Cardano Price Forecast: Can Bitcoin’s latest $100k breakout trigger a 40% ADA rally?

- Cardano price rose 5% on Tuesday to break the $0.95 resistance.

- The Layer-1 sector grew by a mild 0.2%, with all top seven altcoins registering intraday gains.

- ADA Open Interest plunged 20% in 10 days, while prices only declined 16%, signaling active short-covering purchase.

Cardano price rose 5% on Tuesday, as the crypto markets staged an early recovery from the Deepseek fuelled market downturn on Monday. Derivatives markets trends reflect how bull traders’ resilience triggered an early rebound.

Cardano approaches $1 as Bitcoin price retakes $100K

Cardano (ADA) has been making significant strides in the cryptocurrency market, with its price crossing the $0.95 mark, marking a 4% increase over the last 48 hours.

This upward movement is part of a broader recovery in the crypto markets following a downturn influenced by various external factors.

The crypto market experienced a downturn on Monday, primarily driven by concerns over a new AI innovation from China that could potentially challenge the dominance of the US markets.

This led to over $960 million in liquidation losses across global markets. However, the focus shifted as analysts began discussing Trump's policy updates and upcoming macroeconomic data reports.

This shift in focus, along with positive developments in the Layer-1 sector, sparked a major rebound in the crypto markets.

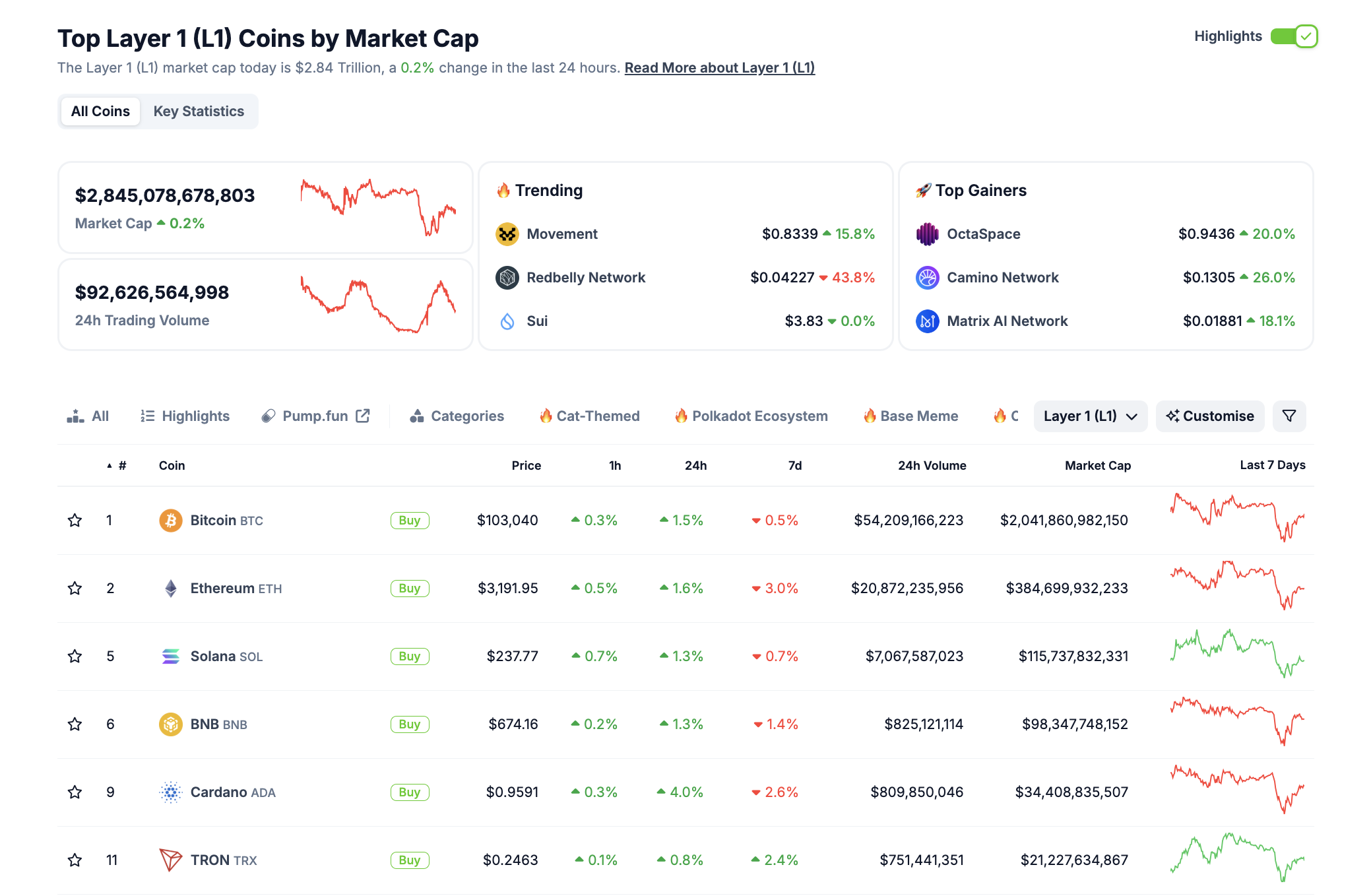

Layer-1 Sector Performance | Coingecko, January 2025

Layer-1 Sector Performance | Coingecko, January 2025

The Layer-1 (L1) sector has been a significant driver of the market recovery. According to data from CoinGecko, as of January 28, 2025, the L1 market cap stands at $2.84 trillion, with a 0.2% change in the last 24 hours.

The 24-hour trading volume for L1 coins is $92,626,564,998. This sector includes major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), which have also shown positive movements.

Cardano price increase to over $0.95 can be attributed to several factors. First, the overall recovery in the crypto market has provided a positive environment for Cardano's growth.

As part of the L1 sector, Cardano has benefited from the sector's strong performance. Technological Developments: Cardano's ongoing development and adoption of new technologies have increased investor confidence.

Cardano (ADA) Price Action

As Cardano approaches $1, the focus will likely shift to how it performs relative to other major cryptocurrencies.

With Bitcoin retaking $100K, the market's attention is on whether Cardano can maintain its upward momentum.

The upcoming week will be crucial, with investors watching for any signs of further growth or potential corrections.

Cardano's recent price action, crossing $0.95 with a 4% gain over the last 48 hours, is a testament to its resilience and potential in the cryptocurrency market.

As the market continues to evolve, Cardano's position within the L1 sector and its technological advancements will be key factors in determining its future performance.

ADA Open Interest holds above $1.2B, hinting at further upside potential

Cardano's (ADA) price has shown resilience, increasing by 5% following Monday's market crash. Despite the downturn, derivatives market trends suggest that bullish traders' tenacity may have catalyzed an early rebound.

Cardano Open Interest vs. Price

The Coinglass chart above indicates that ADA's Open Interest has dropped only 20% over 10 days, dropping from $1.5 billion on January 17 to settle at $1.2 billion at press time.

Meanwhile Cardano price has declined by a lesser 16%, hinting at active short-covering purchases.

This could imply that the majority of speculative traders are positioning for further upside, as Open Interest is often seen as a measure of market sentiment and future price movements. The stability in Open Interest, even amidst price fluctuations, suggests that investors remain confident in Cardano's potential for growth.

Against the backdrop of founder Charles Hoskinson’s alignment with the Trump administration, and talks of an ADA ETF filing by Grayscale, Cardano’s near-term price outlook leans largely bullish.

Cardano Price Forecast: Rising volumes could spark 40% rally

The Cardano price forecast suggests a potential bullish scenario, as evidenced by the rising trading volumes and the recent price action on the daily chart.

The MACD indicator, which is a momentum oscillator, shows a bullish crossover with the signal line moving above the MACD line, indicating increasing buying pressure.

Additionally, the price has managed to stay above the 50-day moving average, which is often considered a sign of a healthy uptrend.

The recent candlestick pattern, with a significant bullish engulfing pattern, also supports the bullish case, suggesting that buyers are regaining control.

Cardano Price Forecast | ADAUSDT

On the flip side, the bearish scenario is supported by the presence of a downward trendline that Cardano's price has been respecting.

The volume profile at the point of interest shows a high volume node at $0.9258, which could act as a strong resistance level.

If the price fails to break above this level with sufficient volume, it could lead to a reversal and a potential drop back towards the support at $0.8566.

However, if the bullish momentum continues and the price breaks above the trendline with high trading volumes, it could spark a significant rally, potentially leading to a 40% rally towards the $1.50 territory.