Tether Acquired $65 Billion in US Treasury Bonds in Q1 2025

Tether just released its Q1 2025 Attestation Report, describing a massive increase in US Treasury bond holdings. The firm purchased over $65 billion in these assets between January 1 and the end of the quarter.

Tether’s report also repeatedly mentioned a potential role in global US dollar flows, calling USDT “the leading digital representation” of this currency. The firm’s treasury holdings now represent more than 80% of its total assets.

Why is Tether Buying US Treasury Bonds?

When Tether, the world’s largest stablecoin issuer, publicized its Q4 2024 Attestation Report, it reported $33 billion in held US Treasury bonds.

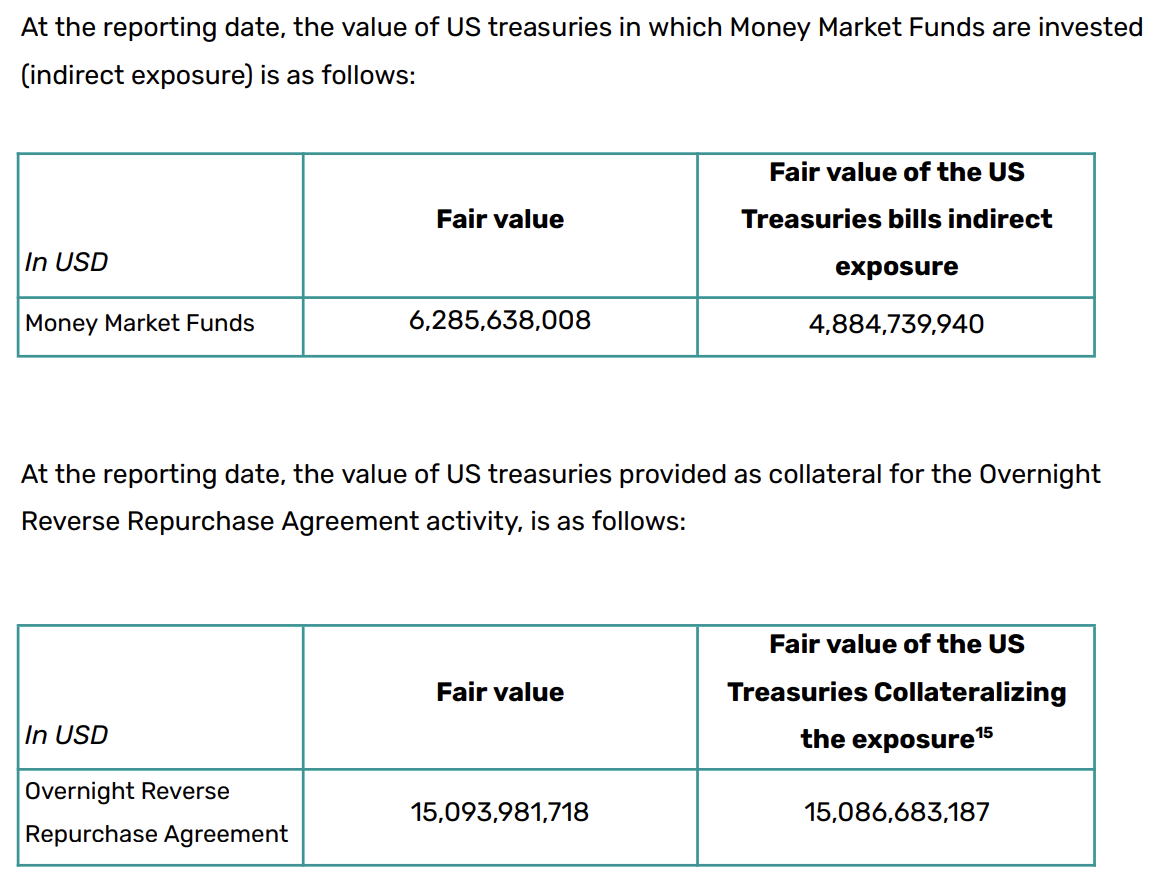

An entire quarter has since passed, and the firm’s newest report details a massive pattern of acquisitions. By March 31, it held $98.5 billion in Treasury bonds, with another $21.3 billion in indirect exposure.

Tether’s Indirect Treasury Exposure. Source: Tether

Tether’s Indirect Treasury Exposure. Source: Tether

The company’s report further claims that its total assets amount to $149.2 billion. In other words, more than 80% of Tether’s assets are directly and indirectly held in US Treasury bonds.

Comparatively, it only holds $7 billion in BTC, which the firm has consistently acquired in the past.

Rumors suggested that the firm would de-prioritize Bitcoin to better align with US stablecoin regulations, and this event may be taking place. If proposed legislation becomes law, the US will require Tether to hold most of its reserve assets in Treasury bonds. Thanks to these acquisitions, that requirement has been fulfilled.

Tether has been reorienting its business in a few key ways to facilitate compliance with US regulations. In late March, President Trump suggested that stablecoins could support dollar dominance, and Tether seems interested in this goal.

The report repeatedly mentioned concepts like “Tether’s growing role in distributing dollar-denominated liquidity” and “supporting the global relevance of the US dollar in a rapidly evolving economy.”

The firm described USDT as “the leading digital representation of the US dollar,” and its CEO, Paolo Ardoino, echoed these sentiments:

“Our mission is clear: to responsibly and compliantly power the digital economy and strengthen the role of the US dollar on the global stage,” he claimed.

If Tether wants to take on this transformative role, its massive US Treasury holdings will substantially help that task. Its holdings are vastly larger than most governments’, to the extent that it could move the global treasury market.

Overall, these purchases will likely drive Tether’s substantial business ventures in the US market soon.