Tether Reportedly Plans New Stablecoin Amid SEC’s Latest Guidelines

The US Securities and Exchange Commission (SEC) has issued one of its most definitive statements yet on the regulatory treatment of stablecoins.

In a move that could reshape the market, the agency clarified that certain stablecoins, under specific conditions, do not fall under the definition of securities.

Tether Considers Shifting Strategy with SEC’s New Update

The SEC labeled these assets as “covered stablecoins,” and they must meet strict requirements to remain outside the regulator’s oversight.

“Covered Stablecoins are not marketed as investments; rather, they are marketed as a stable, quick, reliable and accessible means of transferring value, or storing value and not for potential profit or as investments,” the SEC explained.

According to the statement, a covered stablecoin must maintain a one-to-one peg with the US dollar and be backed by highly liquid, low-risk assets.

It must also be redeemable on demand at full value. Importantly, these tokens cannot offer profit, interest, governance rights, or ownership stakes. Their sole function must be payment, money transfer, or value storage.

The SEC explained that these assets are not investment vehicles and are typically marketed as “digital dollars.” As such, the agency does not consider its offer or sale to involve securities under federal law.

“Accordingly, it is the Division’s view that Covered Stablecoins are not offered or sold as investment contracts,” the financial regulator concluded.

This marks a rare moment of clarity from the SEC, which has often taken an ambiguous or enforcement-first approach to crypto regulation.

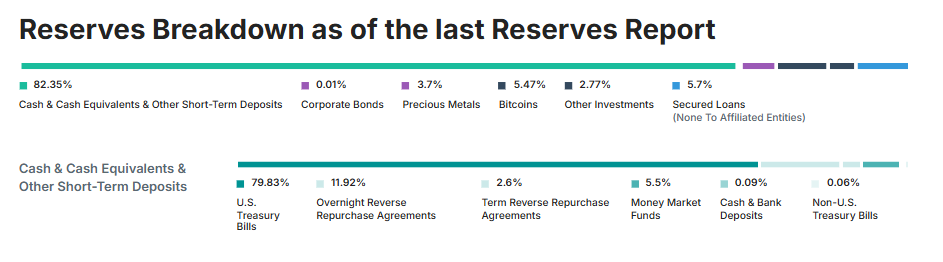

However, while the SEC’s guidance clearly provides a path forward for stablecoins like USDC, it casts doubt on whether Tether’s USDT qualifies. The guidance specifically excludes reserves made up of crypto assets or precious metals, both of which are part of USDT’s current backing.

Tether’s USDT Reserve Backing. Source: Tether

Tether’s USDT Reserve Backing. Source: Tether

Meanwhile, Forbes journalist Nina Bambysheva reported that Tether is considering launching a new stablecoin to align with US regulations. This means the proposed asset would be fully backed by cash and US Treasuries. Such a pivot would mark a major shift in strategy for the issuer as it navigates increasing scrutiny.

Crypto analyst Novacula Occami also pointed out that USDT’s reserves include Bitcoin and gold, which are explicitly disqualified by the SEC’s criteria. As a result, USDT may fall within the scope of securities law and face potential restrictions in the US.

“USDC and the Paxos coins comply with the SEC’s guidance and are not securities. USDT however, with its gold, BTC and other reserves are securities and cannot be legally offered in the US,” he added.

Industry Reactions to the Regulator’s Move

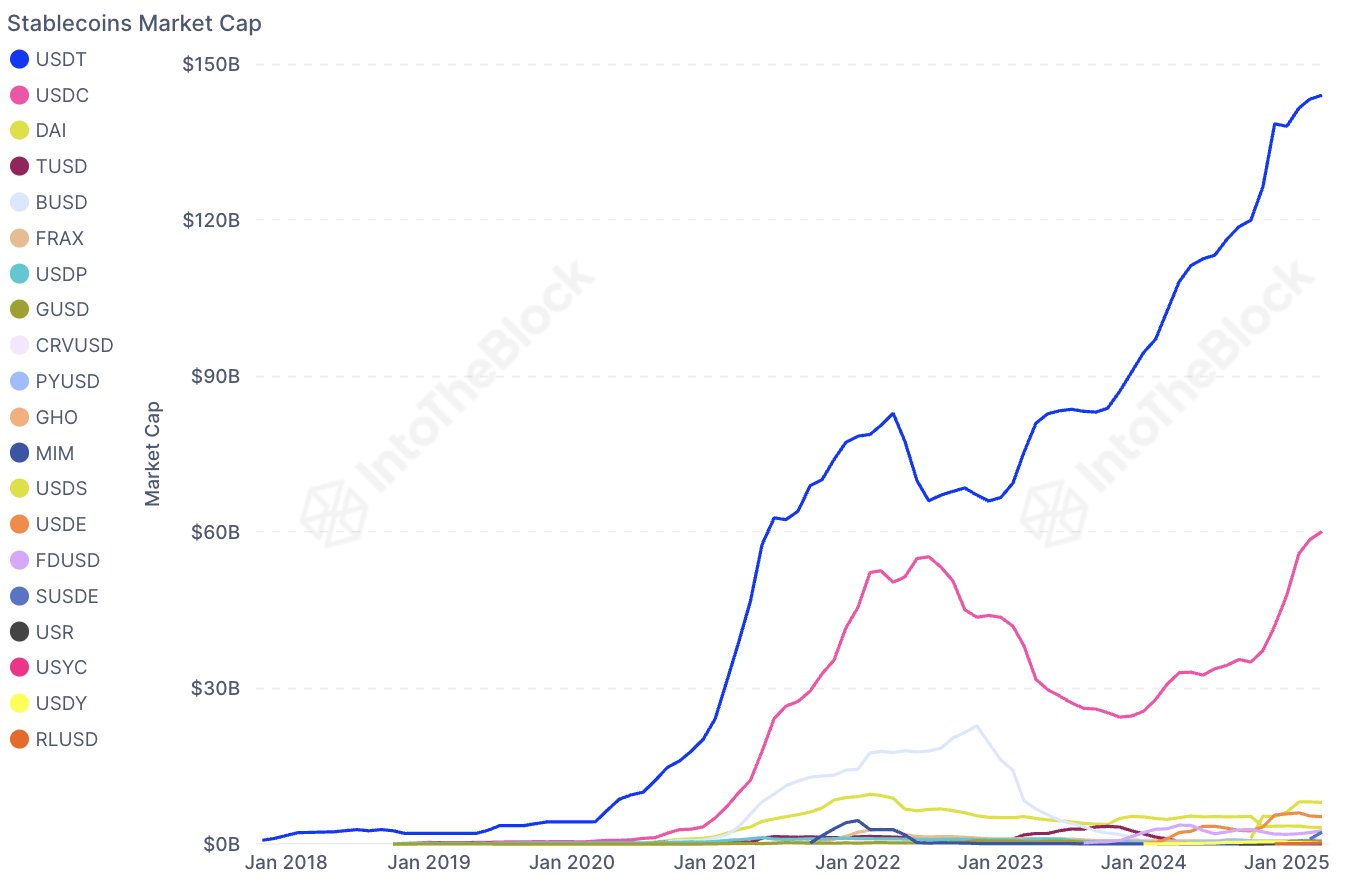

The news comes as stablecoins are gaining wider adoption despite market volatility. Daily usage continues to climb even during a challenging first quarter for digital assets.

Data from IntoTheblock shows that the sector increased by more than $30 billion during the first quarter of the year despite the broader market sell-off.

Stablecoins Market Cap. Source: IntoTheBlock

Stablecoins Market Cap. Source: IntoTheBlock

Nevertheless, industry responses to the new guidelines have been mixed. David Sacks, a White House advisor on crypto policy, welcomed the move.

Sacks said the statement provides long-overdue clarity and could ease regulatory burdens for compliant issuers.

“The SEC has determined that fully-reserved, liquid, dollar-backed stablecoins are not securities. Therefore blockchain transactions to mint or redeem them do not need to be registered under the Securities Act,” Sacks stated.

However, SEC Commissioner Caroline Crenshaw offered sharp criticism. She warned that the guidance downplays risks in the stablecoin market and misrepresents key legal issues.

According to her, the statement presents an overly simplistic view of the industry.

“The [SEC’s] statement’s legal and factual errors paint a distorted picture of the USD-stablecoin market that drastically understates its risks,” Crenshaw added.