Top 3 Artificial Intelligence (AI) Coins of the First Week of October 2024

As the first week of October 2024 wraps up, several Artificial Intelligence (AI) coins are making waves with standout price performances and increasing investor interest.

In this analysis, BeInCrypto highlights the top three AI coins dominating the market, examining the key drivers behind their rise and what could be on the horizon in the coming weeks.

DIA

DIA is a company specializing in cross-chain oracles for Web3. It delivers services like digital asset price feeds, adjustable NFT floor price feeds, multi-chain randomness for DeFi and GameFi applications, and the creation of bespoke oracles for decentralized apps.

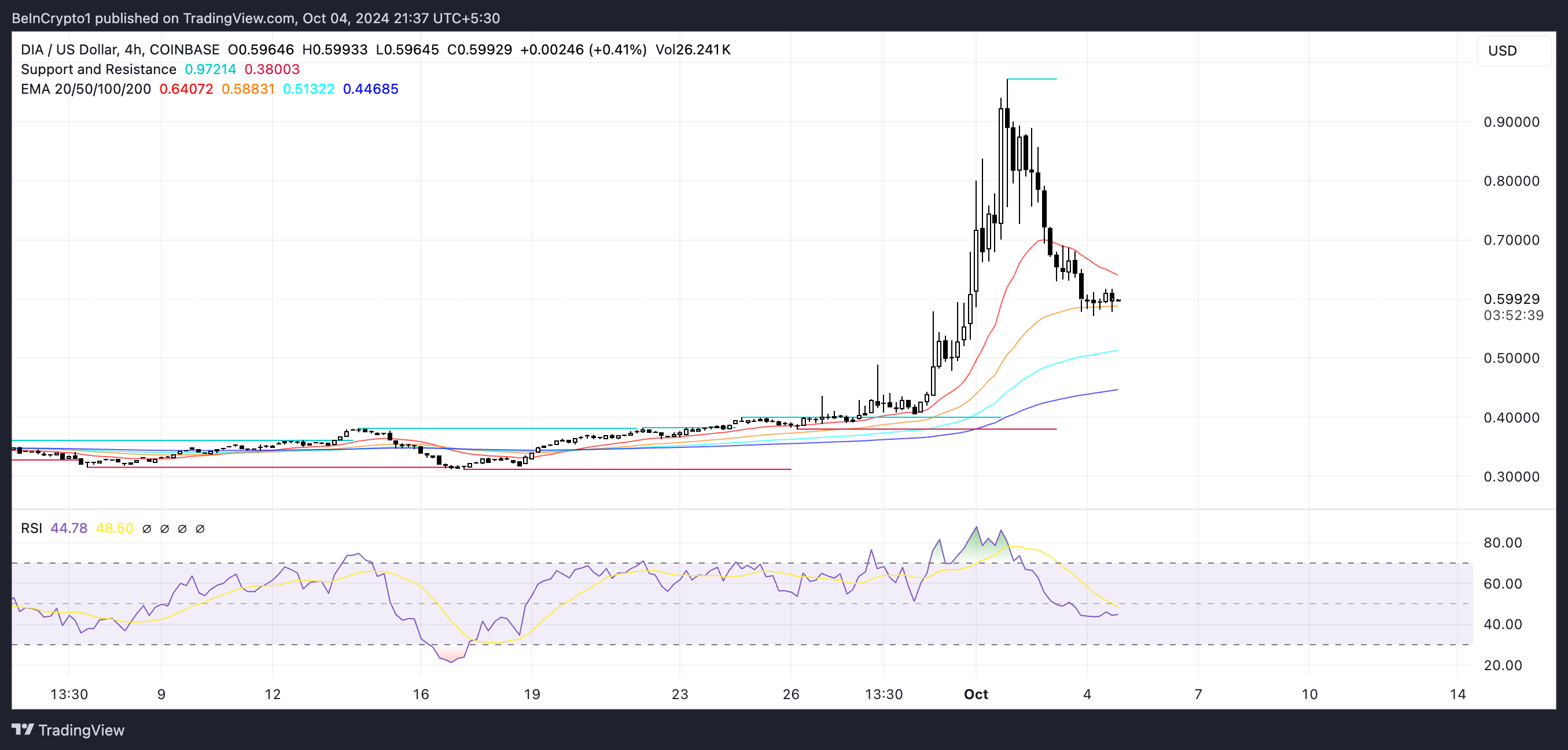

DIA surged 47.79% over the past seven days, ranking it among the top-performing artificial intelligence coins during this period. Its price skyrocketed from $0.41 on September 29 to $0.92 by October 1, marking an impressive 124% gain. Following this surge, the price corrected back to $0.59.

Despite this retracement, DIA’s Exponential Moving Average (EMA) lines remain bullish. The short-term EMAs continue to stay above the long-term ones, signaling that the bullish trend is still intact, although it has weakened compared to the earlier peak.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

DIA EMA Lines and RSI. Source: TradingView

DIA EMA Lines and RSI. Source: TradingView

The DIA’s Relative Strength Index (RSI) currently stands at 44.68, which suggests it is neither overbought nor oversold. RSI is a momentum indicator that ranges from 0 to 100 and is used to gauge whether an asset is overbought (above 70) or oversold (below 30) territory.

With DIA’s RSI at 44.68, it indicates that the asset is in a neutral zone, showing steady movement without extreme pressure in either direction. This level suggests there is still potential room for upward growth before hitting an overbought condition. That implies that DIA could have more upside momentum ahead.

Zero1 Labs (DEAI)

DEAI is the token from Zero1 Labs, a platform dedicated to developing decentralized artificial intelligence applications. Zero1 Labs offers Keymaker, an open platform that includes a DeAI (Decentralized Artificial Intelligence) toolset, API, and dApp Store, along with Cypher, a blockchain optimized for AI and large language models, with a focus on data governance and ownership. The platform is designed to simplify the creation and monetization of DeAI apps.

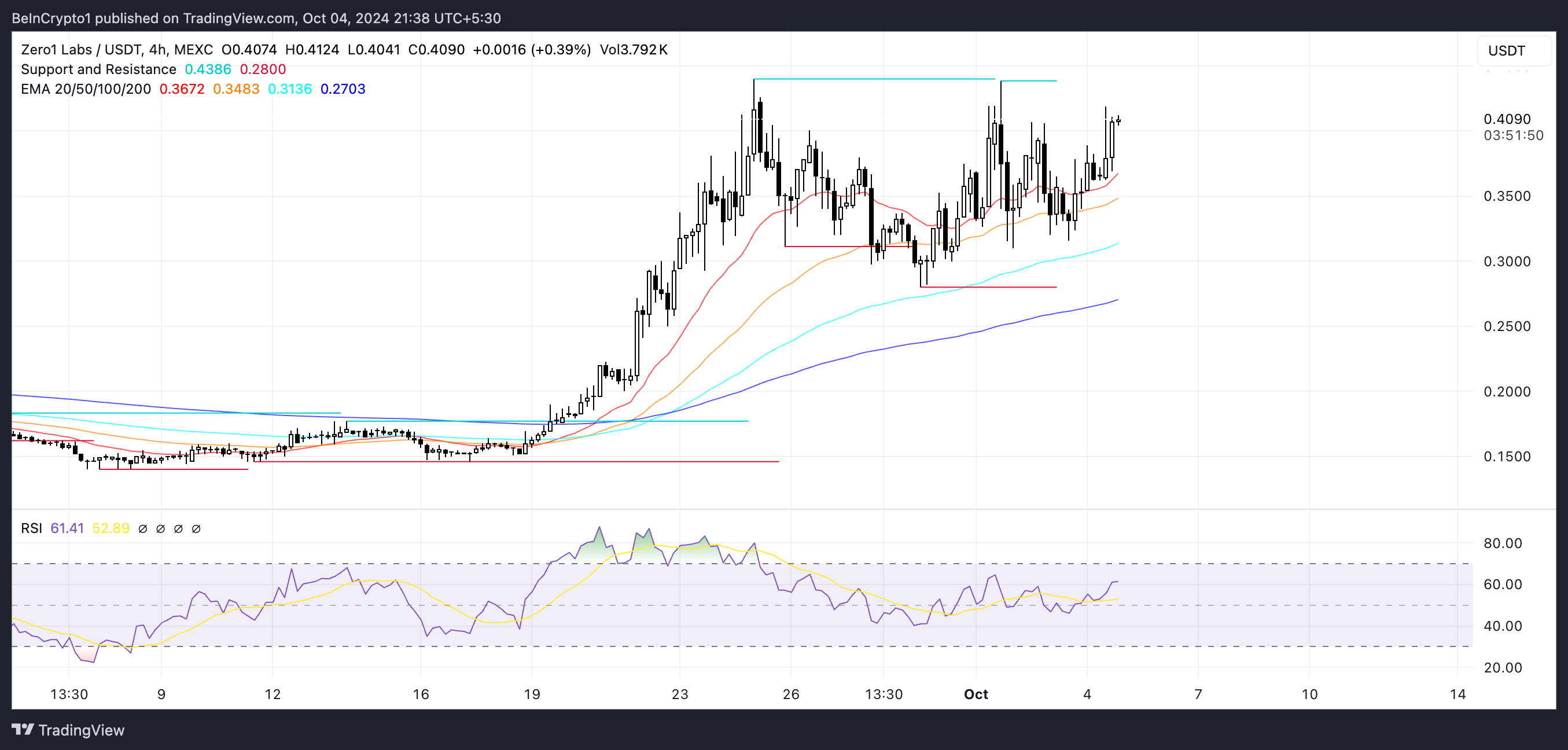

DEAI price surged 14.05% in the last week, currently sitting at $0.41. DEAI EMA lines are strongly bullish, with the short-term lines all above the long-term lines. They also show a good distance between them, which shows the uptrend is sustainable.

DEAI EMA Lines and RSI. Source: TradingView

DEAI EMA Lines and RSI. Source: TradingView

DEAI currently shows support at $0.31, and its next resistance is at $0.43, which should be tested soon. Its relative Strength Index (RSI) currently stands at 61.41. That indicates that while it is nearing the overbought threshold of 70, it still has some room for potential growth.

With DEAI’s RSI approaching 70, the token shows signs of strength and upward momentum. However, it could be nearing a point where gains could slow or a correction may occur. While there is still room for growth, this momentum may not last much longer as it inches closer to the overbought zone.

Lambda (LAMB)

LAMB is the coin of Lambda, a storage network that defines itself as the “leading omnichain modular storage”, supporting DeFi and artificial intelligence applications. LAMB price followed the same trend from DIA and DEAI, surging from $0.0016 on September 27 to $0.0030 on September 30. That represents an 87,5% growth in just three days.

It then dropped to $0.0023, but its price chart still shows a growing potential for the next few days. LAMB EMA lines still look bullish, although the distance between its two short-term lines is not as big as before. This could indicate that the current uptrend is less strong.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

LAMB EMA Lines and RSI. Source: TradingView

LAMB EMA Lines and RSI. Source: TradingView

LAMB’s RSI currently sits at 50.33, signaling that the asset is in a neutral position, neither overbought nor oversold. This leaves ample room for growth as it indicates that LAMB is not facing excessive buying pressure yet.

If the current uptrend continues, LAMB could soon retest the $0.0030 resistance level, presenting a potential 32% increase opportunity. With its RSI comfortably in the middle, there is space for further upward momentum before any significant resistance is encountered.