GBP/USD flattens ahead of UK Retail Sales

- GBP/USD pumped the brakes on Thursday, stuck near 1.3400.

- UK Retail Sales in the barrel for Friday, investors expect a third straight decline.

- Cable markets are losing steam after tapping fresh multi-year highs this week.

GBP/USD treaded water on Thursday, marking in a tight circle just north of the 1.3400 handle as global market sentiment suffers knock-on effects from a recent bout of worry that shot through Treasury yields this week. Investors are broadly focusing on the United States’ (US) mounting debt problems, which are poised to get a fresh injection (in the wrong direction) as President Donald Trump’s deficit-swelling “big, beautiful” tax and budget bill grinds its way through Congress.

UK Retail Sales (and not much else) in the Friday pipeline

United Kingdom (UK) Retail Sales lie ahead as the final key data release this week. UK Retail Sales in April are expected to show a third consecutive monthly decline, with median market forecasts prepped for a slide to 0.2% MoM from March’s 0.4%. Annualized Retail Sales are forecast to jump to 4.5% YoY from 2.6%, but Pound Sterling traders will be keeping a closer eye on the slowdown at the front end of the curve.

Markets on both sides of the Pacific will be wrapping the trading week up on Friday heading into a long weekend. Banks, brokers, and exchanges will be dark on Monday with dual holidays: the Spring Break Holiday in the UK, and Memorial Day in the US. Next week’s economic calendar is also notably dry on the Pound Sterling side, leaving Cable traders at the mercy of any shifts in broader market sentiment.

GBP/USD price forecast

Overall, the Pound Sterling has been on a tear in 2025, rising 11.3% bottom-to-top from mid-January’s multi-month bottoms at the 1.2100 handle. Cable has entirely reversed losses through the last quarter of 2024, rising to multi-year highs near 1.3450 this week.

In the near-term, bullish momentum has drained out of the GBP/USD chart; intraday price action has been caught in a tight consolidation pattern, and although the pair appears poised for a bullish breakout, there may not be enough bidding powder remaining in the keg to muscle Cable prices back above 1.3440 before intraday prices fall back to the 200-hour Exponential Moving Average (EMA) near 1.3355.

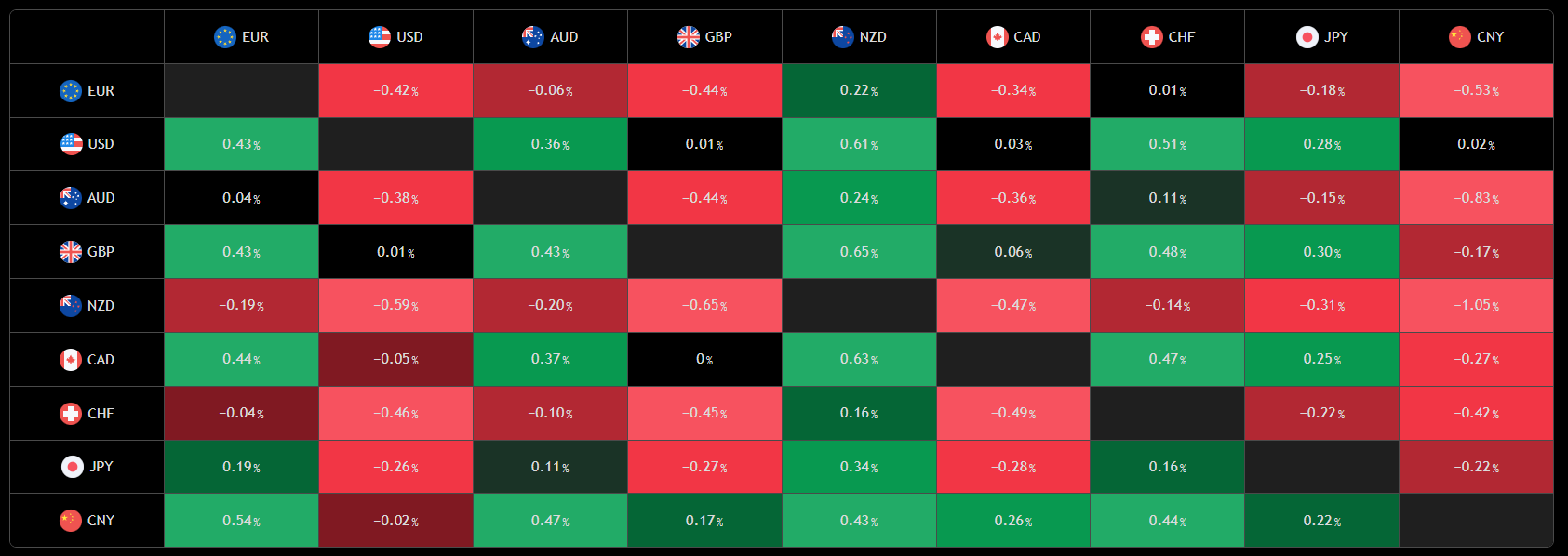

(TradingView currency heatmap, 1D timeframe)

GBP/USD daily chart

GBP/USD 1-hour chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.