Top Crypto News This Week: Donald Trump’s Crypto App, the Fed Rate Decision, and More

This week brings pivotal events in both the economic and crypto spaces. The US Federal Reserve’s anticipated interest rate decision could shake global markets while Donald Trump prepares to launch his new cryptocurrency platform, World Liberty Financial.

In addition, Solana’s Breakpoint event and MakerDAO’s transformation into Sky are adding excitement to the blockchain space. Several high-profile token unlocks, led by Arbitrum, are also set to increase market volatility. With political, economic, and blockchain developments all converging, this week promises interesting developments for the crypto sector.

How the Fed’s Rate Decision Could Shape Crypto’s Near Future

This week, the Federal Reserve’s interest rate decision is causing major speculation, particularly for risk assets like cryptocurrencies. CME Group data suggests a 59% chance of a 50 basis point (bps) cut and a 41% chance of a smaller 25bps cut. Historically, interest rate changes have significantly affected the crypto markets, particularly for assets like Bitcoin, which were under pressure during September, a month traditionally difficult for crypto.

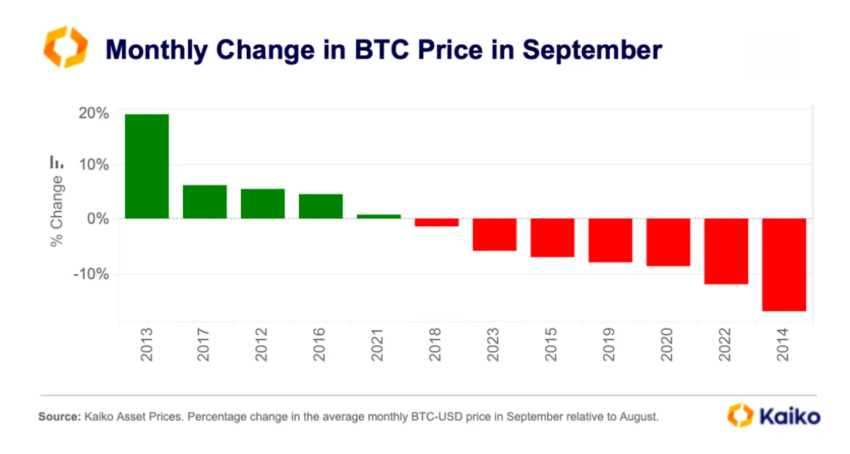

Analysts at crypto research firm Kaiko point to Bitcoin’s (BTC) “September Effect,” a phenomenon in which the cryptocurrency has declined in seven out of the last twelve Septembers. This trend has continued in 2024, with Bitcoin falling 7.5% in August and another 6.3% so far in September.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

BTC Monthly Price Change in September. Source: Kaiko

BTC Monthly Price Change in September. Source: Kaiko

Adding to the mix is a spike in volatility across both Bitcoin and Ethereum. Bitcoin’s 30-day volatility has jumped to 70%, marking almost double last year’s level. Meanwhile, Ethereum’s volatility has also increased, fueled by events like the launch of the Ethereum ETF.

“On a brighter note, the rise in crypto volatility has been accompanied by increased market participation, at least in the Bitcoin market. Bitcoin’s cumulative trade volume for the first eight months of 2024 is up nearly 20% from the previous peak in 2021, approaching a record of $3 trillion,” Kaiko’s analysts noted.

Donald Trump to Launch New Crypto App Ahead of US Presidential Election

Former US President Donald Trump is preparing to launch his new crypto platform, World Liberty Financial, in a live stream from Mar-a-Lago on Monday at 20:00 ET. Trump’s platform aims to position itself as a leading player in the crypto space. It promises to revolutionize finance by offering an alternative to traditional banking systems.

“We’re embracing the future with crypto and leaving the (0:11) slow and outdated big banks behind,” Trump said in a promotional video posted on X (Twitter).

The timing of the launch has sparked conversations about the intersection of Trump’s political and business ambitions. However, critics raised concerns about the potential use of government influence to benefit his family’s venture.

Solana Network State, Firedancer, and More: What to Expect at Breakpoint 2024

Solana is set to host its highly anticipated Breakpoint event on September 20-21 in Singapore. Organized by the Solana Foundation, this multi-day event will bring together developers, industry leaders, creators, and blockchain enthusiasts from around the world to explore the latest innovations in the Solana ecosystem. Breakpoint 2024 promises to be the most exciting yet, with discussions on the Solana Network State and Solana 2.0 and keynotes from influential figures like Raj Gokal and Balaji Srinivasan.

Participants can expect workshops, interactive talks, and networking opportunities designed to highlight Solana’s vision for the future of blockchain technology. Attendees will also get exclusive updates on Firedancer, Solana’s next-generation validator client, and other breakthrough developments in the ecosystem.

Sky’s (MakerDAO) Rebranding and New Token Launch

Another key development in the decentralized finance (DeFi) space is MakerDAO’s rebranding to Sky, which will take effect on September 18. Along with the new brand identity comes the launch of two key tokens: USDS, an upgraded version of the DAI stablecoin, and SKY, a governance token that will replace MKR.

Sky’s leadership sees this transformation as necessary to enhance scalability and accessibility within the DeFi ecosystem. The USDS token offers a more resilient, scalable alternative to DAI with the same 1:1 conversion rate. Meanwhile, the SKY token introduces new governance functionalities.

This rebranding is part of Sky’s broader “Endgame Plan,” which aims to address critical challenges in DeFi, including regulatory compliance and scalability. By introducing “Sky Stars,” decentralized projects designed to foster innovation, and Sky.money, a non-custodial platform to simplify access, Sky aims to lead the next phase of DeFi development.

EigenLayer’s Season 2 Stakedrop: What You Need to Know

On September 17, Ethereum’s restaking platform EigenLayer will begin distributing its Season 2 stakedrop. The platform will reward stakers, ecosystem partners, and community members with EIGEN tokens. Approximately 70 million EIGEN tokens, or 4.2% of the total initial supply, will be distributed to participants who actively staked and operated nodes during Season 2. Rewards will be calculated based on each staker’s proportional share of ETH-hours accumulated during the snapshot period on August 15, 2024.

For ecosystem partners, up to 10 million EIGEN tokens, or 0.6% of the supply, will be allocated to contributors who supported EigenLayer through roles in Actively Validated Services (AVSs), Layer-2 rollups, and other decentralized services. Meanwhile, community members, including early advocates, open-source contributors, and supporters since EigenLayer’s inception, will receive around 6 million EIGEN tokens. This amount represents 0.35% of the total supply.

To claim these rewards, community members must verify their social identity through the platform’s portal. This mechanism will ensure that only genuine participants can access their tokens.

ARB and Other Major Token Unlocks This Week

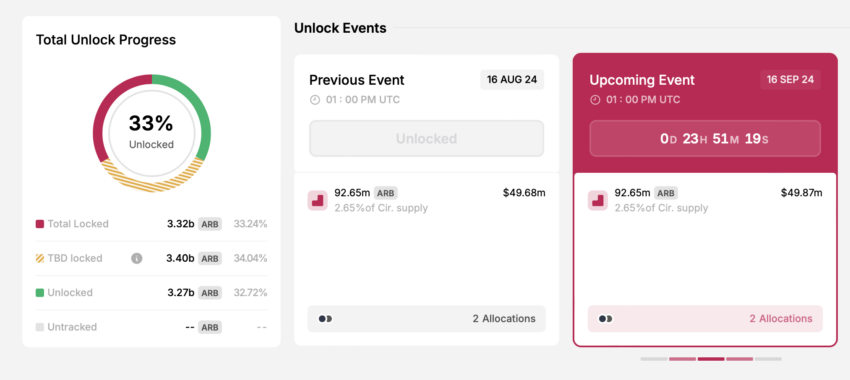

This week, the crypto market will see the unlocking of over $116 million worth of tokens, with Arbitrum leading the charge. Arbitrum’s scheduled token unlock will release over 90 billion ARB tokens, valued at approximately $49.87 million, on September 16. These tokens will be distributed to the project’s team, advisors, and early investors.

Read more: How to Buy Arbitrum (ARB) and Everything You Need to Know

ARB Token Unlock. Source: token.unlock

ARB Token Unlock. Source: token.unlock

Other notable token unlocks include ApeCoin and Space ID, which are also set to release large quantities of tokens into the market. Token unlocks often increase market volatility as newly available tokens create liquidity but may also prompt sell-offs. Read this article for further detailed information on major crypto token unlocks this week.