Stellar (XLM) Eyes 69% Surge as $0.91 All-Time High Draws Closer

Stellar (XLM) has been steadily gaining momentum in recent days, currently trading at $0.52 — a 127% increase over the past week.

Strengthening buying pressure is pushing XLM closer to reclaiming its all-time high of $0.91, which it last reached in January 2018.

Stellar’s Uptrend Continues To Strengthen

XLM’s rising open interest indicates heightened market activity and confirms strong investor confidence. On Saturday, the token’s open interest climbed to an all-time high of $291 million.

Open interest measures the total number of outstanding contracts in the futures or options market that have not been settled or closed. When it climbs during a price rally, it indicates that new money is entering the market. This reinforces the upward price movement and signals strong market conviction.

This trend in the XLM market suggests that traders are increasingly confident in the sustainability of its rally, which may drive its price higher.

XLM Open Interest. Source: Santiment

XLM Open Interest. Source: Santiment

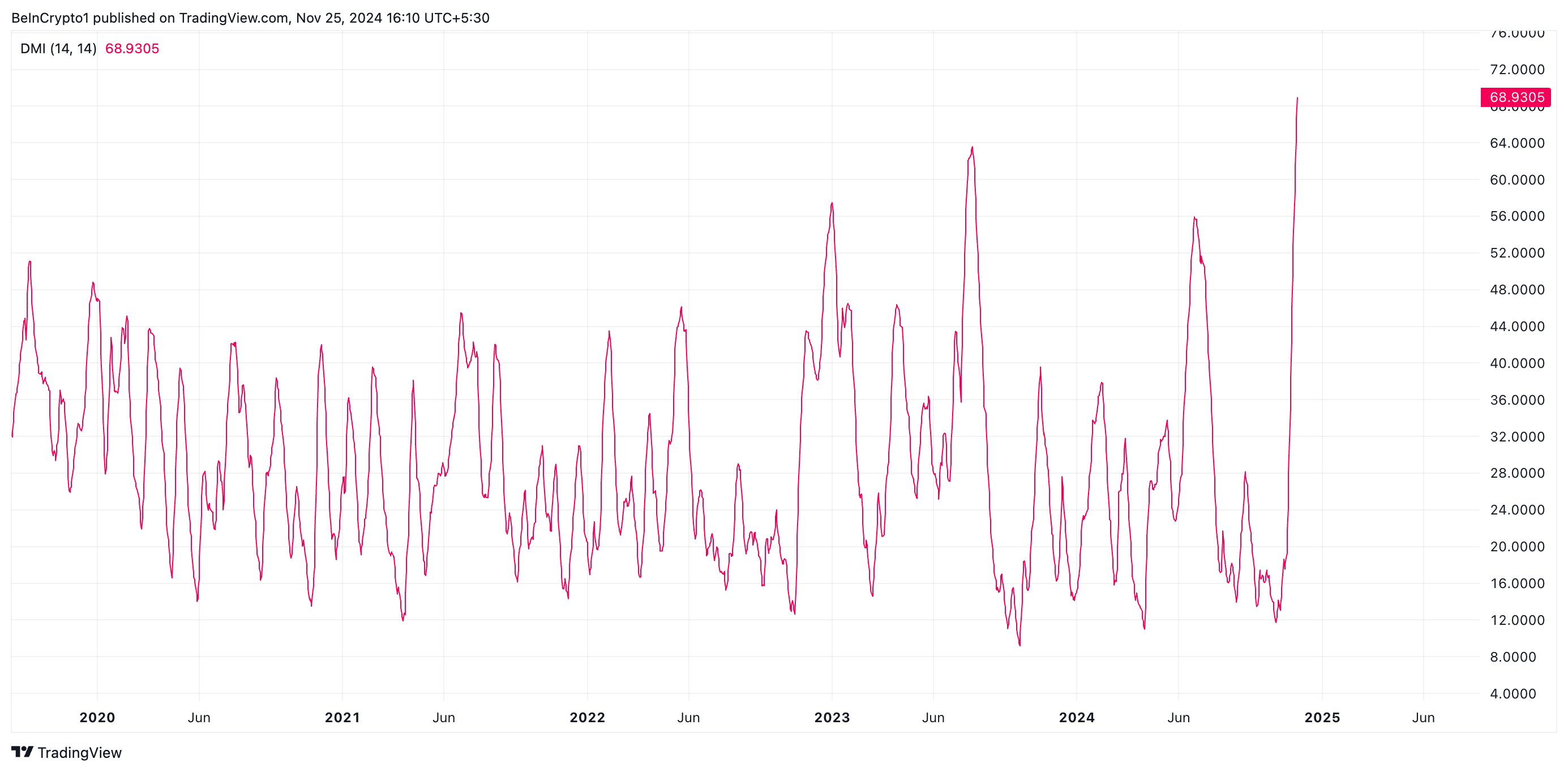

Furthermore, readings from its Average Directional Index (ADX) confirm this bullish outlook. As of this writing, XLM’s ADX is in an upward trend at 68.93.

The ADX measures the strength of a market trend, ranging from 0 to 100. An ADX reading of 68 indicates an extremely strong uptrend. This high value suggests that XLM’s current trend is likely to persist.

XLM ADX. Source: TradingView

XLM ADX. Source: TradingView

XLM Price Prediction: Token May Rally Toward All-Time High

XLM is currently trading just below a key resistance level at $0.58. Breaking through this critical price point could pave the way for a surge to $0.71. Sustained buying momentum at this level may position XLM to reclaim its all-time high of $0.91.

XLM Price Analysis. Source: TradingView

XLM Price Analysis. Source: TradingView

However, if buyer exhaustion sets in, XLM’s price will fall toward support at $0.47, invalidating this bullish outlook.