Blum Announces Airdrop Snapshot Date Following Co-Founder’s Arrest

Blum — a Telegram mini app that had 42 million monthly users last year — has announced its airdrop criteria and snapshot date after more than a year of development.

The project transitioned from a tap-to-earn model to a trade-to-earn one and is gradually positioning itself as a decentralized exchange (DEX). However, available data suggests Blum has yet to attract significant trading activity amid intensifying competition among DEX platforms.

Blum Reveals Airdrop Conditions and Snapshot Schedule

In its latest announcement, the team stated that the snapshot will occur on June 7. This snapshot will record user balances and activity to determine airdrop eligibility. The distribution is expected to follow shortly after.

Blum also outlined three conditions for airdrop eligibility. Participants must meet at least one of the following:

- Own over 100,000 Blum Points (BP),

- Accumulate at least 750 Meme Points (MP) or provide proof of active engagement,

- Refer at least two users and pass the Sybil check (to confirm they are not bots or duplicate accounts).

These criteria have sparked mixed reactions within the Blum community. While some users are pleased to qualify, others have expressed frustration over the strict requirements.

For example, one user on X posted a screenshot showing he didn’t qualify despite logging in for 67 consecutive days. Another user called the Meme Points requirement “very unfair,” especially for long-time supporters of the project.

These reactions highlight Blum’s challenge in balancing fairness with anti-sybil measures to prevent abuse.

Although Blum has shared the snapshot date and airdrop rules, it still hasn’t disclosed the tokenomics. This lack of detail makes it difficult for users to estimate the potential value of their airdrops.

Blum Attempts to Restore Community Trust After Co-Founder’s Arrest

Blum’s airdrop and snapshot announcement came shortly after a shocking development: the arrest of co-founder Vladimir Smerkis on fraud-related charges.

“We understand the community’s anticipation around the token launch. Despite recent challenges following Vladimir Smerkis’ departure, we remain incredibly confident in Blum’s proposition and ability to deliver outstanding value and returns,” the project stated.

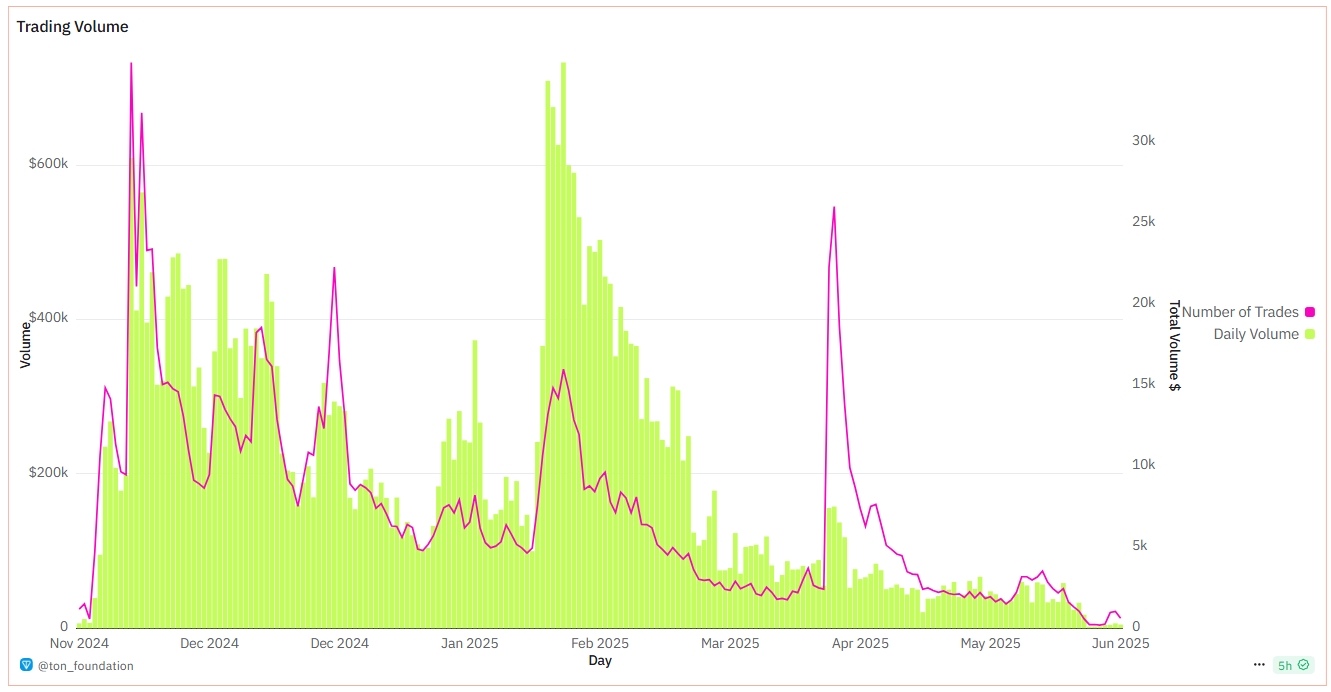

Meanwhile, Blum’s daily trading volume has plummeted in 2025. According to Dune Analytics, daily trading volume on Blum.io fell from over $700,000 in February to about $6,000 in June.

This sharp drop has severely weakened Blum’s ability to compete in the DEX space — a significant downturn for a project that once rode the tap-to-earn hype and attracted tens of millions of users.

Daily trading volume and transaction count on the Blum platform. Source: Dune

Daily trading volume and transaction count on the Blum platform. Source: Dune

Previously, Blum raised $5 million in a funding round led by gumi Cryptos Capital, with participation from other major venture firms such as Spartan, No Limit Holdings, YZi Labs, and OKX Ventures.

As of writing, Blum’s pre-market token price remains around $0.0015, down 90% from its early-year peak. This reflects ongoing investor skepticism and places the project in a precarious position.