Forex Today: US Dollar retreats on fiscal concerns, Pound Sterling rises to multi-year highs

Here is what you need to know on Friday, May 23:

The US Dollar (USD) struggles to hold its ground against its rivals on Friday after posting marginal gains on Thursday. The European Central Bank (ECB) will publish Negotiated Wage Rates data for the first quarter. Later in the day, New Home Sales for April will be the only data featured in the US economic calendar. Heading into the weekend, investors will continue to pay close attention to speeches from central bank policymakers.

US Dollar PRICE This week

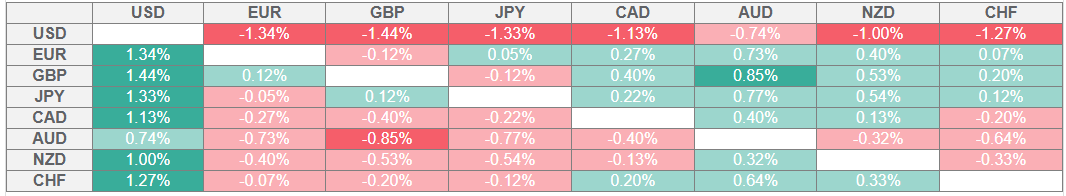

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

United States (US) President Donald Trump's sweeping tax and spending bill passed the Republican-controlled House of Representatives on Thursday by a slim margin. The Senate is expected to start discussions on the bill after the Memorial Day holiday on May 26 and vote on it before July 4. The benchmark 10-year US Treasury bond yield declined more than 1% on Thursday and was last seen edging lower toward 4.5%.

Meanwhile, the USD Index stays in negative territory at around 99.50 after posting small gains on Thursday. The data published by S&P Global showed that the economic activity in the US' private sector expanded at an accelerating pace in May, with Composite Purchasing Managers Index (PMI) rising to 52.1 from 50.6 in April. Finally, US stock index futures trade modestly higher in the European morning.

EUR/USD benefits from the renewed USD weakness and trades comfortably above 1.1300 on Friday.

GBP/USD gathers bullish momentum and trades at its highest level since February 2022 near 1.3500.

USD/JPY stays on the back foot and declines toward 143.00 early Friday. Japan’s Prime Minister Shigeru Ishiba reiterated on Friday that there was no change in Japan's stance on US tariffs and its demand that they be eliminated. Additionally, Reuters reported that Japan's Economy Minister Ryosei Akazawa is planning to visit the US around May 30 for the fourth round of talks.

After correcting lower, Gold regains its traction on Friday. At the time of press, XAU/USD was trading at around $3,330, rising about 1% on the day.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.