Ripple Price Forecast: Canary Capital files for XRP ETF

Ripple price today: $0.530

- Ripple hovers near $0.530 on Wednesday, technicals point to a decline ahead.

- Canary Capital has officially filed for an XRP ETF with the US SEC.

- XRP’s long-to-short ratio trades below one, suggesting a bearish move on the horizon.

Ripple (XRP) stabilizes around $0.530 on Wednesday after facing rejection from its daily resistance level on Monday. Canary Capital’s official filing for an XRP Exchange Traded Fund (ETF) with the US Securities and Exchange Commission (SEC) on Tuesday is generally a positive development. However, technical analysis and on-chain metrics indicate a potential short-term correction for Ripple.

Canary Capital files for Ripple ETF with US SEC

Canary Capital officially filed for an XRP ETF with the SEC on Tuesday, following a similar move by Bitwise last week. Despite ongoing regulatory challenges, ETF fillings by big investment companies are generally positive signs for Ripple in the long term, as an ETF can make it easier for traditional investors to gain exposure to XRP without needing to purchase and store the cryptocurrency directly. Moreover, approving an ETF could lend more legitimacy to XRP and increase liquidity.

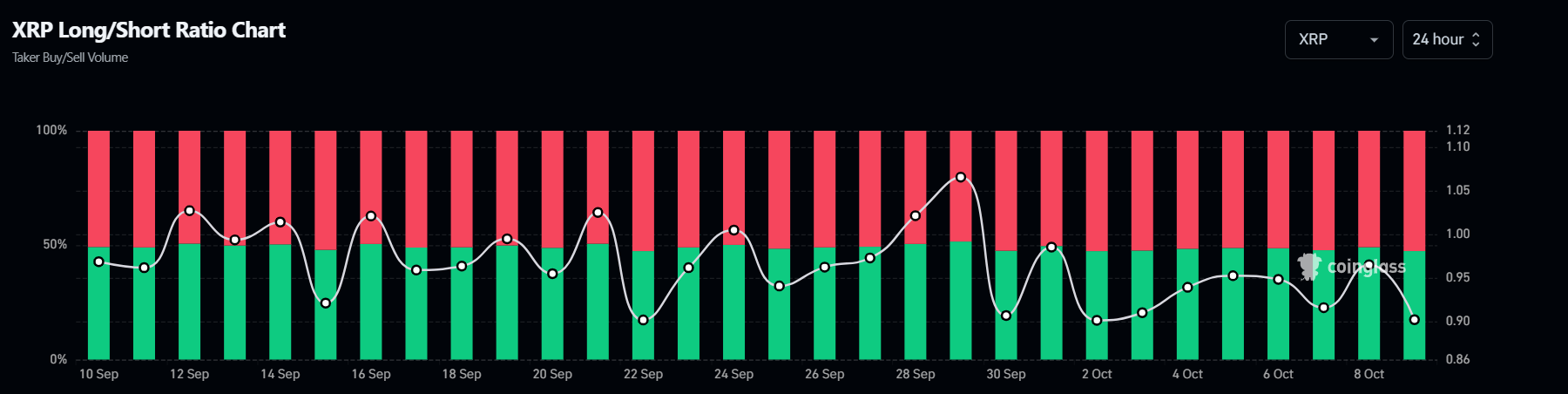

However, Ripple’s on-chain metric from Coinglass hints at a short-term correction for XRP. Its long-to-short ratio trades at 0.9, the lowest level in one month. This ratio below one reflects bearish sentiment in the market, as more traders are betting on the asset price to fall. Other on-chain metrics, as seen in a previous article, also support the bearish scenario.

XRP long-to-short ratio chart. Source: Coinglass

Ripple Price Forecast: XRP faces rejection from resistance barrier

Ripple’s price stabilizes after breaking below an ascending trendline last week and being rejected from the daily resistance level of $0.544 on Monday. This daily level roughly coincides with the two crucial resistance levels: the 200-day EMA at $0.554 and the previously broken ascending trendline (drawn by connecting multiple lows since early July). At the time of writing on Wednesday, XRP/USDT trades at around $0.532.

If the $0.544 level continues to hold as resistance, XRP could decline over 19% from its current trading level to retest the August 5 low of $0.431.

The Relative Strength Index (RSI) indicator on the daily chart also trades below its neutral level of 50, indicating bearish momentum and continuing the downward trend.

XRP/USDT daily chart

However, if XRP breaks and closes above the 200-day EMA at $0.554, it could extend the rise by 13% to retest its next daily resistance at $0.626.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.