Ethereum Price Forecast: ETH dives 7% amid stablecoin volume hitting $11 trillion in 2025

Ethereum price today: $2,420

- Ethereum declined 7% on Thursday and risks a further drop to $2,260 after crossing below the support of a rising wedge.

- Ethereum's stablecoin volume across its L1 and L2s has surpassed $11 trillion in 2025.

- Bots' stablecoin activity spiked in May, with transaction volume and count reaching $480 billion and 4.84 million, respectively.

Ethereum (ETH) is declining over 7% on Thursday, moving below the $2,500 key level amid rising stablecoin activity across its ecosystem.

Ethereum stablecoin activity surges amid ETH's recovery

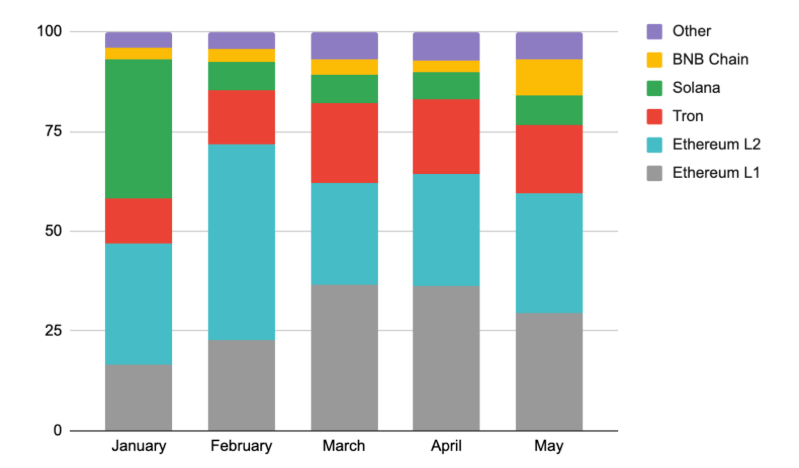

The Ethereum ecosystem — both Layer 1 (L1) and Layer 2s (L2s) — has seen more than $11 trillion in stablecoin volume so far in 2025, with its total share rising from 40% in 2024 to 60%, according to a report by crypto exchange CEX.io.

In January, Solana and L2s led the way in terms of volume, while Ethereum lagged behind before staging a comeback. The rise indicates that Ethereum has regained dominance in stablecoin activity following a decline in transaction fees within its ecosystem. Transaction fees on the L1 plummeted more than 92% to below 1 gwei in April, making Ethereum more attractive to stablecoin traders compared to other L1s.

Monthly Stablecoin Transaction Volume. Source: Cex.io via Artemis

"Most of Ethereum's gains in overall stablecoin activity this year occurred during this record low-fee period," wrote Cex.io's lead analyst, Illya Otychenko.

The low-fee environment proved attractive to bots, with their stablecoin transaction count and volume reaching all-time highs of 4.84 million and $480 billion, respectively, in May. This marked the largest share of stablecoin activity from bots on Ethereum, accounting for 57% of total volume and 31% of transaction count.

Ethereum's recovery of stablecoin activity and volume dominance follows a similar resurgence in its native cryptocurrency, Ether, which recorded a more than 40% gain in May. During the period, ETH's market cap dominance also rose from 7.4% to 9.7%.

Meanwhile, US spot Ethereum exchange-traded funds (ETFs) extended their inflow streak to 13 consecutive days after posting $56.98 million in net inflows on Wednesday.

Ethereum Price Forecast: ETH struggles at 200-day SMA resistance amid rising wedge validation

Ethereum plunged 7% over the past 24 hours, resulting in $189.75 million in liquidations across its futures market, according to Coinglass data. Liquidated long and short positions accounted for $174.78 million and $14.97 million, respectively.

The large liquidation comes after Ethereum saw a rejection at the 200-day Simple Moving Average (SMA) on Wednesday. Since ETH's over 40% surge between May 8 and 13, the 200-day SMA has served as a critical resistance, pushing prices down more than eight times.

ETH/USDT daily chart

With the recent rejection, ETH has declined below the lower boundary of a rising wedge pattern. If ETH holds the decline below the wedge's support, it will validate a bearish outlook and potentially send its price to the range between $2,260 and $2,110, with the 50-day SMA serving as dynamic support within it.

On the upside, ETH has to recover the wedge's support and sustain a firm move above the 200-day SMA and key levels at $2,750 and $2,850 to begin an uptrend. In such a scenario, ETH could rally to test the $3,250 level. Historically, ETH has initiated a strong uptrend whenever it breaks above its 200-day SMA.

The Stochastic Oscillator (Stoch) is in the oversold region and the Moving Average Convergence Divergence (MACD) histogram bar is below its neutral level, indicating dominant bearish momentum.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.