Grayscale Adds 3 Altcoins to Its Top 20 Crypto Investment List for Q2 2025

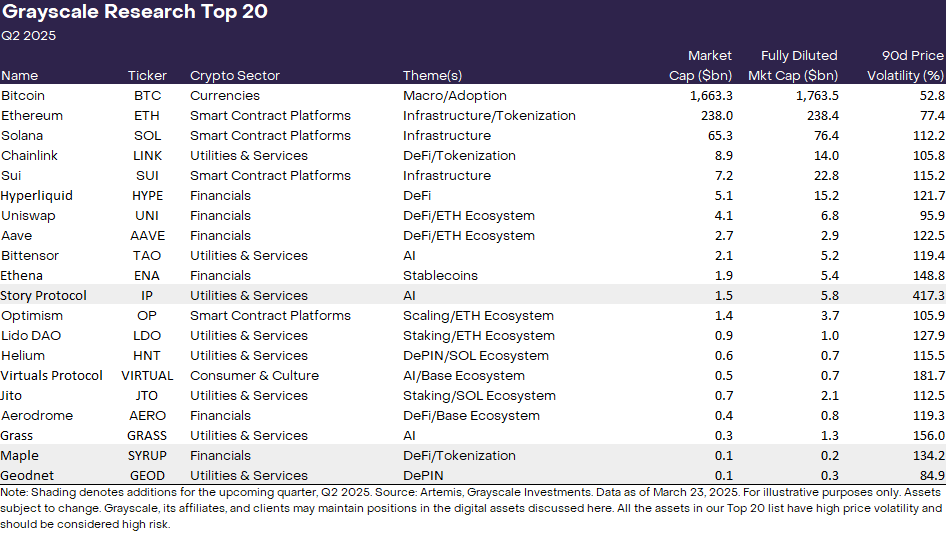

Grayscale Research has released its updated Top 20 list of digital assets, identifying key cryptocurrencies with strong potential for the coming quarter.

The firm updates this curated selection quarterly, reflecting its analysis of network adoption, market trends, and fundamental sustainability.

Grayscale Adds 3 Altcoins to Investment Consideration List

The latest update introduces three new assets—Maple (SYRUP), Geodnet (GEOD), and Story Protocol (IP). This suggests an inclination toward real-world applications in decentralized finance (DeFi), decentralized physical infrastructure networks (DePIN), and intellectual property (IP) tokenization.

Grayscale organizes the digital asset market into five distinct crypto sectors: currencies, smart contract platforms, financials, consumer & culture, and utilities & services. This framework allows the firm to track industry trends and assess high-growth opportunities within each category.

With the latest rebalancing, the crypto sectors now encompass 227 distinct assets with a total market capitalization of $2.6 trillion, covering the vast majority of the global crypto market.

Grayscale’s Top 20 altcoin features SYRUP, GEOD, and IP. Source: Grayscale

Grayscale’s Top 20 altcoin features SYRUP, GEOD, and IP. Source: Grayscale

Maple Finance (SYRUP)

Maple Finance (SYRUP) is a leading DeFi protocol specializing in institutional lending. The project operates through two core platforms: Maple Institutional, designed for accredited investors, and Syrup.fi, which serves DeFi-native users.

Over the past year, Maple Finance has grown significantly, reaching $600 million in Total Value Locked (TVL) and $20 million in annualized network fee revenue. The project aims to scale Syrup.fi to $2 billion in TVL by integrating with other DeFi protocols, including Pendle (PENDLE).

Geodnet (GEOD)

Meanwhile, Geodnet (GEOD) has emerged as a leader in the DePIN space. As the world’s largest real-time kinematic positioning provider, the network offers geospatial data with centimeter-level accuracy. It serves industries such as agriculture, robotics, and autonomous vehicles.

The network has expanded to include more than 14,000 active devices across 130 countries and has seen its revenue grow substantially. Annualized network fees increased by 500% year-over-year (YoY) to $3 million.

Geodnet’s decentralized approach presents a cost-effective alternative to centralized GPS solutions, positioning it as a critical infrastructure provider in the blockchain space.

Story Protocol (IP)

Story Protocol (IP) is tackling the growing intellectual property space by bringing IP rights onto the blockchain. With AI-generated content sparking copyright disputes, Story Protocol offers a way for companies and creators to monetize their intellectual property. At the same time, it enables investors to trade and earn royalties.

The project has already onboarded high-profile assets, including music rights for Justin Bieber, BTS, Maroon 5, and Katy Perry. It also launched its dedicated IP-focused blockchain and token in February 2025.

Grayscale Removes 3 Altcoins From its List of Investible Products

The latest update also includes the removal of three assets from the Top 20 list, comprising Akash Network (AKT), Arweave (AR), and Jupiter (JUP).

“Grayscale Research continues to see value in each of these projects, and they remain important elements of the crypto ecosystem. However, we believe the revised Top 20 list may offer more compelling risk-adjusted returns for the coming quarter,” the firm explained.

Beyond these new additions, Grayscale continues to highlight key investment themes. These include Ethereum scaling solutions, AI-integrated blockchain development, and DeFi and staking innovations. The continued inclusion of assets like Optimism (OP), Bittensor (TAO), and Lido DAO (LDO) reflects the firm’s focus on these high-growth areas.

Meanwhile, the latest Top 20 update follows Grayscale’s broader expansion into evaluating additional digital assets. In January 2025, the firm revealed nearly 40 altcoins under investment consideration. Similarly, Grayscale announced a list of 35 assets for potential inclusion in investment products in October.