Why Cardano’s 50% tax cut proposal could boost ADA above Ethereum

- Cardano (ADA) declined 8% on Tuesday before stabilizing at $0.74 as bulls ward off bearish sentiment from US political uncertainty.

- With a correlation coefficient of 0.88, Cardano and Ethereum have displayed starkly similar price action since the start of 2025.

- The Cardano community has alerted the ecosystem to a proposal to reduce the network’s treasury tax from 20% to 10%.

Cardano (ADA) price broke below the $0.80 support level on Tuesday, booking daily losses of 8% amid bearish macro market sentiment. Market reports suggest Cardano’s latest network improvement proposal could drive positive ADA price action in the days ahead.

Cardano (ADA) price breaks below $0.75, tracking Ethereum’s losses

Cardano suffered a considerable correction on Tuesday, mirroring the broader market trends. As the likes of Chainlink (LINK), Solana (SOL), and Dogecoin (DOGE) posted losses exceeding 5% on the day, ADA also suffered a steep decline, briefly breaking below the $0.75 support level.

The ADAUSDT daily session chart below highlights ADA’s descent below $0.75 at press time on Tuesday. Zooming out, historical market data reveals that ADA’s price action in February has closely tracked Ethereum’s decline.

While Ripple (XRP) and Dogecoin (DOGE) received bullish support from positive sentiment surrounding the Securities and Exchange Commission (SEC) acknowledgment of an altcoin ETF, ADA price has remained largely tethered to Ethereum's trajectory.

Cardano Price Analysis (ADAUSDT), Feb 18, 2025 | Source: TradingView

With a correlation coefficient of 0.88, Cardano and Ethereum have displayed starkly similar price action since the start of 2025.

At press time, ADA price has declined 22% since February began, mirroring Ethereum's 22.3% drop.

This strong correlation suggests that Ethereum's struggles are weighing on ADA, preventing independent price action.

Community proposal to cut Cardano tax rates sparks intense debate

While Cardano's price appears restrained by Ethereum’s sluggish movement, recent community updates suggest a bullish momentum shift could be imminent.

On Monday, the Cardano team published its latest community digest, highlighting major updates within the network and broader development ecosystem.

One key announcement was the confirmation of the highly anticipated “Cardano Builder Fest #2,” which will take place in Da Nang, Vietnam, from April 24 to 25, 2025.

However, what caught the most attention was a community alert about Cardano blockchain developer Andrew Westberg’s latest video, which explores a proposal to reduce the treasury tax from 20% to 10%.

This development has sparked intense debate within the Cardano community. Some argue that reducing the tax would provide greater staking incentives and foster short-term price growth.

Others, however, believe the cut could undermine Cardano’s long-term economic sustainability.

Husky Token, a prominent figure in the ecosystem, voiced opposition:

"I am voting NO on decreasing the Treasury Tax from 20% to 10% because it undermines Cardano’s long-term economic sustainability without sufficient data to justify the change.

My platform, 'Cardano First,' prioritizes fiscal responsibility, decentralization, and governance stability, all of which would be at risk if the tax cut is implemented."

- Husky Token

Adding to the discussion, Cardano YOD₳ provided a breakdown of how the change would impact staking rewards:

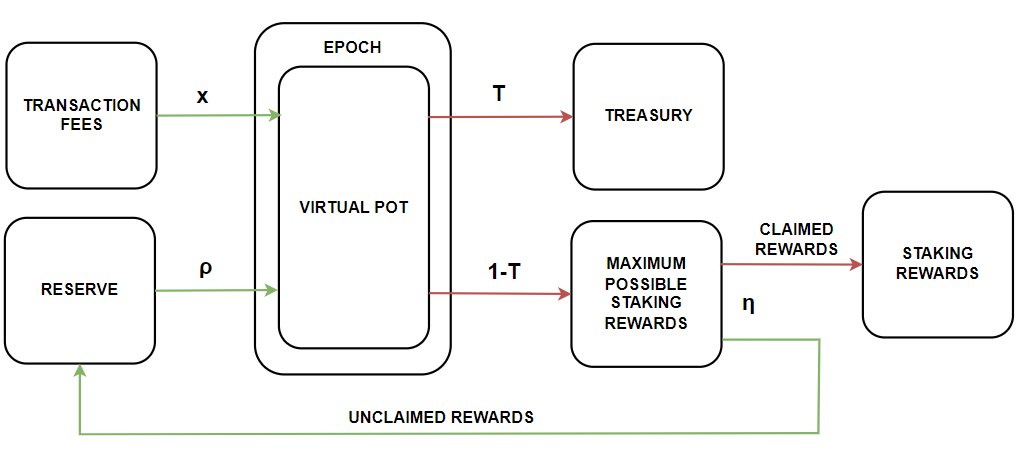

Cardano Staking Rewards Flow Chart | Source: X.com/Cardano YOD₳

"The 'T' parameter defines the percentage of the virtual pot allocated to the treasury, with the remainder designated for staking rewards.

If all stake pools were perfectly optimized, the current 20% tax would allow 80% of rewards to go to stakers. However, we currently have about 1,200 active pools, meaning that not all can be fully saturated.

Reducing the treasury tax could increase staking rewards but might destabilize the network’s economic foundation."

-Cardano YOD₳

While the proposal remains open for debate, the uncertainty has contributed to ADA’s bearish performance.

How will Cardano’s tax cut proposal impact ADA price?

Major cryptocurrencies often rally following the conclusion of major governance votes as investors anticipate policy-driven price shifts.

Regardless of the outcome, ADA could see considerable gains if the vote result aligns with broad community sentiment, as such events often reignite interest from otherwise passive investors.

Additionally, the desire to influence voting outcomes often attracts whale investors who accumulate large amounts of ADA to sway the decision.

This heightened demand could trigger a mild rally in the days leading up to the final vote.

Given ADA's already strong market positioning, a favorable outcome could accelerate gains and push its valuation closer to Ethereum’s, particularly if Ethereum continues to struggle with macroeconomic headwinds.

For now, ADA remains in a precarious position, tracking Ethereum’s losses while the community deliberates the tax cut proposal.

If a clear consensus emerges, bullish momentum could swiftly return, reversing recent losses and setting ADA up for a strong recovery.

Cardano Price Forecast: Close above $0.75 could nullify bearish headwinds

Cardano price is at a pivotal juncture, trading just below the $0.75 resistance level as market sentiment remains fragile.

The daily chart reveals that ADA has been trapped within a consolidation range after suffering a steep 21% decline over the past 18 days.

The Bollinger Bands highlight growing volatility, with the price now hovering near the lower band, suggesting that ADA is in oversold territory.

A close above the midline at $0.78 would be the first sign of bullish strength, potentially setting the stage for a rally toward the upper Bollinger Band at $0.93

Cardano Price Forecast | ADAUSDT

However, ADA’s price action remains vulnerable to further downside.

The persistent failure to reclaim $0.75 signals weak bullish momentum, while the declining volume bars suggest limited accumulation interest.

Should ADA fail to hold above $0.73, bearish continuation could extend losses toward the lower support at $0.63.

Meanwhile, the Average Daily Range (ADR) at 1.19 indicates heightened price swings, implying that ADA could see sharp movements in either direction.

A decisive close above $0.75 could nullify bearish headwinds, attracting renewed interest from sidelined buyers.