Solana (SOL) Surges Past $140 Despite Increasing Competition From Other Blockchains

Solana (SOL) is up nearly 9% in the last 24 hours, climbing above $140 for the first time since March 8, despite BNB surging to become the biggest chain in DEX volume last week.

While price action has strengthened, Solana’s market still shows mixed signals, with some large investors remaining cautious. Traders are now watching key resistance and support levels to gauge whether SOL can sustain its rally or face a potential pullback.

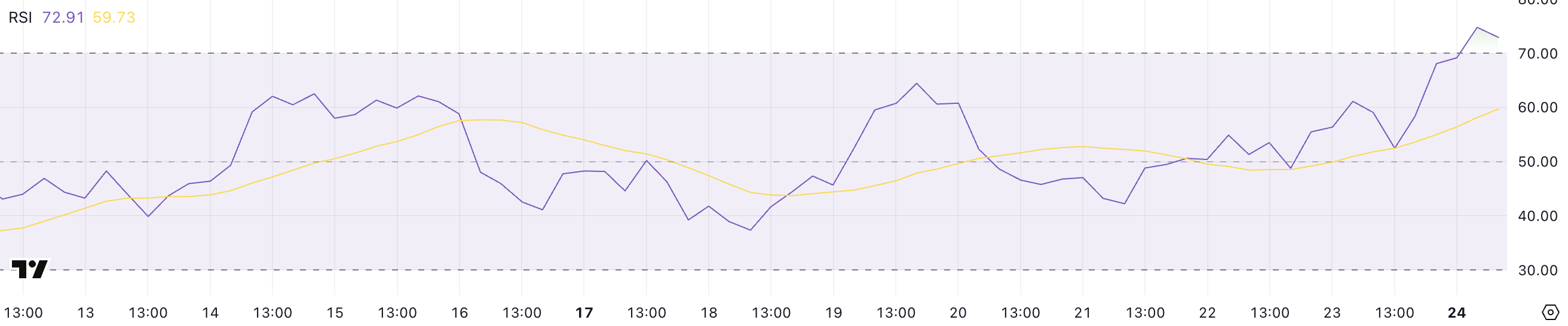

Solana RSI Rise Above 70 For The First Time Since March 2

Solana’s RSI has surged from 52.46 yesterday to 72.91 today, marking the first time it has entered overbought territory since March 2.

This sharp rise signals a sudden acceleration in buying momentum after nearly two weeks of neutral readings hovering around the mid-50s.

The breakout above the 70 level suggests a notable shift in sentiment, as traders have pushed SOL into a more aggressive bullish stance.

SOL RSI. Source: TradingView.

SOL RSI. Source: TradingView.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It helps traders identify potential overbought or oversold conditions.

Typically, an RSI value above 70 is considered overbought, indicating that an asset may be due for a corrective pullback. Readings below 30 are viewed as oversold, suggesting possible upside reversals. Solana’s RSI, currently at 72.91, highlights a strong bullish push but also raises caution about a potential short-term correction as BNB overtakes Solana in DEX volume.

Given that SOL had been trading in a neutral zone for the past 12 days, this sudden spike could either mark the start of a stronger rally or signal a temporary overheating in price momentum.

SOL Whales Are Still Hesitant

The number of Solana whales – wallets holding at least 10,000 SOL – is currently at 5,019, slightly down from the recent peak of 5,041 recorded on March 18.

This fluctuation highlights ongoing shifts in large-holder behavior, as whale activity has yet to stabilize fully. While the recent whale count remains elevated compared to earlier levels this month, it still suggests hesitation among large investors to re-enter the market fully.

Solana Whales. Source: Glassnode.

Solana Whales. Source: Glassnode.

Tracking whale activity is crucial because these large holders often significantly influence market trends and liquidity. An increase in whale addresses can indicate accumulation and growing confidence, while a decline may signal distribution or caution.

With the current whale count showing signs of volatility and retreating slightly from recent highs, it suggests that major players are still uncertain about Solana’s short-term direction.

Until this number shows more consistent growth, it could imply that SOL’s price may remain sensitive to fluctuations and lack the solid backing typically seen during stronger bullish trends.

Can Solana Sustain The Current Levels?

Solana’s EMA lines recently confirmed a golden cross, signaling the potential for a bullish continuation. Further golden crosses may form soon.

If the current uptrend strengthens, Solana’s price could rise to challenge the resistance at $152.90 and, if momentum persists, extend gains toward the $180 mark.

Despite concerns within the community regarding the competition between PumpFun and Raydium, Chris Chung, founder of Solana-based swap platform Titan, argues that this rivalry could actually benefit Solana’s broader ecosystem:

“Pump.fun launching its own DEX was inevitable as they believe they have a strong enough brand now to eliminate the Raydium tech stack and collect AMM fees themselves. In addition, Raydium announced plans for its own launchpad, showing that competition in the Solana ecosystem is heating up – and fast. It’s great to see new players enter with ideas to improve the speed and usability of end users. This type of competitive behavior helps build robust financial products and DeFi protocols and simply makes Solana’s activity grow,” Chung told BeInCrypto.

SOL Price Analysis. Source: TradingView.

SOL Price Analysis. Source: TradingView.

However, if bullish momentum weakens and the uptrend reverses, SOL could retest key support at $136.71.

A break below this level could expose Solana to further downside, with a target of $120 and potentially $112 if selling pressure intensifies.