Craig Wright Files £911 Billion Lawsuit Against Bitcoin Core and Square Over Bitcoin Integrity

Craig Wright, the Australian computer scientist who claims to have created Bitcoin, has filed a new lawsuit regarding the top digital asset.

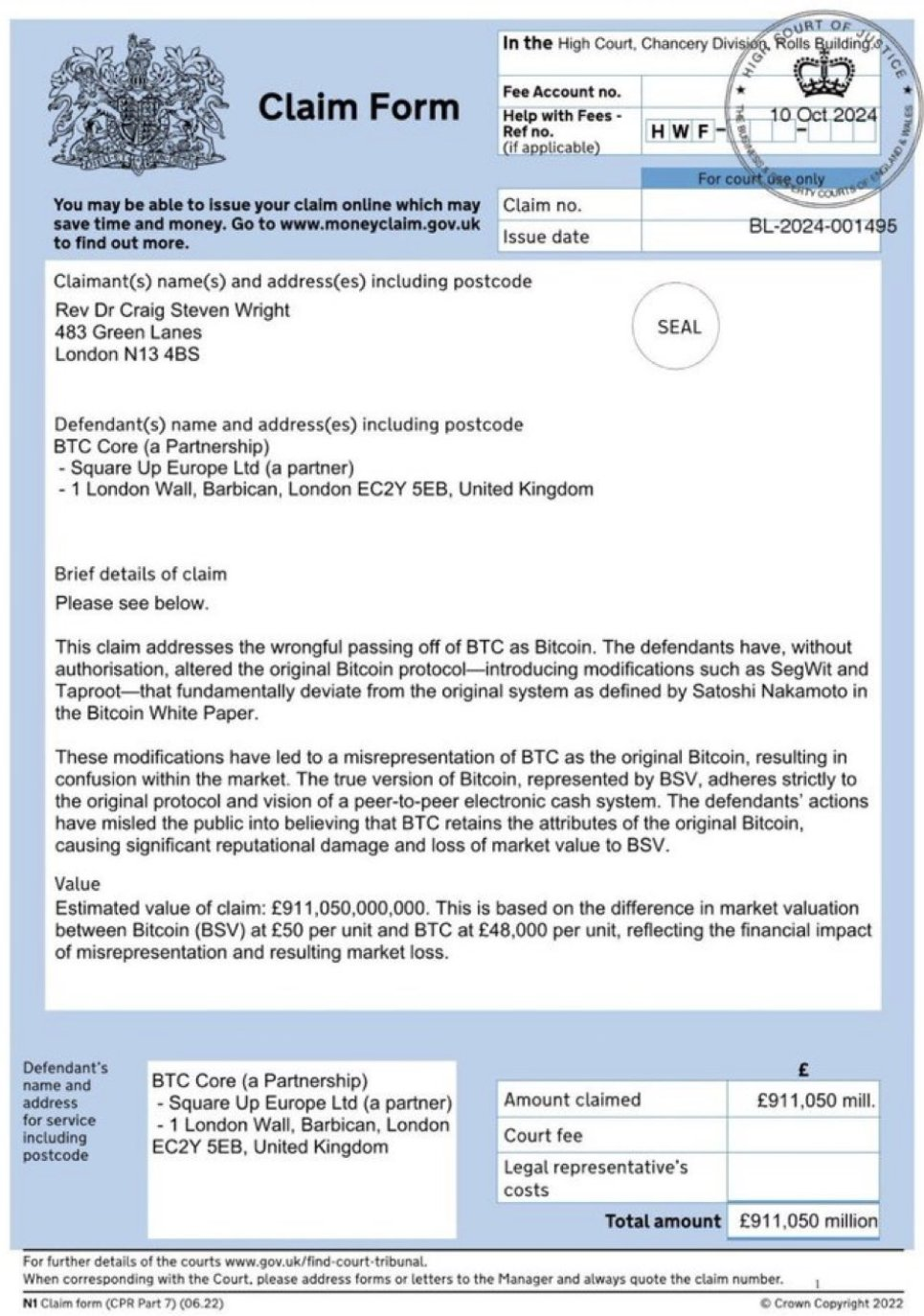

On October 11, a UK High Court case tracker revealed that Wright’s legal action targets Bitcoin Core, the technology behind Bitcoin’s distribution, and Square. He later clarified on X that he is suing not just the Bitcoin Core developers but also all affiliated parties.

Wright Files £911 Billion Claim Against Bitcoin Core

Wright’s lawsuit seeks approximately £911 billion from Bitcoin Core and Square. He alleges that they misrepresented Bitcoin (BTC) as the genuine version of the digital asset espoused by Satoshi Nakamoto, the developer of the top crypto. Notably, Wright is representing himself in this case, identifying as a “litigant-in-person.”

In a post on X, Wright expressed his willingness to debate any official representatives from Bitcoin Core. He emphasized that if Bitcoin Core could prove it adheres to the original concept of Bitcoin, as outlined by Nakamoto, he would drop all litigation immediately. Wright insists that honesty is paramount and demands no obfuscation or evasions—only the unvarnished truth.

Wright argues that the top crypto should not serve the interests of the powerful. He believes Nakamoto designed Bitcoin as electronic cash for small, casual transactions, a well-defined and documented vision. He then challenged Bitcoin Core to demonstrate their commitment to these principles.

“If BTC Core wishes to assert that they are the true continuation of Bitcoin, they must do so openly and transparently, and they must do it on the basis of the original design. The burden of proof is theirs. If they can demonstrate, through fact and reason, that they have upheld the principles of small, peer-to-peer transactions, of a decentralized, electronic cash system—then I will have no need to continue with my lawsuits,” Wright stated.

Read more: What Is Bitcoin? A Guide to the Original Cryptocurrency

Wright’s New Bitcoin Lawsuit. Source: X/Bitmex Research

Wright’s New Bitcoin Lawsuit. Source: X/Bitmex Research

The controversial scientist further clarified that his new lawsuit is unrelated to Satoshi Nakamoto’s identity.

“The issue at hand is not about who Satoshi is, but whether BTC Core has adhered to those original, foundational principles. This debate is about the integrity of Bitcoin’s design, not the identity of its creator,” Wright added.

It’s important to note that a UK court previously ruled against Wright, stating that he is not a Bitcoin developer and that he has extensively misrepresented this claim. Following this ruling, a legal notice on Wright’s website now states that he is not Satoshi and has been ordered to cease any further legal actions based on these false claims.

Read more: Satoshi Nakamoto – Who is the Founder of Bitcoin?

This lawsuit comes shortly after Wright threatened to sue MicroStrategy CEO Michael Saylor for allegedly misrepresenting Bitcoin. Wright accused Saylor of suggesting that BTC aligns with the original Bitcoin whitepaper. It remains unclear whether this threat is related to his recent lawsuit.