Is It Time To Buy XRP? TD Sequential Says Yes

A cryptocurrency analyst has pointed out how the Tom Demark (TD) Sequential has just given a buy signal on the hourly XRP price chart.

XRP Has Just Witnessed A Bullish Setup On TD Sequential

In a new post on X, analyst Ali Martinez has discussed about a TD Sequential signal that XRP has seen recently. The “TD Sequential” here refers to an indicator from technical analysis (TA) that’s used for locating probable points of reversal in any asset’s price.

The indicator consists of two phases: setup and countdown. In the first of these, candles of the same polarity (that is, whether red or green) are counted up to nine. Once these candles, which don’t have to be one after the other, are printed on the chart, the TD Sequential gives a reversal signal.

The countdown phase begins as soon as the setup is over. This phase also works much in the same way, with the only difference being that candles here are counted up to thirteen, not nine. Once the countdown is finished, the asset can be assumed to have arrived at another potential turnaround.

Where a TD Sequential signal might lead the price naturally depends on the type of candle that led to the phase’s completion. Green candles naturally mean a correction may be coming, while red ones suggest a bullish reversal.

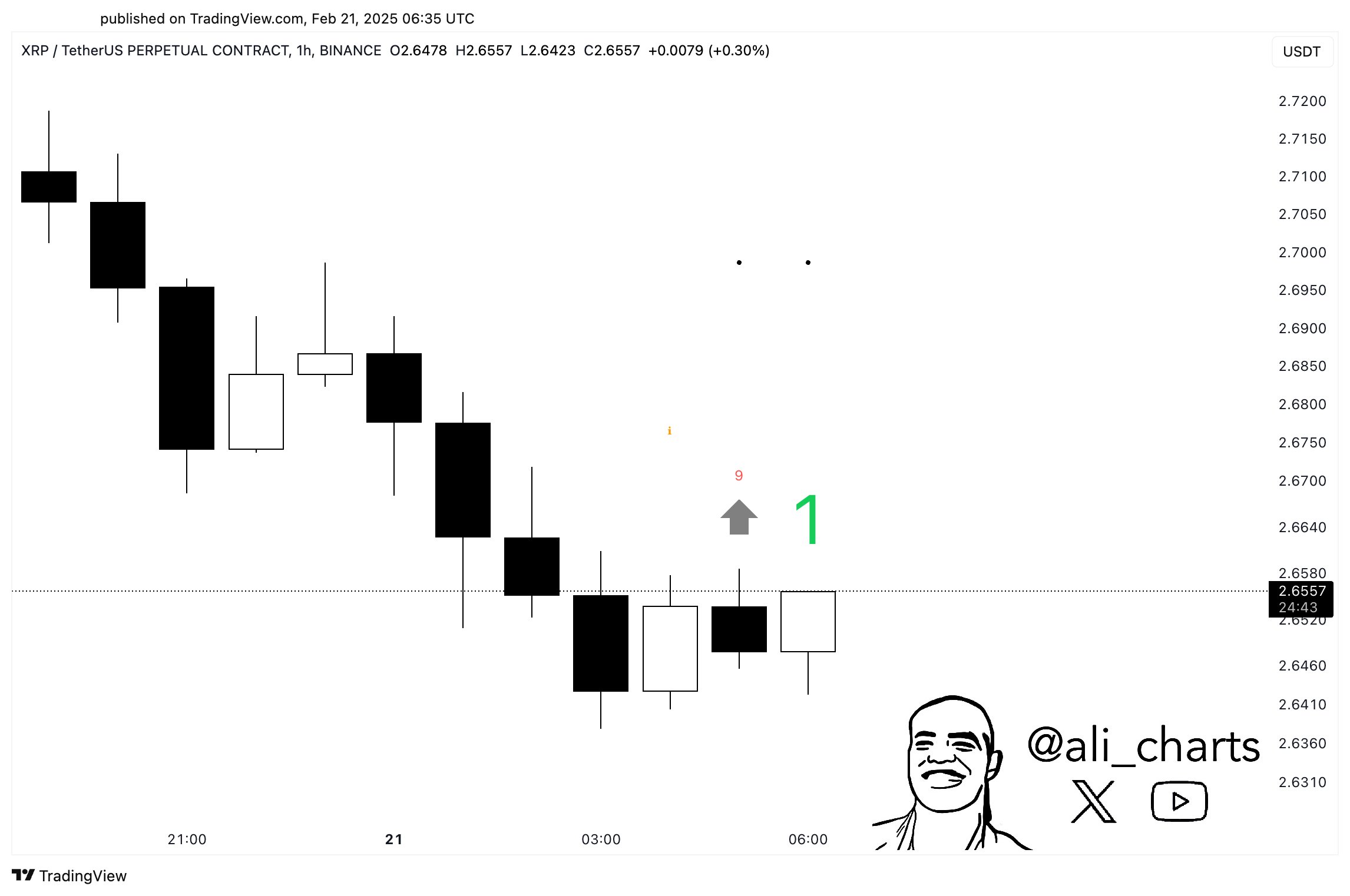

XRP has recently completed the former TD Sequential phase on its 1-hour price. Here is the chart shared by the analyst, that shows this pattern forming for the cryptocurrency:

As is visible in the above graph, the TD Sequential has finished a setup with nine red candles for XRP recently, which implies the cryptocurrency’s price can be considered to have reached a bottom.

If the pattern indeed holds, then the asset would next see a rebound to the upside. Though, given the fact that this buy signal has formed on a short timeframe (1-hour), the surge resulting from the signal may not be too large.

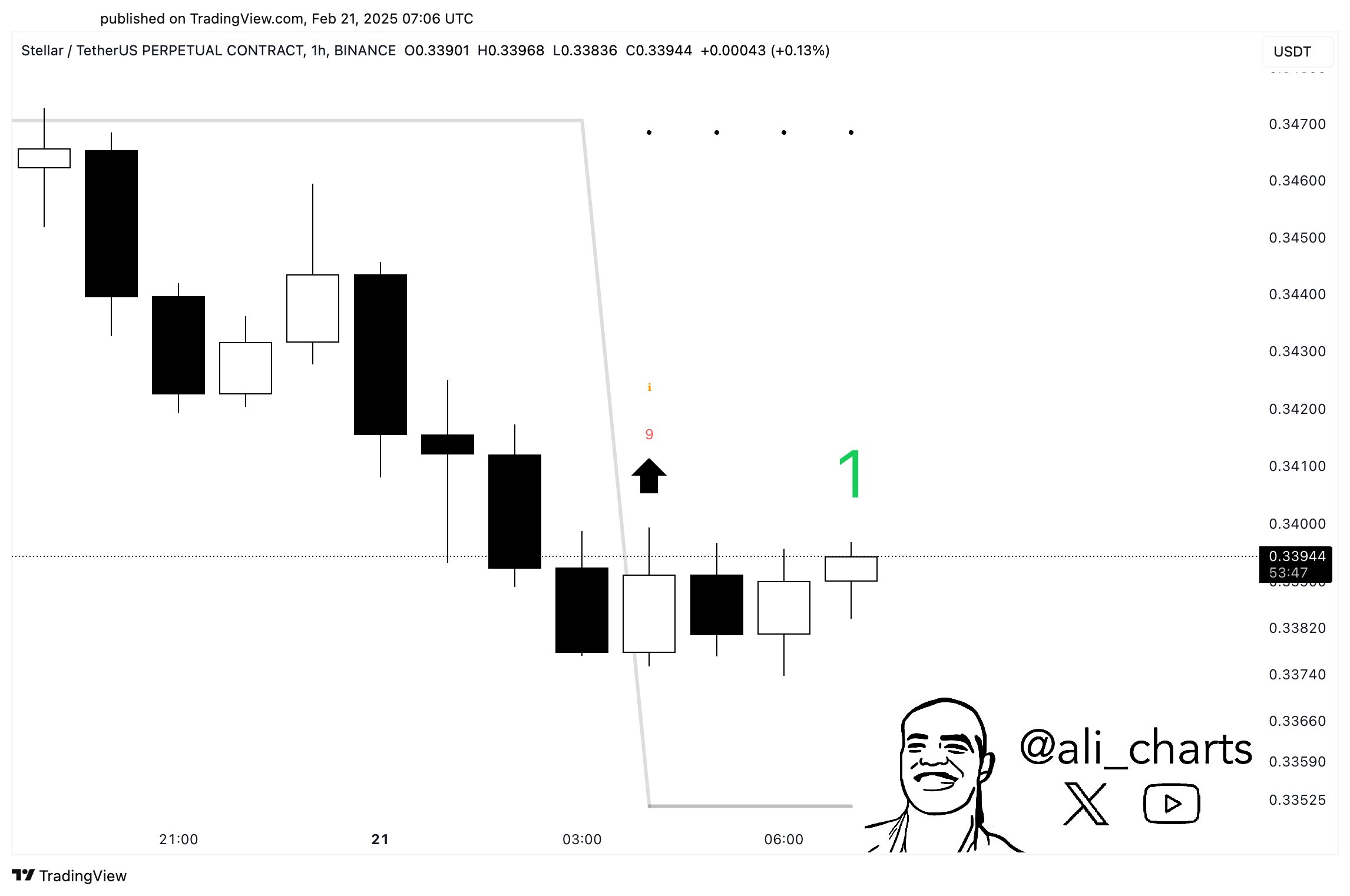

Speaking of the TD Sequential, XRP isn’t the only cryptocurrency that has displayed a bullish formation in its hourly price. As Martinez has pointed out in another X post, Steller (XLM) has also seen a buy setup recently.

“Stellar $XLM is ready to rebound as the TD Sequential indicator shows a buy signal on the hourly chart!” notes the analyst. It only remains to be seen, though, whether the signal would come to fruition for XRP and XLM or not.

XRP Price

At the time of writing, XRP is floating around $2.67, down 1% in the last seven days.