BNB Chain testnet implements Lorentz hard fork ahead of mainnet upgrade

- BNB Chain testnets’s Lorentz hard fork significantly improves transaction speed and network efficiency.

- opBNB and BSC mainnet upgrades are scheduled for April 21 and April 29, respectively.

- The Maxwell upgrade scheduled for June will reduce BSC block times to 0.75 seconds.

- BNB price upholds mid-week gains, targeting movement above $600 in the short term.

BNB Chain, a blockchain created by Binance, the leading cryptocurrency exchange by daily traded volume, has successfully implemented the Lorentz hard fork upgrade on its test networks, marking significant milestones in its efforts to improve network performance. The platform said that the opBNB and BSC testnets upgrades are not “just technical milestones – they’re about giving builders, validators and users a more responsive chain.”

BNB Chain leaps toward faster block times

The Lorentz hard fork upgrade, finalized on the opBNB and BSC testnets on Thursday, reduced block times to 0.5 seconds and 1.5 seconds, achieving faster transaction confirmations while improving network efficiency.

Following the successful deployment on test networks, BSC Chain looks forward to advancing the Lorentz hard fork upgrade to mainnet protocols later this month. The opBNB mainnet hard fork upgrade will come first on April 21, while the BSC mainnet upgrade has been scheduled for April 29.

BNB Chain stressed that the upgrade is not optional and that node operators and developers should prepare accordingly. According to the X thread, node operators on opBNB will upgrade their platforms via provided GitHub links, while BSC node operates will download the mainnet hard fork release.

“This isn’t just an update – it’s a step forward for the entire ecosystem,” BNB Chain emphasized, encouraging developers to prioritize testing their decentralized applications (dApps) on the test networks. This exercise will ensure that they identify potential issues before mainnet upgrades. User experience is expected to improve significantly with instant transaction confirmations, a factor crucial in decentralized finance (DeFi).

BNB Chain is concurrently working on the next major upgrade, dubbed Maxwell, slated for June. Maxwell will boost the block time on the BSC mainnet to 0.75 seconds. The Maxwell upgrade builds on the foundation laid by the Lorentz hard fork upgrade to achieve a high-performance blockchain that can cater to the growing and dynamic crypto landscape.

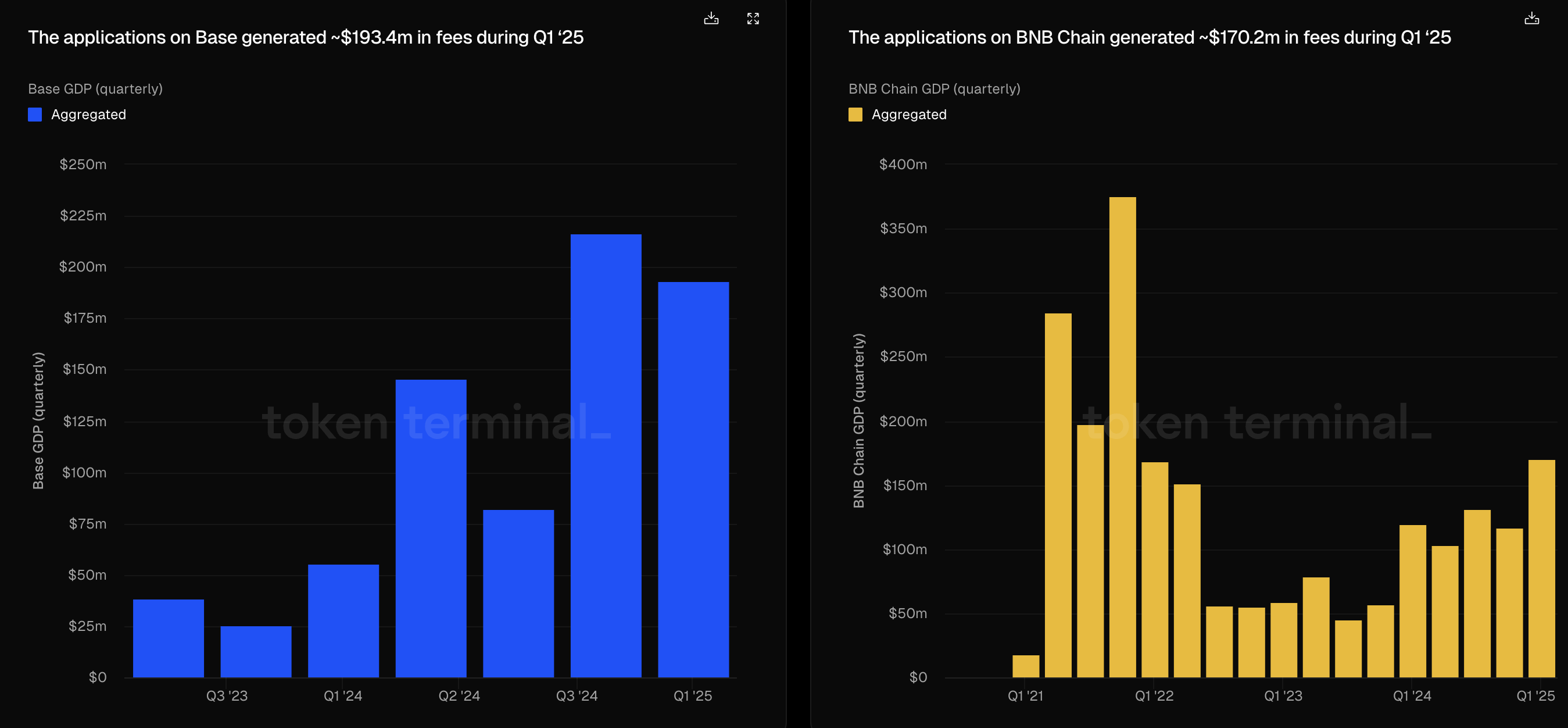

According to a report by Token Terminal, dApps on the BSC Chain generated $170.2 million in fees in Q1 2025 compared to $119.34 million in Q1 2024. The chart shows consistent growth in the last year, although BSC lags behind Coinbase’s Base, with $193.4 million generated in fees in Q1 2025 and Ethereum’s $1.01 billion in the same period.

BSC Chain vs. Base Q1 2025 dApps fees | Source: Token Terminal

BNB price bullish momentum steady

Binance Coin faces resistance at $580 at the time of writing on Friday despite the mid-week rebound triggered by US President Donald Trump’s 90-day tariff pause, following Monday’s drawdown to $520.

The Relative Strength Index (RSI) momentum indicator neutrality at 44.84 after recovering from near-oversold conditions at 34.40 in the daily chart suggests that the trend leans bullish.

However, the RSI holds below a descending trendline and the midline at 50 to highlight an existing bearish outlook that must be broken for the BNB price to ascend above the psychological resistance at $600.

BNB/USDT daily chart

The 50-day Exponential Moving Average (EMA) at $605, the 200-day EMA at $616, and the 100-day EMA at $620 could limit BNB’s bullish potential above $600. Moreover, failure to confirm support at $580 would mean bullish momentum is declining. This may encourage traders to reduce exposure, adding to sell-side pressure while increasing the probability of another correction to Monday’s low at $520.