Wanted by Interpol, Hayden Davis still launches another meme coin

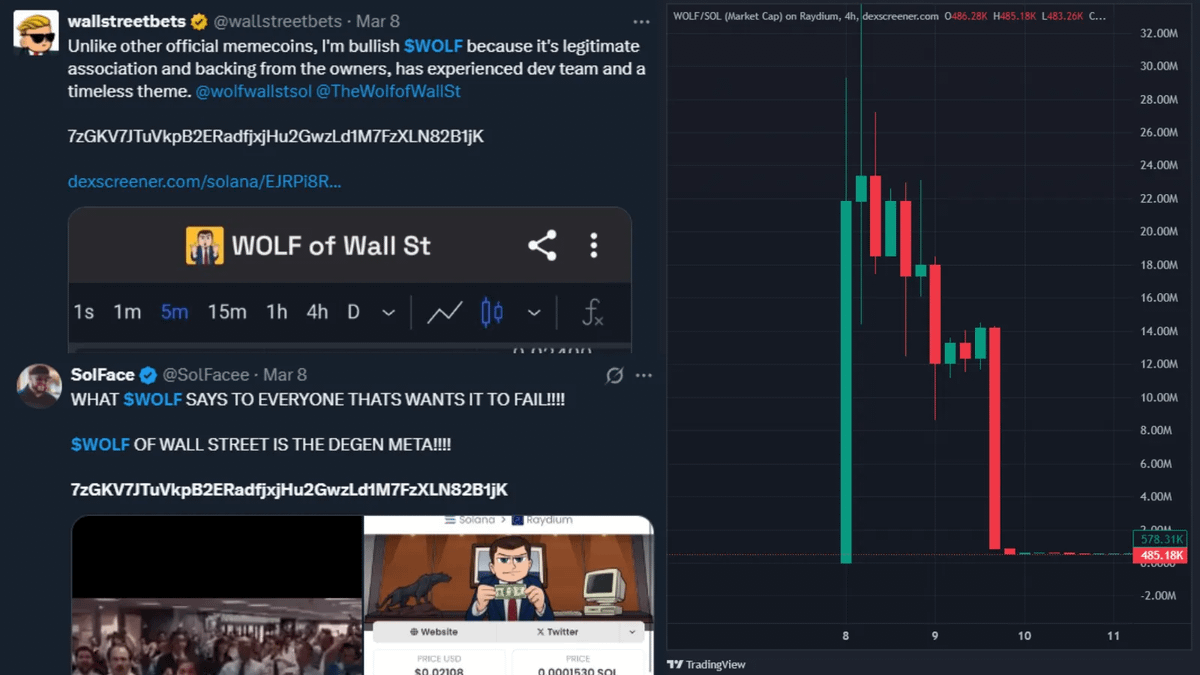

Hayden Davis, the notorious crypto scammer wanted by Interpol, has launched yet another meme coin, $WOLF, despite facing global arrest warrants and fraud investigations. $WOLF surged to a $40 million market cap after being hyped by the WallStreetBets (WSB) community, only to crash within days.

On-chain analysts at Bubblemaps uncovered evidence of insider manipulation, showing that 82% of the total supply was controlled by a small group of wallets, raising rug pull concerns.

On-chain data exposes Hayden’s connection to $WOLF

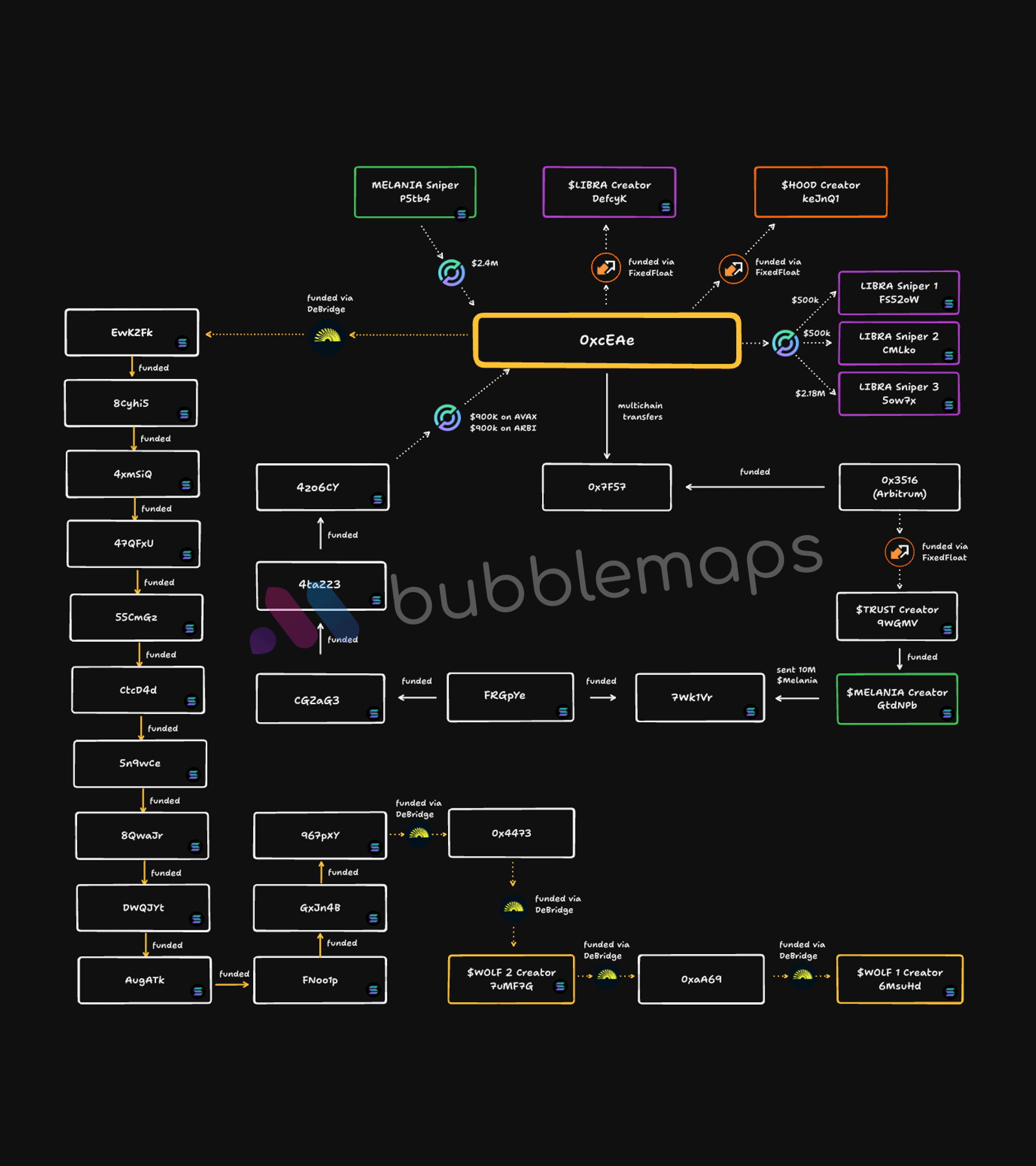

Hayden has a history of failed meme coins, including $LIBRA and $MELANIA, both of which ended in massive losses for investors. His latest project, $WOLF, follows the same pattern. Bubblemaps says Hayden has been concealing his identity but left a trail of on-chain transactions that links him directly to yet another multi-million-dollar crypto disaster.

Bubblemaps, alongside crypto investigator Coffeezilla, traced $WOLF’s transaction history and identified Hayden as the mastermind. Bubblemaps detailed how they followed 17 addresses and five cross-chain transfers, all leading to one address: OxcEAe, which they confirmed belongs to Hayden.

In a post on X, Bubblemaps said, “Starting with the $WOLF creator 6MsuHd, we followed funding transfers back across 17 addresses and 5 cross-chain transfers. All led to a single address: OxcEAe. The same one owned by Hayden Davis!”

Hayden’s $LIBRA remains one of the largest rug pulls in recent crypto history. The meme coin was heavily promoted by Argentine President Javier Milei, who said it could be a solution to Argentina’s economic crisis in a post on X.

Investors rushed in, pushing $LIBRA’s market cap past $1 billion, before it crashed overnight, erasing $99 million in liquidity. More than 10,000 investors lost a combined $250 million, while Hayden allegedly cashed out nearly $100 million before the crash.

Following the $LIBRA collapse, Argentine attorney Gregorio Dalbon called for Hayden’s immediate arrest and requested an Interpol Red Notice for fraud and financial crimes. Regulators worldwide are now closely monitoring his movements, but as you can see, he has so far evaded law enforcement and continues to launch new meme coins under fake identities.

Hayden’s rise from small-time hustler to global fugitive

Hayden’s background is far from ordinary. He was a college dropout who sold energy drinks and Oreos to pay his bills as a teenager. On LinkedIn, he once listed “hustling expert” as one of his key skills. He’s currently 28 years old.

His venture capital firm, Kelsier Ventures, is run by his father, Tom Davis, a convicted felon who previously ran a controversial Christian adoption nonprofit before switching to entrepreneurship and business coaching.

In 2023, Kelsier moved its operations from America to Dubai, where it invested in crypto startups and provided marketing services for NFTs, exchanges, and meme coins.

At the time, Tom Davis was far from a cryptocurrency expert. Earlier, he had gotten into trouble forging checks, he told the Christian Broadcasting Network, and pleaded guilty to burglary, according to law-enforcement records. He went to Bible school and became an entrepreneur, investing in bricks-and-mortar businesses such as Skrimp Shack, a chain of seafood restaurants in the U.S. and the Middle East.

Though Tom Davis was Kelsier’s founder, Hayden was its face. Industry peers who worked with Hayden said he’s a smooth talker and a natural dealmaker.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot