Three factors that could catalyze a significant surge in Optimism in the upcoming weeks

- Optimism Delta upgrade will activate on the mainnet on February 22, effectively reducing Layer 1 costs.

- Optimism launched its first Security Council on February 9, decentralizing the protocol further.

- OP is gearing towards Stage 1 decentralization milestones like establishing a multiproof network.

- $85.28 million in Optimism tokens are scheduled for unlock on February 29.

- OP price declined slightly to $3.735, observing a 2% loss on Tuesday.

Optimism, an Ethereum scaling solution launched its first Security Council, a collective that assumes control of keys and multisigs for the Foundation, on February 9. The protocol has lined up several significant upgrades for February, these developments are expected to catalyze gains in OP price.

The protocol is inching towards further decentralization, hitting technical development milestones along the way.

Two key events for February are Delta upgrade and the $85.28 million OP token unlock. The recent migration of decentralized social media protocol Farcaster to OP mainnet is another catalyst that is likely to fuel OP price rally in the coming weeks.

Also read: XRP price resumes uptrend amidst possibility of settlement in SEC v. Ripple lawsuit

Optimism to benefit from Ethereum’s upcoming upgrade

Ethereum’s Dencun upgrade has successfully completed its testnet releases and is ready for its mainnet release as early as March 2024, according to the latest update from Ethereum core developers. The upgrade is pivotal to Optimism since it will slash the requirement for data for maintaining Ethereum-based Layer 2 chains.

Dencun will reduce the cost of transactions that are processed via Layer 2 blockchains and make Optimism cost-effective for users. This could further boost demand for Optimism in the crypto ecosystem. Dencun is therefore one of the key catalysts for Optimism price gains in the coming weeks.

Three catalysts likely to drive OP price gains

The top three catalysts likely to drive OP price gains are as follows:

- Delta upgrade on OP mainnet

- OP decentralization milestones

- Farcaster migration to OP mainnet

Another key development is the upcoming OP token unlock.

Delta upgrade

Optimism has lined up the mainnet release of its Delta upgrade that activates Span Batches for OP Mainnet and all other OP Chains. Span Batches is a feature that makes technical changes to the underlying blockchain to reduce Layer 1 costs by 97% for inactive chains. The upgrade could derisk the launch of new OP chains through its meaningful cost reduction.

Aside from the technicalities, this upgrade could boost OP’s popularity among developers in the community, driving demand for OP among new web3 projects and increasing its relevance in the ecosystem.

The upgrade goes live on Thursday, February 22.

OP decentralization

On February 9, the Collective launched its first Security Council and established a 2/2 multisig. This multisig is authorized to sign protocol upgrades for OP mainnet. The two signers are the Optimism Foundation and the Security Council.

Following this development, Optimism will advance its decentralization on the technical, social and governance track, to reach all Stage 1 decentralization milestones outlined by Vitalik Buterin in his 2022 roadmap.

This development is likely a catalyst for OP price gains in the coming months.

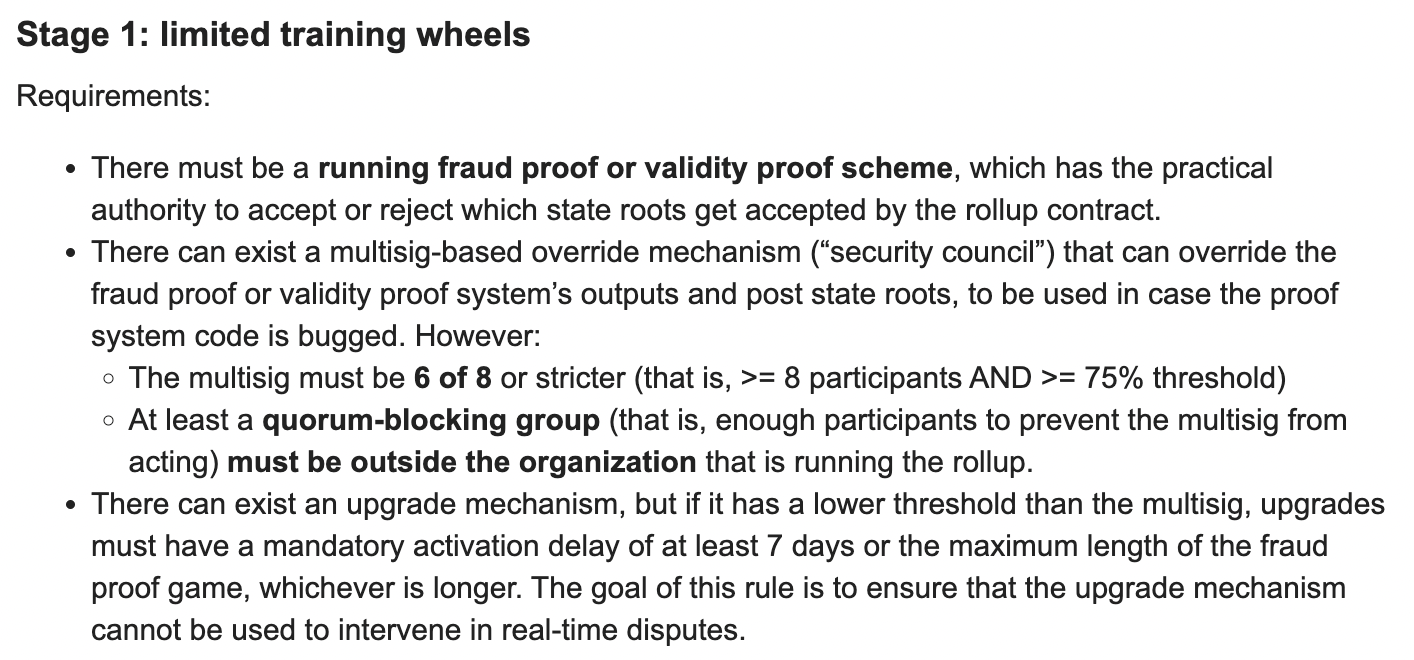

Vitalik Buterin’s roadmap for Stage 1 decentralization

Farcaster migration to OP mainnet

Decentralized social media protocol Farcaster completed its migration to the OP mainnet recently. The project’s apps and associated smart contracts migrated from Ethereum to the popular Layer 2 chain.

Farcaster’s co-founder Dan Romero confirmed the plan and shared an update in 2023. While this development may seem dated, it is a key aspect of Optimism’s growth story since the OP mainnet has witnessed a massive spike in active addresses with the arrival of apps like WorldCoin and Farcaster.

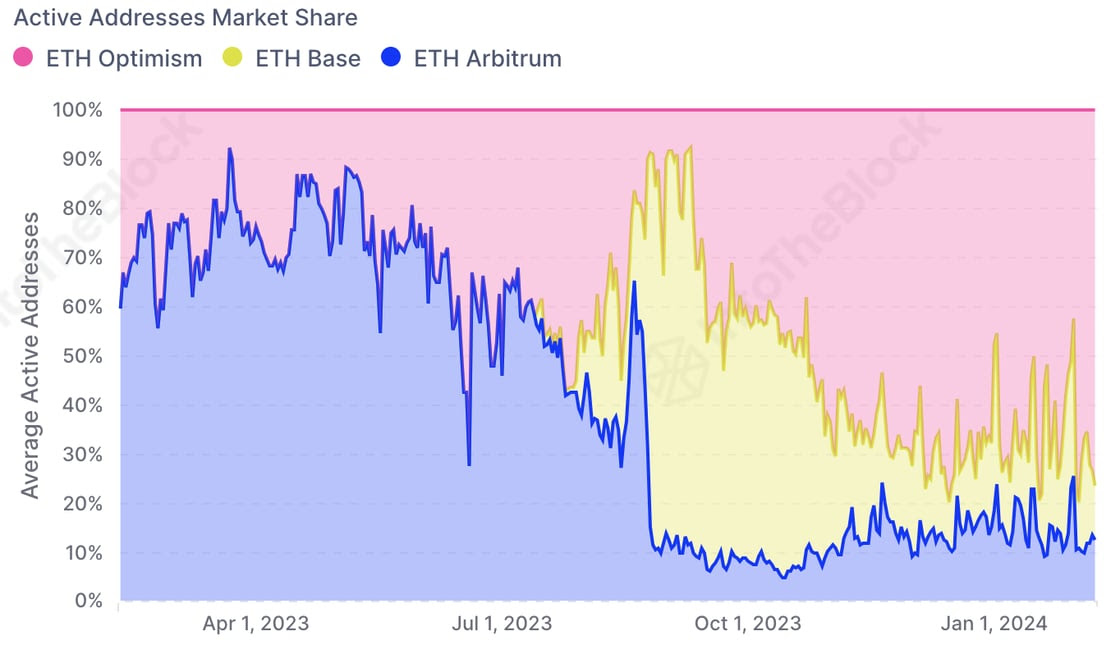

Data from IntoTheBlock reveals that user activity on Optimism has increased significantly with the deployment of these two popular applications, driving OP mainnet to the top 60% of the daily active addresses in Optimistic Rollups.

Active Address share of Optimism. Source: IntoTheBlock

OP token unlock

According to data from Token Unlocks, Optimism has scheduled a token unlock of 24.16 million OP tokens worth $85.28 million, on February 29. The previous token unlock event was a similar one that took place on January 30 and OP price declined nearly 7% in the week following the event. If the trend repeats, OP price could plummet in the week following the token unlock, in March 2024.

OP price could rally 15% in February

OP price is currently in an uptrend, trading at $3.733, at the time of writing. The Layer 2 token is likely to rally higher, according to two technical indicators. The green bars on the Awesome Oscillator (AO) and the Moving Average Convergence/ Divergence (MACD) indicate that there is positive momentum and the uptrend is intact.

OP price could climb towards resistance at $4.098, a level that has acted as resistance for OP since December 2023. Once OP price breaks past this resistance, the Layer 2 token could hit its 2024 peak of $4.283. This would represent 14.7%, or nearly 15% gains in the Layer 2 token.

OP/USDT 1-day chart

The 50% Fibonacci retracement level of the decline from the 2024 peak to January 23 low, at $3.446 is key support for OP. A daily candlestick close below this level could invalidate the bullish thesis for OP price. In the event of further correction, OP price could nosedive to January 23 low of $2.610.