Michael Saylor Sparks New Speculation About MicroStrategy Bitcoin Plans

Michael Saylor, co-founder of MicroStrategy, has reignited speculation about the company’s next big Bitcoin acquisition.

On December 28, Saylor took to social media platform X to share cryptic insights about the SaylorTracker portfolio, which monitors MicroStrategy’s Bitcoin purchases.

A Hint of More Bitcoin Ahead?

In his post, Saylor stated that the marker had “disconcerting blue lines,” which led to speculations that another large-scale buy may be imminent. Over recent weeks, similar hints from Saylor have preceded official announcements of major Bitcoin investments.

“Disconcerting blue lines on SaylorTracker,” Saylor stated.

MicroStrategy has been on a Bitcoin buying spree, accumulating over 192,042 BTC at an estimated cost of $18 billion. During this time, Bitcoin’s price climbed from $67,000 to $108,000, while MicroStrategy’s stock price surged more than fivefold this year, now trading around $360 — up 400% on the year-to-date metrics.

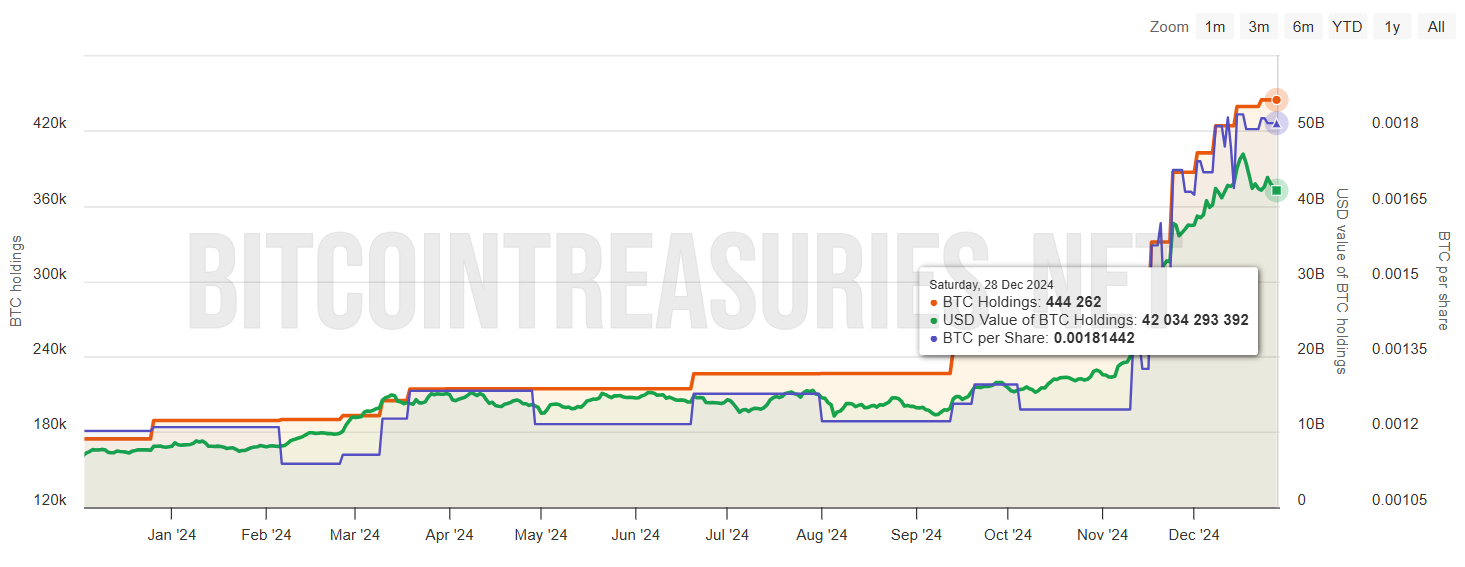

MicroStrategy Bitcoin Holdings. Source: Bitcoin Treasuries

MicroStrategy Bitcoin Holdings. Source: Bitcoin Treasuries

MicroStrategy’s stock performance and inclusion in the Nasdaq-100 have been remarkable. The company’s shift from its core business of enterprise data analytics to a heavy focus on Bitcoin accumulation has positioned it as the largest public holder of the cryptocurrency. However, this aggressive strategy has faced its share of criticism.

Some market participants argue that Saylor’s announcements of Bitcoin buys create volatility. Critics claim that once the purchases are disclosed, day traders short Bitcoin, leading to a price retracement and a drop in MicroStrategy’s stock value.

“The problem with Saylor purchases is that he announces them, then Day-traders immediately start shorting BTC because they know the big-buyer customer is done buying. Then Bitcoin retraces, and $MSTR stock goes down, not up,” one crypto trader said.

Moreover, some have suggested that the purchase pattern was reportedly influenced by its plan for a blackout period in January, during which it will pause Bitcoin acquisitions.

However, early indications suggest that Bitcoin buys will not be stopping anytime soon. Instead, MicroStrategy prepares for its next steps, which include increasing its authorized shares of Class A common stock and preferred stock. The proposal seeks to expand Class A stock from 330 million to over 10 billion shares and preferred stock from 5 million to 1 billion.

Market observers believe this move will significantly increase its capacity to issue shares in the future, allowing it to allocate more funds for Bitcoin purchases.