Bitcoin Long-Term Holders Are Buying Again — Can They Push BTC Price Higher?

After a dreadful start to the week, the price of Bitcoin appears to be recovering nicely with a strong rally to begin the weekend. The latest on-chain data shows that a specific class of investors might be behind the relative stability experienced by the premier cryptocurrency amidst the recent macroeconomic chaos.

Seasoned Investors Are Loading Their Bags Again

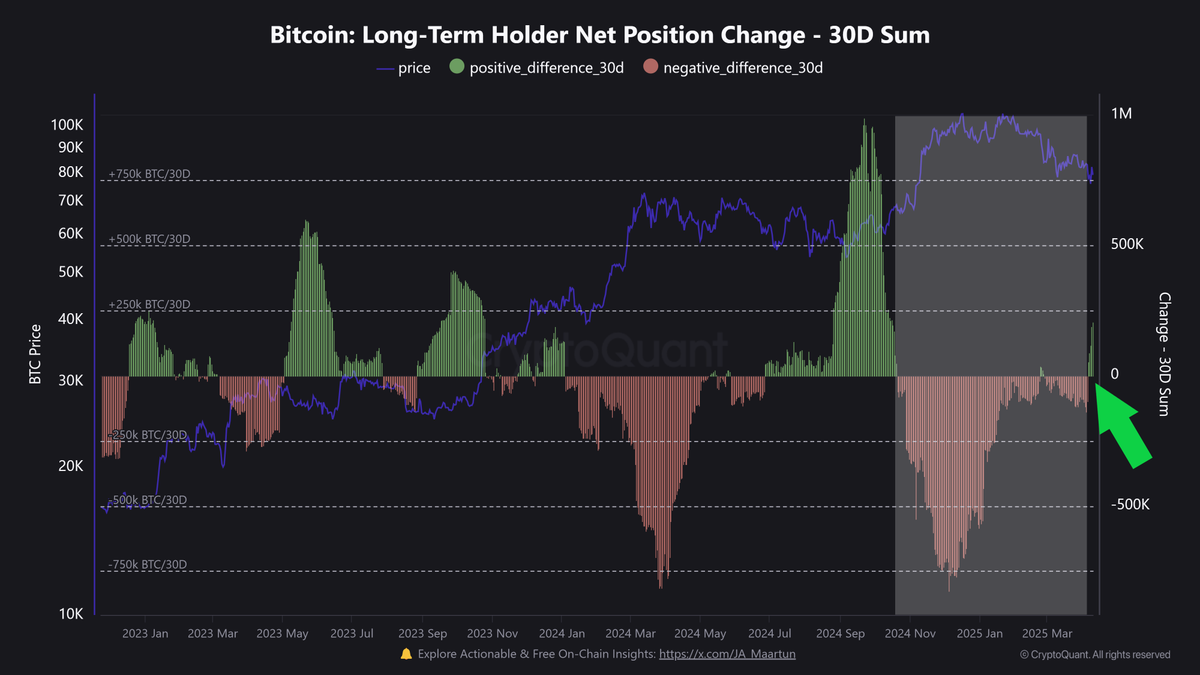

In an April 11 post on X, crypto analyst Burak Kesmeci revealed that the Bitcoin long-term holders (LTHs) might be getting more active in the market over the past few weeks. This on-chain observation is based on changes in the Long-Term Holder Net Position Change (30-day sum), a metric that tracks the net change in the BTC supply held by LTHs over a 30-day period.

This metric basically tracks the aggregated behavior of an important investor cohort, providing an insight into the overall sentiment in the market. When this metric is positive, it implies that the long-term holders are in the accumulation phase. On the flip side, when the net position change is negative, it means that Bitcoin LTHs are trimming their holdings and selling their BTC.

According to Kesmeci, the long-term investors have been offloading their Bitcoin in the past six months, as the LTH Net Position Change has remained in the negative zone since the last week of October 2024. The metric reached a negative peak level of 827,750 BTC on December 5, 2025, accompanied by a 32% decline in the Bitcoin price.

The chart above shows that the Long-Term Holder Net Position Change shifted to the positive territory on April 6, 2024, and appears to be on the rise at the moment. This positive change signals fresh buying amongst the seasoned investors over the past few weeks.

Kesmeci noted that the positive shift of the Long-Term Holder Net Position Change has coincided with a recent 12% jump in the Bitcoin price. The Bitcoin price returned above $81,000 after United States President Donald Trump paused trade tariffs on imports from all countries except China.

Kesmeci added in the post:

Time will tell whether this is just a reactionary bounce or the early stages of a longer bullish phase. However, the metric continuing to remain in the positive region with acceleration could be an important “trend change signal” for us.

Nevertheless, the on-chain analyst urged investors to approach the market with caution, as the current momentum is not sufficient. Hence, further conviction is needed from the long-term investors to sustain a major rally in the current market state.

Bitcoin Price Overview

As of this writing, the premier cryptocurrency is valued at around $83,400, reflecting an almost 5% increase in the past 24 hours. According to data from CoinGecko, BTC has barely changed in the past seven days. However, this record doesn’t quite tell the full story, as the Bitcoin price had fallen to around $74,000 at the beginning of the week.

Featured image from iStock, chart from TradingView