Is DeFAI’s next narrative in crypto-space?

- DeFAI combines DeFi with AI to address DeFi’s challenges, like complexity and data overload.

- The main focus of DeFAI is on abstraction layers, trading agents, and research agents to enhance usability, trading efficiency, and informed decision-making.

- DeFAI still has room for growth, valued at $2.7 billion, only 2% of the market for DeFi tokens.

The K33 report on Tuesday highlights DeFAI’s potential to revolutionize the crypto space by merging DeFi (Decentralized Finance) with AI (Artificial Intelligence). DeFAI's main focus is on abstraction layers, trading agents, and research agents to enhance usability, trading efficiency, and informed decision-making. While capturing just 2% of the DeFi token market, with a $2.7 billion valuation, DeFAI signals growth opportunities and could be the next big narrative in the crypto space.

DeFAI, the next big thing

DeFi Analyst at K33 David Zimmerman’s report on Wednesday highlights key features of the DeFAI ecosystem.

Zimmerman’s report explains that DeFAI, meaning DeFi (Decentralized Finance), when combined with AI (Artificial Intelligence), gives birth to DeFAI. The DeFAI combination can automate tasks, analyze data, and simplify complex processes to address DeFi’s challenges like complexity and data overload. In theory, this will reduce the burden on users, enabling them to focus on goals rather than navigating the complicated and sometimes mind-numbing maze of the DeFi ecosystem.

The analyst further explains that the DeFAI ecosystem is still in its infancy and has room for growth, given the rapidly changing nature of the crypto market. Currently, DeFAI's main focus is on abstraction layers, trading agents, and research agents to enhance usability, trading efficiency, and informed decision-making.

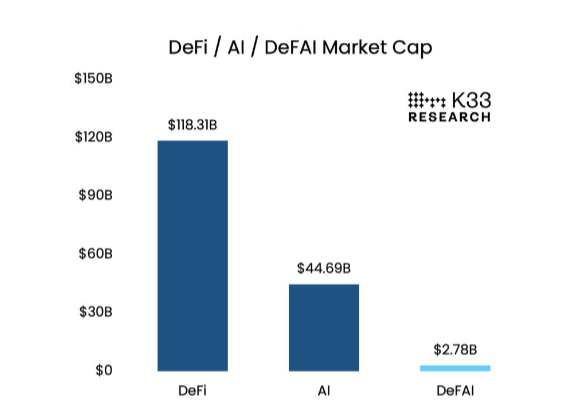

According to CoinGecko data, the current DeFAI sector is only $2.78 billion, just over 2% of the DeFi market, as shown in the graph below. For context, the entire crypto AI sector and DeFi are $44 billion and $118 billion, respectively. If DeFAI can deliver on a fraction of its promises, its relative valuation will shift significantly.

“As for now, given the speculative nature of these categories, the narrative alone is likely to fuel enough to adjust these relative valuations if not simply due to a surge in new DeFAI projects expected in the immediate future,” says Zimmerman.

Defi, AI and DeFAI market capitalization chart. Source: K33 Research

Lastly, the report concluded that while DeFAI shows promise, it is largely speculative and faces some challenges in its development. Nevertheless, the analyst is optimistic about its narrative-driven growth.