support level

VIRTUAL is down almost 1% at the time of writing on Wednesday, extending its losses by over 8% so far this week. The AI agent token closes below the 50-day EMA support with a 6.80% drop the previous day, pressurizing the $1.64 support marked by the May 17 low.

A clean daily close below $1.64 could extend the bearish trend toward the $1.39 support, highlighted by the May 7 closing. The 100-day EMA at $1.57 could provide short-term, intermediate support.

The declining trend in the MACD indicator crossing below the zero line alongside its signal line signals a surge in bearish momentum.

VIRTUAL/USDT daily price chart.

If VIRTUAL bounces back from the $1.64 support to surpass the weekly high at $2.01, it could undermine the downside risk.

WIF risks further losses

Dogwifhat, a Solana-based meme coin, dropped over 7% during the market pullback on Tuesday, marking the lowest 30-day trading price. The meme coin also breached the $0.798 support floor, tested multiple times over the last couple of weeks.

As selling pressure grows, the WIF breakdown trend could test the $0.550 support, last tested on May 6.

The declining MACD indicator, which has entered negative territory alongside its signal line, suggests a fresh bearish trend in motion.

WIF/USDT daily price chart.

If the WIF price reclaims the lost $0.164 support, it could revert towards the $1.000 psychological mark.