Florida Police Arrests Ben “BitBoy” Armstrong Arrested Over Emails Sent to Judge

Ben “BitBoy” Armstrong, a popular crypto influencer, was arrested in Florida last night. Based on his social media posts, it seems like the reason was harassing or possibly threatening a Judge over email.

BitBoy is being held without bond, rendering him unable to bail out of incarceration for the foreseeable future.

Why Was BitBoy Arrested?

Ben “BitBoy” Armstrong, a prominent crypto influencer, has been involved in a fair share of scandals. Two years ago, he was removed from the BitBoy YouTube channel, which rebranded in his absence.

He was also arrested in 2023 for loitering, and his business ventures have suffered. Last night, Armstrong was arrested again in Florida.

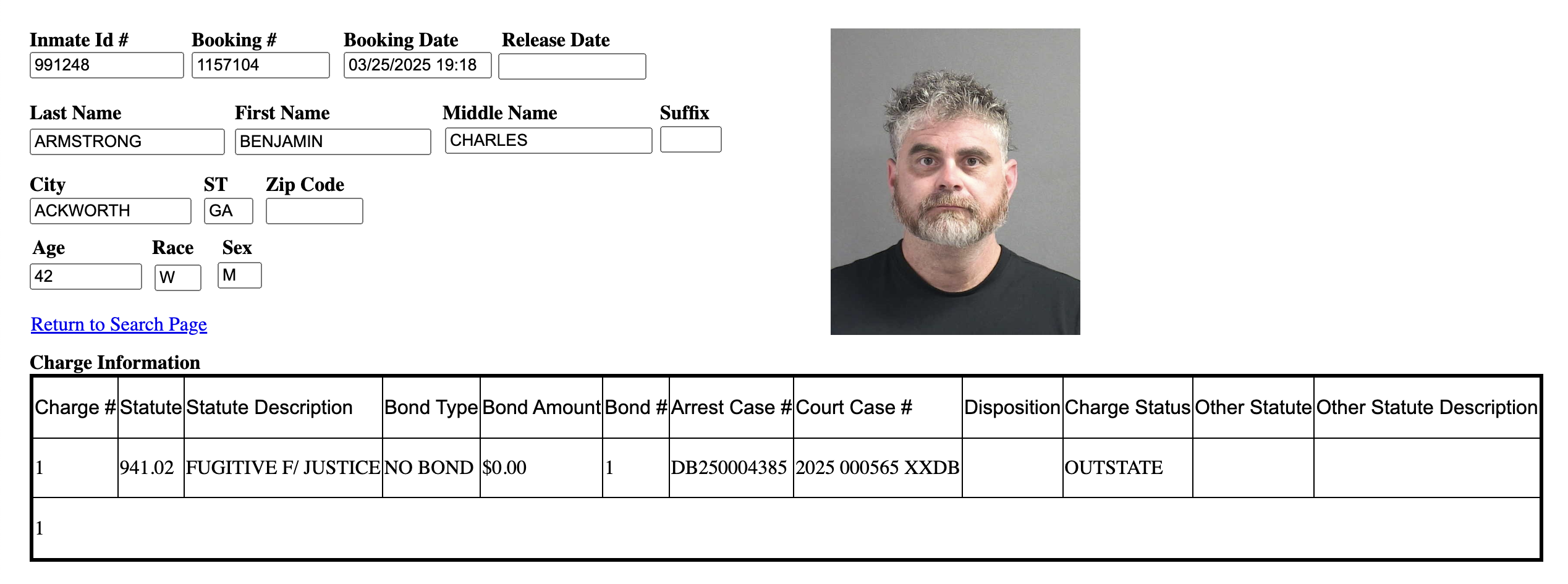

Ben Armstrong’s Arrest Record. Source: volusiamug.vcgov.org

Ben Armstrong’s Arrest Record. Source: volusiamug.vcgov.org

According to BitBoy’s arrest record, he was determined to be a fugitive from justice and held without bond. This means that Armstrong has no way of bailing out of jail before pre-trial hearings begin.

Although some members of the community speculated that he was detained for causing a public disturbance, the evidence is not credible.

Similarly, although BitBoy has allegedly been involved in promoting rug pulls and other shady projects, this also seems unrelated to this incident.

Instead, a look at his social media accounts shows some revealing information. His case got a lot of buzz in the crypto community due to his active participation in social media networks.

A Series of Questionable Actions

Five days ago, BitBoy confirmed that there was a warrant out for his arrest.

“I can now confirm that the warrants for my arrest are due to me sending emails (as my own attorney by the way) to the dishonorable Kimberly Childs of Cobb County who has now deleted her Twitter,” Armstrong claimed via social media.

In other words, BitBoy was already involved in some sort of legal dispute, likely related to his former arrests. By emailing Judge Childs, his actions may have constituted harassment, if not outright threatening statements.

Armstrong was also representing himself in court, a highly inadvisable move that may have added to the Judge’s ire.

This isn’t the first time something like this has happened. In 2023, BitBoy was in legal hot water for harassing an attorney in a different legal battle, although he was not arrested in this incident.

He has a pattern of erratic behavior like this; his most recent social media posts involved bizarre tirades against a young actor who coincidentally shares his name.

Until the legal battle proceeds, the public won’t have any access to the harassing emails in question. It’s unclear how long it will take for BitBoy to get a hearing after his arrest.

Whatever happens, this strange battle and incarceration may impact his ability to retain a meaningful following in the crypto space.