Wintermute Launches Multi-Chain Prediction Platform Ahead of 2024 US Presidential Race

As the 2024 US presidential election nears, market maker Wintermute is set to introduce its multi-chain prediction platform.

This platform will integrate decentralized finance (DeFi) capabilities to enable participants to place bets on election outcomes across various blockchain networks.

Prediction Platforms Gain Traction as the US Election Nears

Wintermute’s platform multi-chain functionality allows users to participate directly from their chosen blockchain. This approach removes the technical barriers often found in single-chain prediction markets. It simplifies the process by eliminating the need to transfer assets between different chains, ultimately reducing costs and complexity.

Wintermute also offers expanded token utility through the TRUMP and HARRIS tokens, representing US election candidates—Donald Trump and Kamala Harris. Users can utilize these tokens for prediction bets and in DeFi applications. Tradable across various decentralized and centralized exchanges, this feature creates new liquidity opportunities—a notable improvement over most prediction markets, where token usage is typically more restricted.

Read more: Top 9 Web3 Projects That Are Revolutionizing the Industry

Wintermute also implements a permissionless listing model, enabling any trading venue to offer tokens without minting or transaction fee restrictions. This approach boosts accessibility and makes it easier for users across different ecosystems to participate in election-related prediction markets.

Notable partners such as Bebop, WOO X, and Backpack are backing Wintermute’s prediction platform. Additionally, Wintermute has partnered with Chaos Labs to ensure data accuracy across these chains for this platform. Chaos Labs’ Edge Proofs Oracle delivers real-time, tamper-proof data that forms the backbone of Wintermute’s prediction engine.

“What sets our market and data integrity engine apart is the unique integration of advanced AI and LLMs with risk models. […] Edge Proof’s multi-chain architecture ensures seamless delivery of price, risk, and proofs across ecosystems, embedding trust in prediction markets,” Omer Goldberg, CEO of Chaos Labs, said.

Wintermute’s timing aligns with the growing interest in election-related prediction markets. BeInCrypto recently reported that Polymarket’s election-related betting volume has reached $926 million. As the US election nears, this number is projected to hit $1 billion.

Read more: Top 5 Web3 Use Cases: Where Web3 Is, Where It’s Going

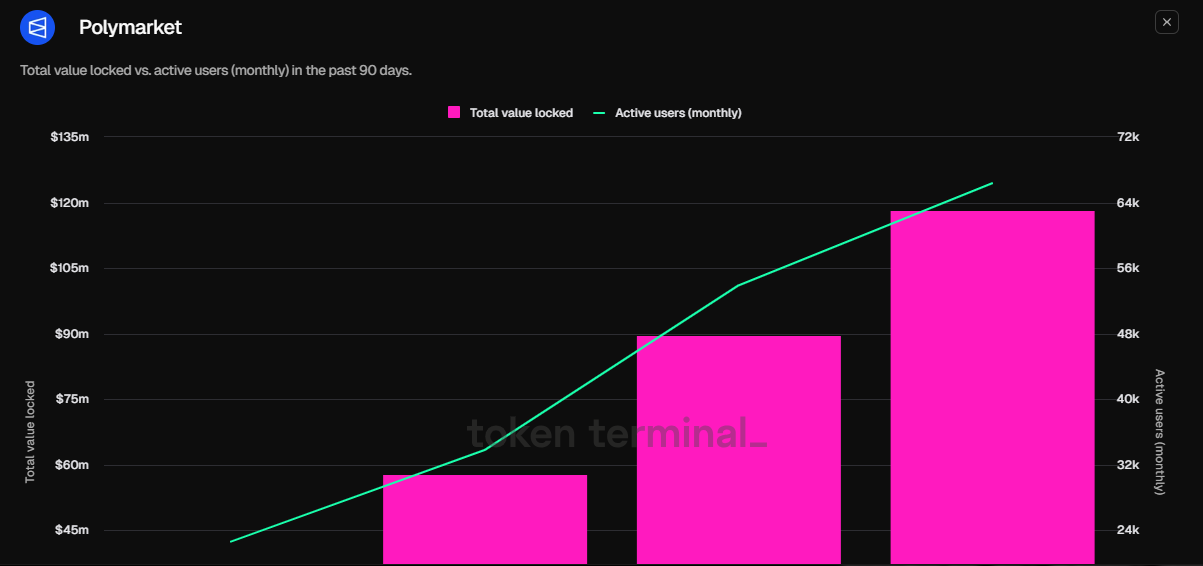

Polymarket TVL. Source: Token Terminal

Polymarket TVL. Source: Token Terminal

Moreover, Dune Analytics data shows that nearly 70% of Polymarket’s weekly users focus on election bets. Since June, Polymarket’s total value locked (TVL) has surged by 277%, reaching close to $120 million. Meanwhile, the number of monthly active users has increased by 50%, reaching 66,400.