Over $3 Billion in Bitcoin and Ethereum Options Expire Ahead of Trump’s White House Crypto Summit

Today, over $3 billion worth of Bitcoin and Ethereum options expire. It will see over $2.5 billion worth of BTC and nearly $500 million worth of ETH contracts settled. How will the prices of both assets react?

These options’ expiry will take place at 8:00 UTC on Deribit, potentially inspiring volatility across the crypto market.

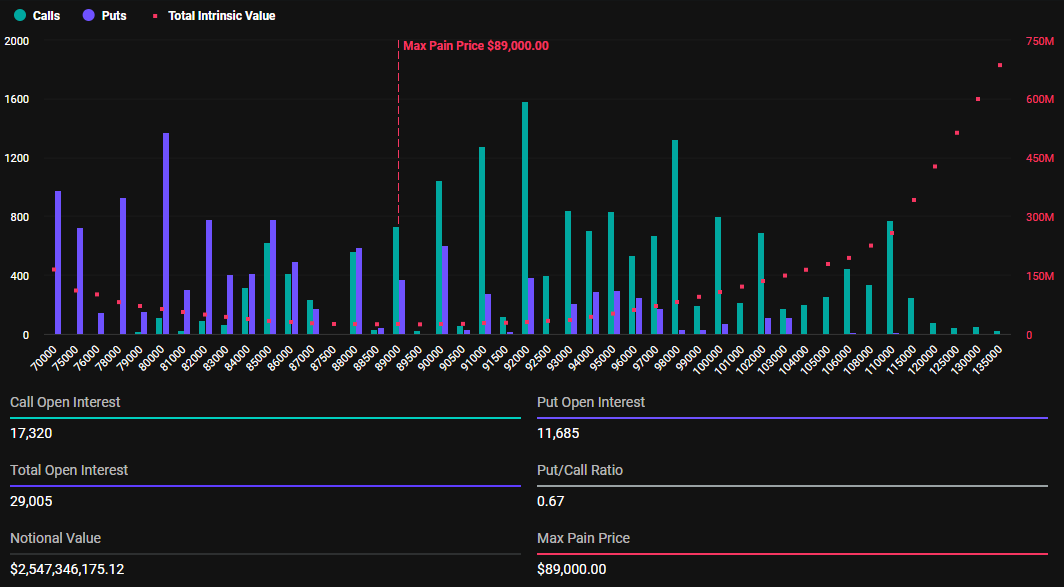

Bitcoin Faces $89,000 Max Pain in Today’s Options Expiry

Today, March 7, 29,005 Bitcoin contracts with a notional value of $2.54 billion are set to expire. According to Deribit data, Bitcoin’s put-to-call ratio is 0.67. The maximum pain point—the price at which the asset will cause financial losses to the greatest number of holders—is $89,000.

Bitcoin Options Expiration. Source: Deribit

Bitcoin Options Expiration. Source: Deribit

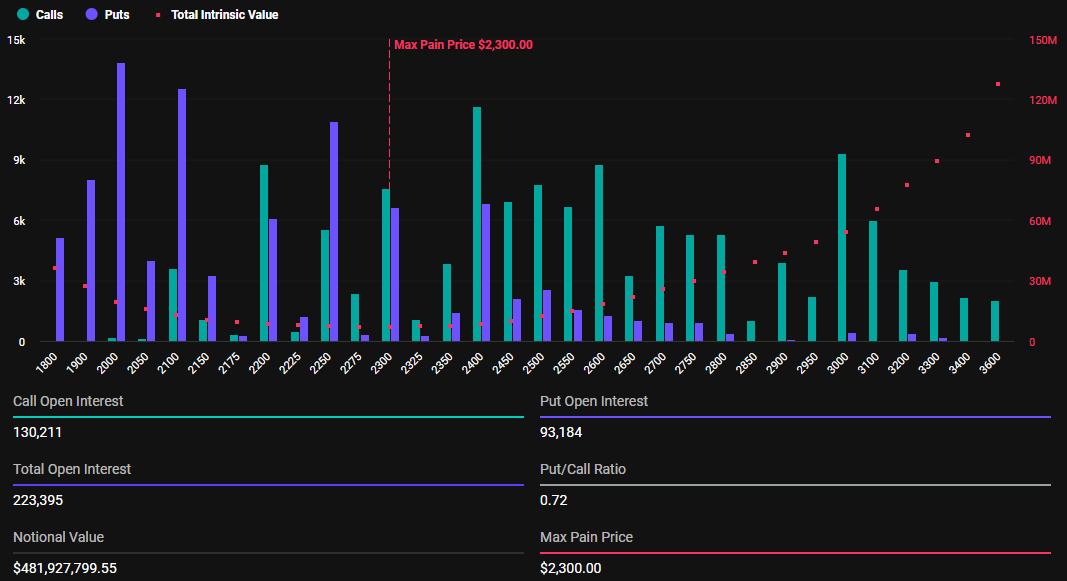

Additionally, Ethereum sees the expiration of 223,395 contracts with a notional value of $481.9 million. The maximum pain point for these contracts is $2,300, with a put-to-call ratio of 0.72.

Expiring Ethereum Options. Source: Deribit

Expiring Ethereum Options. Source: Deribit

The maximum pain point in the crypto options market represents the price level that inflicts the most financial discomfort on option holders. At the same time, the put-to-call ratios, below 1 for both Bitcoin and Ethereum, indicate a higher prevalence of purchase options (calls) over sales options (puts).

Crypto options trading tool Greeks.live provided insights into the current market sentiment. They cited an overall bearish market sentiment, with traders expressing frustration over extreme volatility and choppy price action.

Bitcoin’s sharp intraday swings, such as recent moves of $6,000, have led to what traders describe as “scam both ways” conditions. According to analysts at Greeks.live, this makes it difficult to establish a clear directional trend.

“Most traders are watching the 87,000-89,000 range as key resistance, with 82,000 noted as a recent bottom, though there is significant disagreement on whether a sustainable bottom has been found,” wrote Greeks.live.

Further, the pronounced put skew reflects the broader pessimism, as traders continue to favor downside protection despite occasional upward moves. The analysts also observe that traders are adjusting their strategies amidst the high volatility.

“Several traders are selling calls at 89,000-90,000 range as a preferred strategy in this environment, with one trader reporting they’re at -260% on calls bought at lower levels,” Grreeks.live added.

The belief that the market is currently in a liquidity-driven phase has led to a focus on quick entries and exits. This level of caution comes as longer-term positions remain vulnerable to abrupt swings. External macro factors, such as shifting trade policies and tariff announcements, add to the uncertainty.

As a result, many traders are choosing to stay on the sidelines, waiting for clearer signals before committing to new positions.

“With markets on edge, where do you think price action will land? Above or below max pain?” Deribit posed in a post on X (Twitter).

Nonetheless, traders must remember that option expiration has a short-term impact on the underlying asset’s price. Generally, the market will return to its normal state shortly after and possibly even compensate for strong price deviations.

Traders should stay vigilant, analyzing technical indicators and market sentiment to navigate potential volatility effectively. Meanwhile, these developments come after US President Donald Trump signed the strategic Bitcoin reserve order.

Notably, the order was short of specific details, with many questions likely to be answered later during the White House Crypto Summit.