Dozens of crypto-related ETFs await SEC approval, among them those related to XRP, Litecoin, and Solana

- Eric Balchunas, Senior ETF Analyst for Bloomberg, highlights 72 crypto-related ETFs awaiting SEC approval.

- The diversity of these ETFs encompasses major cryptocurrencies, such as XRP, Litecoin, and Solana, as well as meme-based memecoins.

- Approvals of altcoin ETFs indicate increasing adoption, could significantly broaden crypto market participation by providing institutional-grade exposure beyond Bitcoin and Ethereum, crypto market experts tell FXStreet.

Eric Balchunas, Senior ETF Analyst for Bloomberg, highlights 72 crypto-related Exchange Traded Funds (ETFs) awaiting US Securities and Exchange Commission (SEC) approval. The diversity of these ETFs encompasses major cryptocurrencies, such as Ripple (XRP), Litecoin (LTC), and Solana (SOL), as well as meme-based memecoins. To gain more insights into these crypto-based ETFs, FXStreet interviewed experts in the cryptocurrency markets.

Crypto ETFs await green signal from the US SEC

Eric Balchunas, Bloomberg's Senior ETF Analyst, highlighted on his X post on Tuesday that 72 crypto-related ETFs, covering major cryptocurrencies like XRP, Litecoin, and Solana, as well as niche assets like 2x Melania (MELANIA) and Dogecoin (DOGE), are awaiting approval from the US Securities and Exchange Commission.

The wide range of proposed ETFs – from leveraged funds to meme coin exposures – highlights the speculative appetite driving crypto markets, as firms like Tuttle Capital push the limits of what regulators may allow in pursuit of investor demand.

Despite the influx of altcoin ETFs, the SEC has approved only two so far: Bitcoin (BTC) on January 10, 2024, and Ethereum (ETH) on May 23, 2024. Bitcoin ETFs continue to dominate, accounting for approximately 90% of global crypto fund assets.

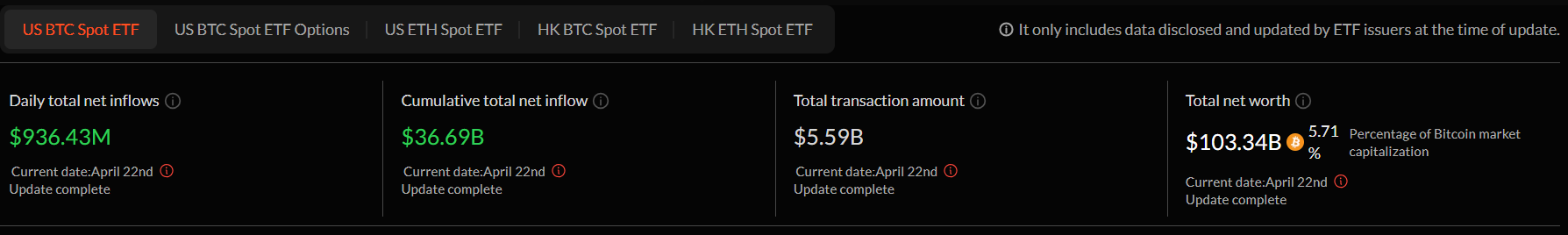

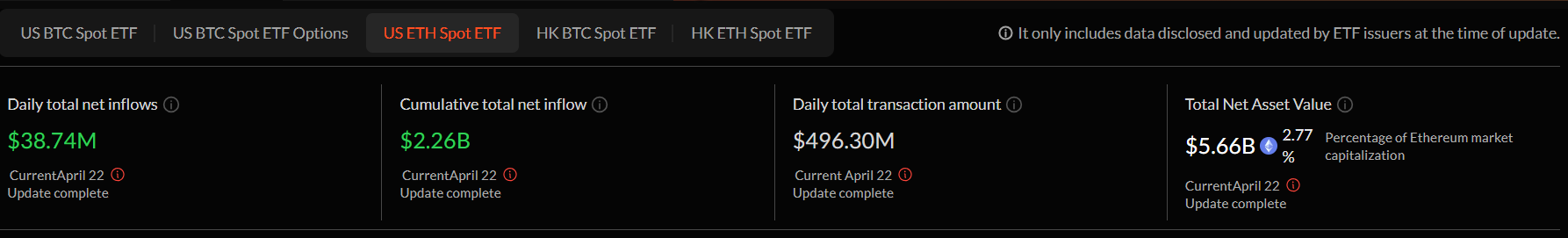

According to SoSoValue, the total net worth of the US BTC spot ETF is $103.34 billion, 5.71% of BTC market capitalization on Tuesday, and the US ETH spot ETF stands at $5.66 billion, 2.77% of ETH market capitalization.

US BTC spot ETF chart. Source: SoSoValue

US ETH spot ETF chart. Source: SoSoValue

To gain more insights into these crypto-based ETFs, FXStreet interviewed experts in the cryptocurrency markets.

Tracy Jin, COO at MEXC

Q: What impact could the approval of altcoin-based ETFs (like those tied to XRP, Solana, or Litecoin) have on the broader market compared to the earlier Bitcoin and Ethereum ETFs?

The approval of altcoin-based ETFs would be a landmark moment in crypto’s institutional adoption and evolution. Bitcoin and Ethereum ETFs have legitimized crypto as an asset class for institutional investors by providing regulated exposure to two of the most established digital assets. However, altcoin ETFs would help shift institutional attention to the broader blockchain ecosystem. Their approval would attract and distribute institutional capital to the crypto markets beyond just BTC and ETH, deepen altcoin liquidity pools, and foster stability for altcoins during times of increased market volatility.”

Q: Assuming some of these altcoin ETFs are approved, which ones do you expect to attract the most institutional capital, and why?

Solana is the clear frontrunner to attract the most institutional capital. Solana has shown stable network activity and strong liquidity over the past years, rallying from $22 in 2023 to an all-time high of $294 in January 2025 and currently possesses the second-most active developer ecosystem after Ethereum. XRP could also attract significant institutional capital, particularly from firms interested in international remittances, cross-border payments. Its post-Ripple case gives it a regulatory legitimacy advantage. Litecoin will appeal more to conservatives seeking alternatives to BTC exposure with lower volatility, but is unlikely to see the same inflows as Solana or XRP. If meme ETFs launch, DOGE would lead due to its liquidity and pop culture appeal, but institutional flows will be cautious and thematic rather than large-scale.”

Q: Meme coins are also reportedly included in the ETF lineup. What are the potential risks and implications of bringing speculative assets like DOGE or SHIB into regulated financial products?

The inclusion of speculative and low utility tokens into ETFs would create the need for regulation and oversight for meme and speculative tokens, which would help improve compliance, transparency, provide price tracking mechanisms, and reduce the risks of rug pulls in the sector. It could also help stabilize the volatility that meme coins are often associated with and make them develop real utility to appeal to more institutional investors. However, packaging speculative assets in regulated ETF wrappers risks undermining and diluting the credibility of crypto ETFs. Critics may argue that TradFi is trying to legitimize financial gambling by providing access to retail investors who don't fully understand the risk attached to speculative assets. Memecoins are inherently speculative and are often driven by social trends, sentiment, and ETFs' capital injection into unpredictable assets could exacerbate their volatility. However, we are more likely to see thematic meme coin ETFs approved than single-asset funds to soften their speculative risks.

Fei Chen, CEO at Intellectia AI

Q: Do you believe the SEC’s handling of these ETF applications signals a shift in regulatory sentiment toward altcoins, or is Bitcoin likely to remain the primary regulatory focus?

The SEC's cautious stance on altcoin ETFs likely represents incremental regulatory approval and not a broad-based change. Bitcoin will likely continue to be the primary regulatory target since it has a more established institutional presence. But approvals of altcoin ETFs indicate a step-by-step adoption of increasing regulated crypto investment products.

Q: Why do you think certain assets like Solana and Litecoin are being considered for ETF structures, while others with large market caps are not? What makes a coin "ETF-worthy"?

Tokens like Solana or Litecoin are ETF-worthy in the sense that they represent liquidity, stability, and regulatory clarity. Governance clarity, active developer bases, solid market infrastructure in place, and proof of end-use applications set them apart from riskier projects with larger market caps.

Q: Assuming some of these altcoin ETFs are approved, which ones do you expect to attract the most institutional capital, and why?

XRP and Solana ETFs will be of special interest to institutions. XRP, with its cross-border payments application, and Solana, with its high throughput blockchain technology, offer more specific value propositions and institutional utility than meme coins or more speculative assets.

Marcin Kazmierczak, Co-founder & COO of RedStone

Q: What impact could the approval of altcoin-based ETFs (like those tied to XRP, Solana, or Litecoin) have on the broader market compared to the earlier Bitcoin and Ethereum ETFs?

Altcoin ETF approvals could significantly broaden crypto market participation by providing institutional-grade exposure beyond Bitcoin and Ethereum, potentially increasing liquidity across the broader crypto ecosystem. However, expectations should be tempered as ETF openings may not necessarily generate sustained buy pressure—as evidenced by Ethereum ETFs that saw limited deposits after initial interest and minimal price impact on BTC and SOL trading pairs.

Q: Meme coins are also reportedly included in the ETF lineup. What are the potential risks and implications of bringing speculative assets like DOGE or SHIB into regulated financial products?

Meme coin ETFs present unique risks, including extreme volatility, minimal fundamental value drivers, potential market manipulation, and reputation risks for the broader ETF market; however, they may provide regulated access to speculative assets that would otherwise be traded in unregulated venues.

Q: Assuming some of these altcoin ETFs are approved, which ones do you expect to attract the most institutional capital, and why?

Assets demonstrating strong adoption metrics (transaction volume, developer activity), growing revenue, expanding protocol ecosystems, and institutional-friendly attributes are likely to attract the most institutional capital through ETFs. For instance, Solana exhibits many of these characteristics with its high transaction throughput, vibrant developer community, and increasing institutional acceptance.”