What To Expect From Stellar (XLM) In May 2025

Stellar (XLM) enters May 2025 in a fragile position, underperforming Bitcoin and other altcoins both in price action and trading volume. Despite following BTC’s general trajectory, XLM has failed to capture the same upside, while still participating fully in market corrections.

Volume has also collapsed from early-year highs, highlighting a drop in market interest and liquidity. With price sitting just above a key support and a potential death cross on the horizon, Stellar faces a critical month that could define its near-term trend.

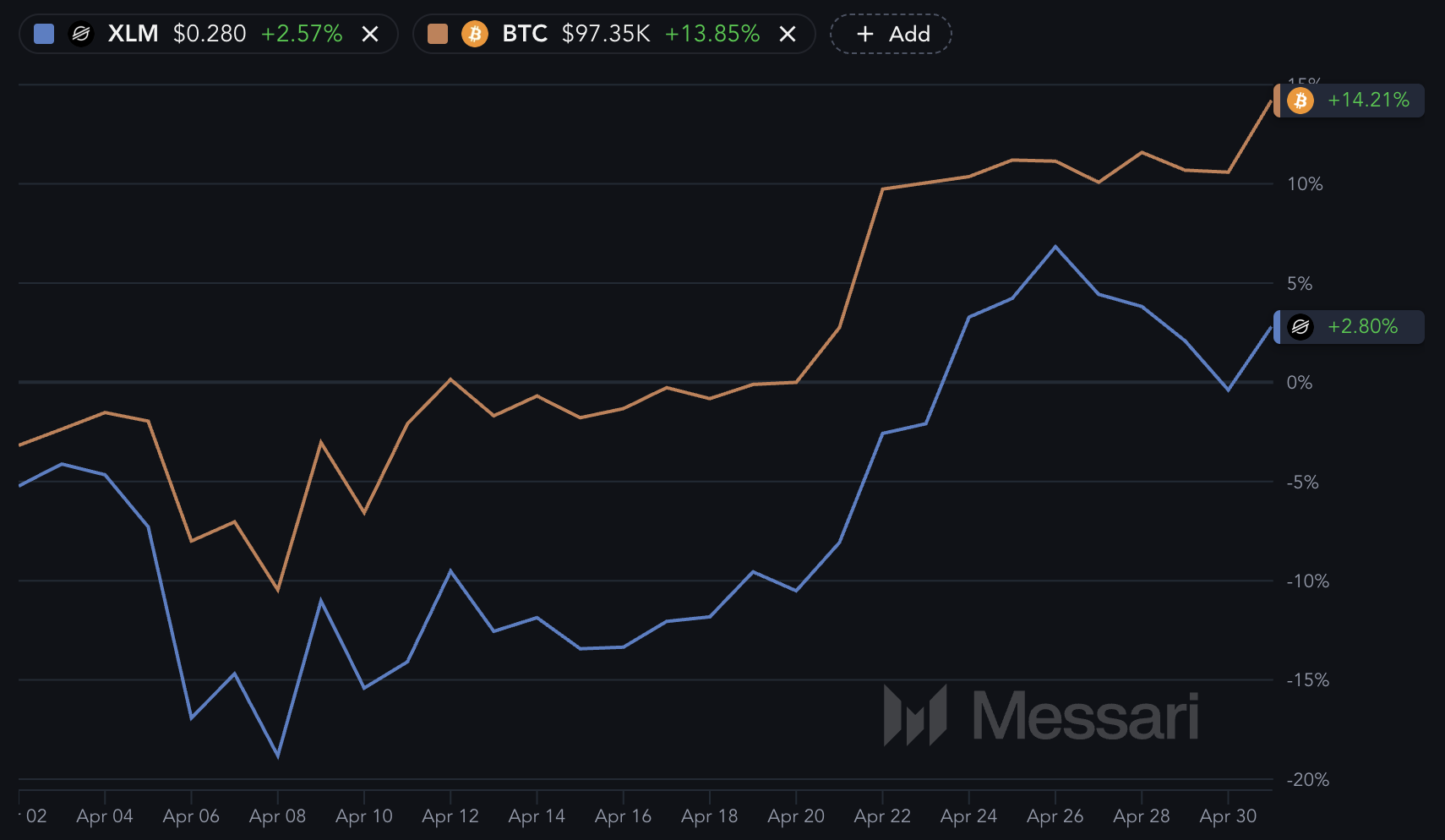

XLM Lags Behind Bitcoin With Asymmetric Volatility

Over the past month, Stellar has been closely following Bitcoin’s trajectory but with significantly weaker upside performance.

While Bitcoin has climbed over 14%, XLM has managed only a 2.8% gain, falling behind BTC and other altcoins like Hedera, which have shown stronger bullish reactions.

This muted upside signals a lack of conviction among traders and raises questions about Stellar’s momentum in the current market cycle.

XLM and BTC. Source: Messari.

XLM and BTC. Source: Messari.

What’s more concerning is that XLM is still behaving like a typical altcoin during corrections—dropping harder than Bitcoin when the market pulls back.

Normally, altcoins are expected to amplify Bitcoin’s movements both ways: outperforming during rallies and underperforming in downturns. Stellar, however, only shows downside volatility without the upside benefit.

This imbalance makes the token vulnerable, signaling weaker market confidence and potentially limiting its appeal in a risk-on environment.

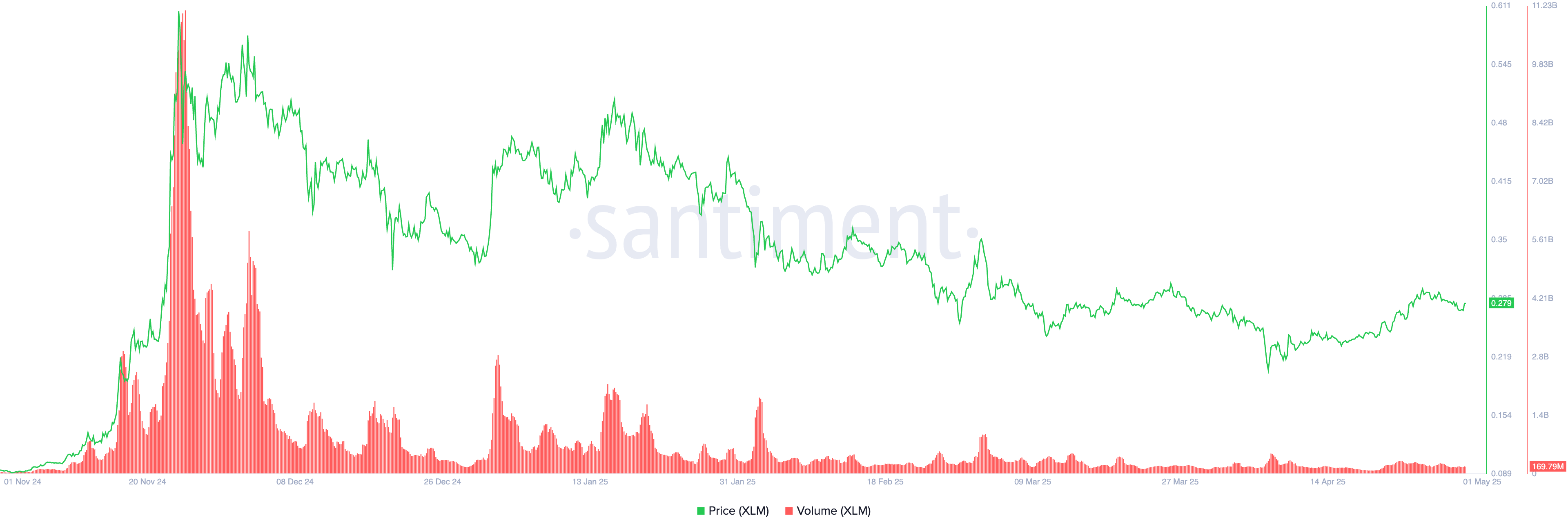

Stellar Trading Volume Collapses From Early 2025 Highs

Stellar has seen a noticeable drop in trading volume over the last 30 days, with activity peaking at just $311 million on April 23.

This is well below previous highs—$480 million on April 7 and $930 million on March 3—showing a clear downtrend in market participation.

Declining volume often signals weakening interest from traders and can limit price momentum, especially in a token that already underperforms on the upside.

XLM Price and Volume. Source: Santiment.

XLM Price and Volume. Source: Santiment.

More importantly, XLM’s current volume levels pale compared to earlier this year’s activity.

Daily volume frequently surpassed $1 billion in January and February, even reaching above $2 billion. That level of liquidity helped fuel stronger price action and volatility.

With current figures sitting at a fraction of those peaks, Stellar faces a market backdrop that lacks energy and conviction—potentially capping any meaningful rallies in the near term.

Stellar at Make-or-Break Support as Death Cross Looms

Stellar is hovering just above a key support level at $0.26, a zone that could determine its next major move. The EMA lines are tightening, and a potential death cross may be forming where short-term EMAs cross below long-term ones.

If the $0.26 support is lost and the death cross confirms, XLM could slide further toward $0.239 and even $0.20, signaling a deeper bearish shift.

XLM Price Analysis. Source: TradingView.

XLM Price Analysis. Source: TradingView.

Conversely, bullish momentum could return if Stellar price manages to bounce and break through the $0.297 resistance.

Moving past that level could open the door to $0.349 and $0.375, with further upside potential toward $0.44 and even $0.495 if volume and sentiment improve.