Federal Reserve Governor Says Stablecoins Could Extend US Dollar’s Global Role

Federal Reserve Governor Christopher Waller has emphasized that stablecoins have the potential to “maintain and extend” the US dollar’s international role.

He joins a growing list of crypto executives who have expressed optimism about stablecoin’s potential to drive a financial market boom.

Stablecoins’ Rising Market Capitalization

At a conference in San Francisco, Waller highlighted the need for a comprehensive US regulatory framework. Specifically, he wants risks associated with stablecoins addressed while ensuring they remain a strong part of the financial system.

“The stablecoin market would benefit from a US regulatory and supervisory framework that addresses stablecoin risks directly, fully, and narrowly,” Bloomberg reported, citing Waller.

He added that the framework should allow banks and non-banks to issue regulated stablecoins, with clear guidelines on compliance and reserve requirements.

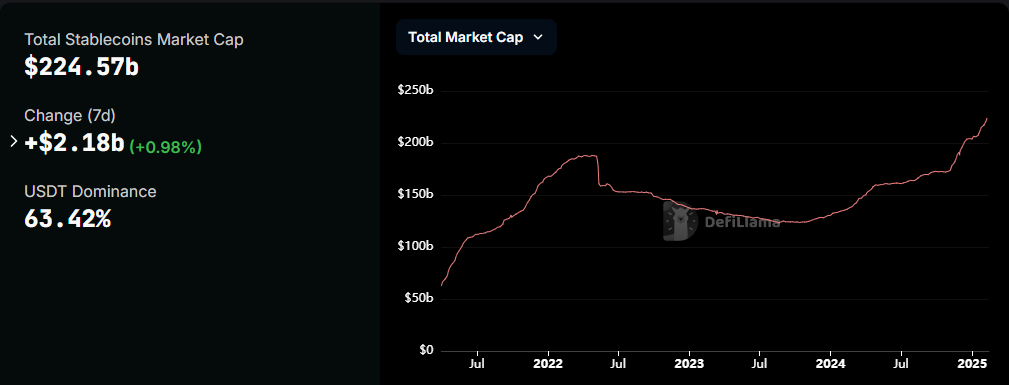

The stablecoin market has been upward, reaching a new high of $224.5 billion in February. This growth reflects stablecoins’ increasing significance in the digital economy and highlights their role in expanding the reach of the US dollar beyond traditional financial (TradFi) institutions.

Stablecoin Market Cap. Source: DefiLlama

Stablecoin Market Cap. Source: DefiLlama

However, Waller noted that stablecoins are still vulnerable to liquidity and run risks, highlighting the importance of stringent oversight.

Stablecoins are digital assets designed to maintain a steady value, often pegged to a specific currency such as the US dollar. Their issuers typically hold reserves in liquid assets like cash or US Treasury bills to back the tokens, ensuring stability.

While their use cases have expanded significantly, Waller cautioned that fragmented regulations at the state and international levels could hinder their global scalability.

“The emergence of different global stablecoin regulatory regimes creates the potential for conflicting regulation domestically and internationally. This regulatory fragmentation could make it difficult for US dollar stablecoin issuers to operate at a global scale,” Waller noted.

Calls for Stablecoin Regulation Gain Momentum

State regulators have also played an essential role in shaping stablecoin policies, with several states already implementing or finalizing new laws. Senator Bill Hagerty recently introduced the GENIUS Act. As BeInCrypto reported, the bill created a regulatory framework for payment stablecoins and enhanced US dollar dominance.

“My legislation establishes a safe and pro-growth regulatory framework that will unleash innovation and advance the President’s mission to make America the world capital of crypto,” he stated.

The proposed bill includes provisions requiring stablecoin issuers to maintain one-to-one reserves and comply with anti-money laundering laws. The House Financial Services Committee has also released a discussion draft of a bill aiming to provide more regulatory clarity.

However, conflicting state regulations could limit the widespread use of certain stablecoins across different jurisdictions.

As regulatory discussions continue at the state level, key figures in the crypto industry have weighed in on the role of stablecoins in the broader financial space. Trump’s crypto Czar, David Sacks, recently hosted a press conference where stablecoins were a focal point. He emphasized their potential to revolutionize global payments and financial inclusion.

“Stablecoins could potentially generate trillions of dollars’ worth of demands for US treasuries, which could lower long-term interest rates,” Sacks said.

Meanwhile, Circle’s Chief Business Officer Kash Razzaghi highlighted the transformative impact of stablecoins on high-inflation economies. Speaking to BeInCrypto, Razzaghi said stablecoins provide a reliable alternative for individuals and businesses in countries where traditional fiat currencies suffer from volatility and depreciation.

The growing relevance of stablecoins has also caught the attention of major crypto industry leaders. Binance CEO Richard Teng recently predicted a major crypto boom in 2025, with stablecoins playing a pivotal role in driving adoption and liquidity within the sector.

Similarly, Hashed CEO Simon Kim echoed these sentiments, stating that stablecoins will drive crypto growth in the coming years.

“Stablecoins represent a significant opportunity for US dollar dominance. While the US dollar accounts for a limited share of global currency reserves, it dominates nearly 99% of the stablecoin market. This essentially expands USD territory in the digital space. From the US perspective, there’s no reason to resist this trend — private companies are effectively expanding dollar dominance in digital spaces without government intervention,” Kim told BeInCrypto.

With increasing institutional interest and mounting regulatory discussions, the future of stablecoins appears poised for expansion. However, their potential to extend the international role of the US dollar largely depends on implementing a balanced and effective regulatory framework.