Crypto Today: Trump’s tariff updates sparks Bitcoin rally, as AVAX, SOL, Chainlink lead altcoin gains

- Cryptocurrency sector’s valuation rose 3.3% on Monday, reaching the $2.83 trillion mark for the first time in two weeks.

- The market rally is linked to reports that the US plans to exclude sector-specific tariffs ahead of the April 2 deadline.

- Bitcoin price recovers above the $88,000 level, with Solana, Chainlink, and Avalanche among the top-gainers within the altcoin market.

Bitcoin market updates:

- Bitcoin price surges 4%, nearing $89,000 in the early hours on Monday.

- The BTC price rally has been linked to imminent tariff rollbacks by the Trump administration, adding to active positive sentiment from the Federal Reserve (Fed) rate pause last week.

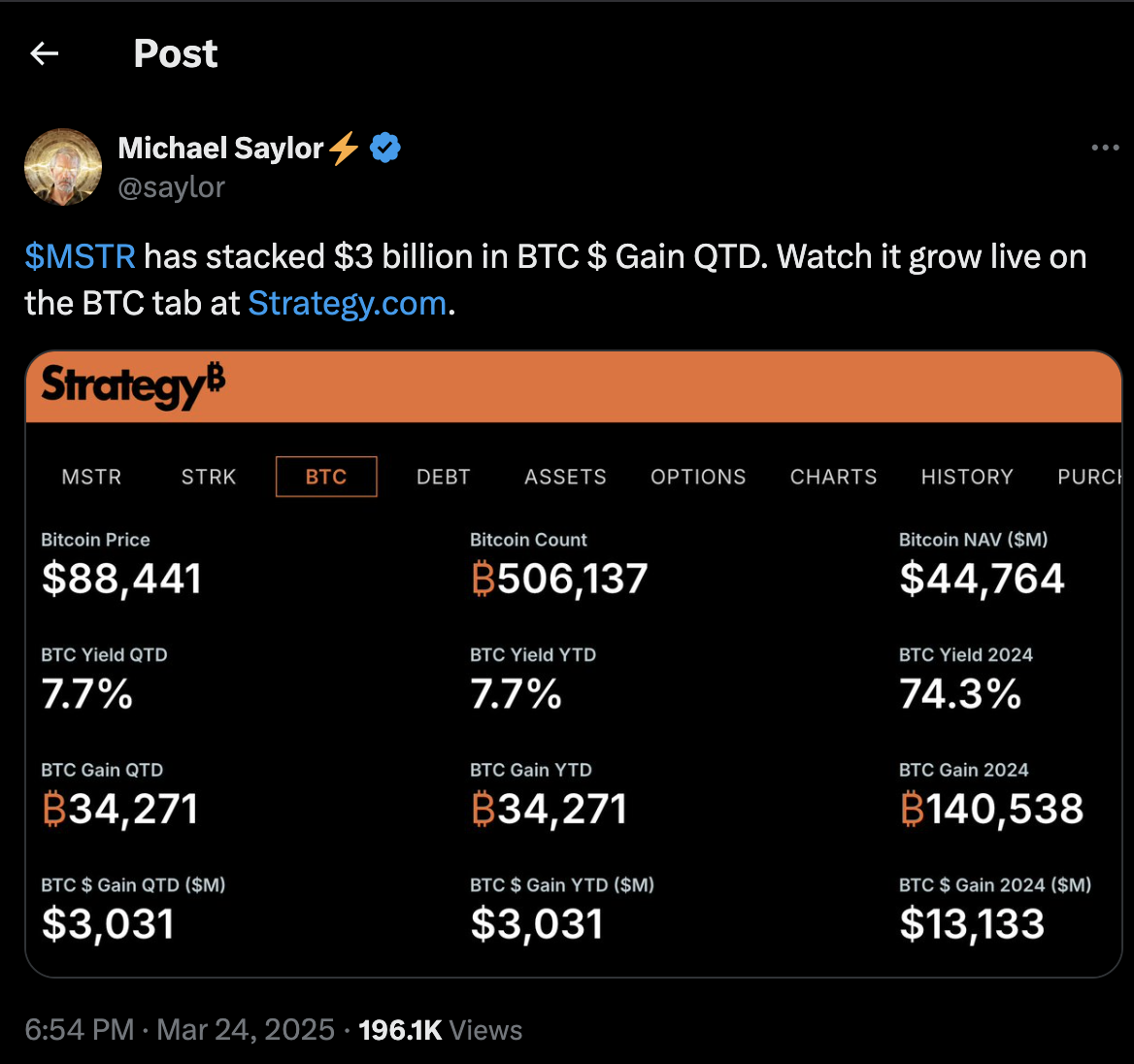

- Michael Saylor announced that Strategy had acquired $3 billion in profits in Q1 2025.

Why is the crypto market up today?

The US Fed decision to maintain rates unchanged last week ignited risk-on appetite across global risk assets markets. This saw demand for the US weaken 4% from its January peaks, according to Bloomberg.

Total Crypto Market Capitalization | Source: TradingView

Total Crypto Market Capitalization | Source: TradingView

Secondly, the Trump administration has hinted at another round of exclusions from reciprocal tariffs on April 2, with the possibility of excluding sector-specific tariffs.

This incentivized investors to place large bullish bets in expectations that tariff rollbacks could further lower inflation.

These two major macro events have sparked increased demand for risk assets globally as investors rotate out of USD-backed securities, expecting interest rates to remain low for longer.

Mirroring the bullish backdrop in the global markets, cryptocurrencies started the week strongly. At press time on Monday, the total cryptocurrency sector valuation has increased by $2.83, reflecting a $200 billion uptick within the last 24 hours, per TradingView data.

Chart of the day: Avalanche, Chainlink, and TRUMP lead gainers ahead of tariff updates

Two key macro factors are driving the cryptocurrency market’s strong start to the week.

Capital allocation within the crypto space has been uneven, driving surges in specific sectors.

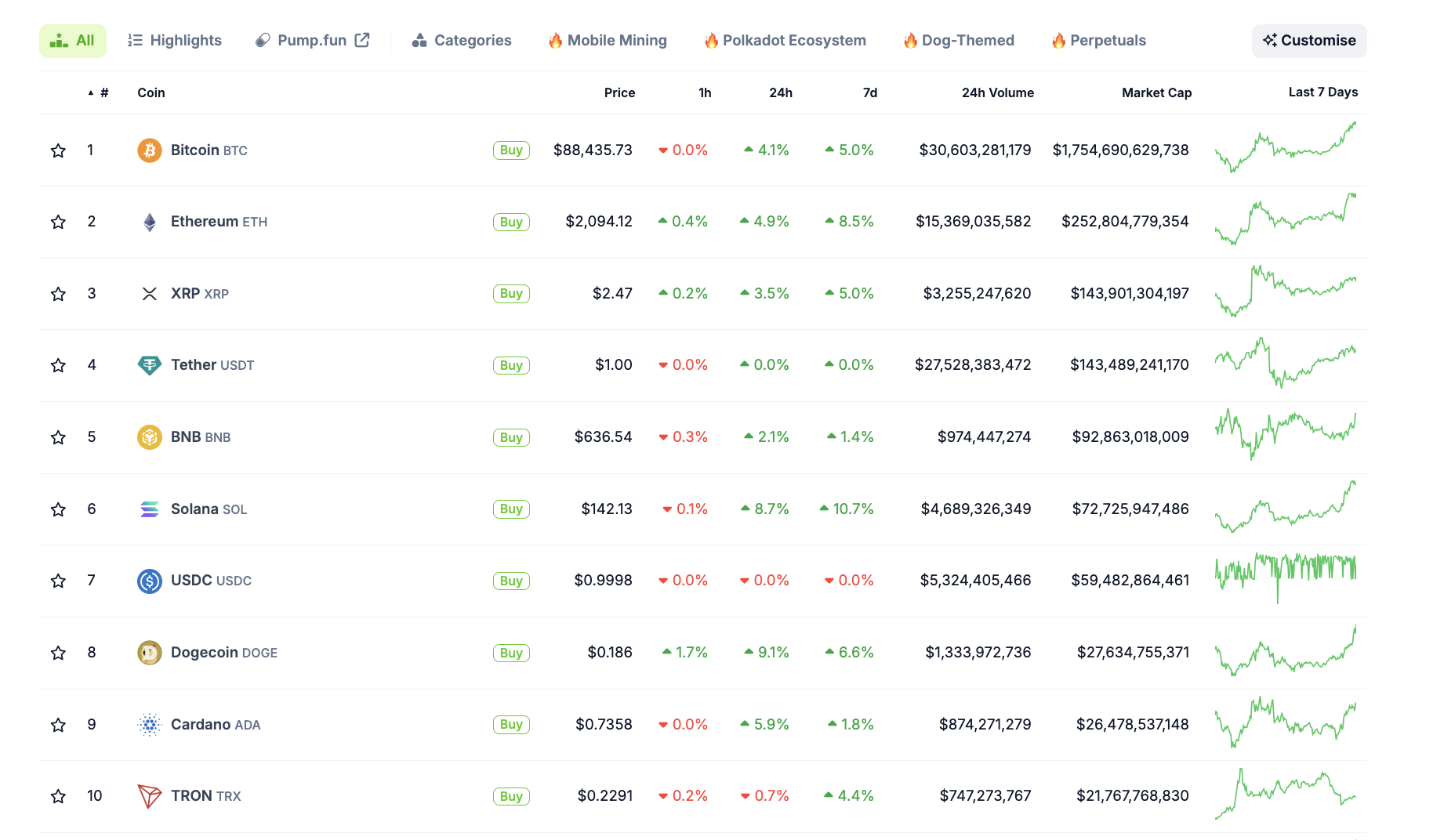

Crypto market performance | Source: Coingecko

Crypto market performance | Source: Coingecko

At press time, mid-cap altcoins, Trump-associated tokens, and memecoins have emerged as top performers.

- Avalanche (AVAX) price surges 10%

Avalanche (AVAX) has seen a 10% price increase, as reflected in the chart. A major catalyst behind this rally is the accumulation by the US President’s firm,

WLFI. Blockchain analytics platform Lookonchain reported that WLFI has been purchasing AVAX in recent weeks, with its most recent acquisition exceeding $7 million around March 16.

- Chainlink (LINK) gains 6% on WLFI links

Chainlink (LINK) has also recorded a 6% increase, driven by news that WLFI has entered into a partnership to utilize Chainlink’s data feeds for decentralized finance (DeFi) and traditional finance (TradFi) integration.

Trump memecoin rises 3%, crossing the $2 billion mark

The Trump memecoin has climbed 3%, pushing its market valuation above $2 billion. Earlier this month, following unpopular trade policies, the token had plummeted nearly 80% from its all-time high of $12.5 billion.

Concerns intensified when controversy surrounding the Libra memecoin led to speculation that the President’s team might abandon the project, further accelerating the sell-off. However, on Monday, Trump reaffirmed his support for the initiative, sparking a renewed rally and making it one of the most-searched tokens of the day, according to Coingecko data.

Crypto News Updates:

-

DWF Labs unveils $250M liquid fund to accelerate web3 growth

DWF Labs has launched a $250 million Liquid Fund to support mid and large-cap crypto projects, aiming to enhance liquidity and accelerate industry growth. The initiative follows the firm’s recent commitment of $11 million to blockchain projects, with an additional $35 million in investments planned. The fund will focus on strategic venture capital, ecosystem expansion, and liquidity provisioning across decentralized finance (DeFi) and lending markets.

The fund is designed to bolster public relations, go-to-market strategies, and broader crypto adoption efforts. DWF Labs aims to drive innovation within the industry by providing financial support and strategic resources to promising projects. This move reinforces the firm's ongoing role as a major player in the crypto investment landscape, actively deploying capital to strengthen blockchain ecosystems.

-

dYdX launches first DYDX buyback program to enhance network security

The dYdX community has introduced its first DYDX Buyback Program, allocating 25% of net protocol fees to repurchase DYDX tokens from the open market on a monthly basis. The acquired tokens will be staked to enhance network security and reinforce the protocol’s economic model.

This initiative is part of a broader strategy to align tokenomics with dYdX’s long-term growth. By integrating buybacks into the ecosystem, the program aims to boost sustainability and strengthen the role of DYDX tokens within the decentralized trading platform.

-

World Network explores Visa partnership for self-custody crypto wallet integration

World Network, formerly known as Worldcoin, is in talks with Visa to integrate card features into its self-custody crypto wallet.

According to a CoinDesk report, the partnership would enable stablecoin payments across

Visa’s global merchant network, expanding crypto accessibility for users.

The initiative follows earlier discussions with PayPal and OpenAI to enhance World Network’s digital payment infrastructure.

Tools for Humanity, the company behind the project, has reportedly reached out to card issuers and crypto card facilitators like Rain, signaling active progress toward implementation.