Bitcoin Weekly Forecast: Can BTC break above $62,000 barrier?

- Bitcoin price rises this week so far, but remains within its broad consolidation zone between $57,000 and $62,000.

- The Data Nerd and Lookonchain data shows that institutions accumulate while some whales deposit BTC in exchanges.

- US spot Bitcoin ETFs registered four straight days of modest inflows this week, totaling $254.4 million.

- Defunct exchange Mt.Gox transferred 13,265 BTC, worth $784.20 million, to a new wallet.

Bitcoin (BTC) trades above $60,000 on Friday, gaining more than 4% this week so far, but fluctuating within a range between $57,000 and $62,000 for the last 15 days. On-chain data shows contradicting signs, with institutions accumulating Bitcoin while some whales are selling. Additionally, the US spot Bitcoin ETFs recorded inflows this week, and continued Mt.Gox fund movements could bring volatility in Bitcoin's price in the coming days.

Institutional investors accumulate BTC, whales prepare to sell

According to data from Data Nerd, Ceffu and Cumberland, an institutional-grade custody solutions company for cryptocurrencies and digital assets, withdrew 246.33 and 300 BTC worth $14.99 million and $18.36 million, respectively, from the Binance exchange on Friday. This indicates that institutions are accumulating BTC as the coin’s price fluctuates between $57,000 and $62,000.

Institutions keep withdrawing $BTC from exchanges.

— The Data Nerd (@OnchainDataNerd) August 23, 2024

Few hours ago, #Cumberland withdrew 300 $BTC (~$18.36M) while #Ceffu withdrew 246.33 $BTC (~$14.99M) from #Binance.

Address:https://t.co/p7PClw3m6Rhttps://t.co/xgA2JAKH5Y pic.twitter.com/25HGlVSmtX

Additionally, Lookonchain data shows that some whale wallet deposited 300 BTC worth $18.25 million at a loss in the Binance exchange on Friday.

A whale sold 300 $BTC($18.25M) at a loss 40 minutes ago.

— Lookonchain (@lookonchain) August 23, 2024

This whale bought 855 $BTC($54.6M) at $63,878 in July, then sold 297 $BTC($15.8M) at a loss during the August 5 market crash, and another 300 $BTC($18.25M) today, leaving 259 $BTC($15.74M).

This trade resulted in a $4.8M… pic.twitter.com/mABp0SNLox

Mt.Gox fund movements have not been transferred to creditors yet

According to Data Nerd, on Wednesday, defunct exchange Mt. Gox transferred 13,265 BTC, worth $784.20 million, to a new wallet. This transfer could later be sent to exchanges like Bitstamp, BitGo and Kraken to repay creditors.

4 hours ago, #Mt_Gox transferred 13,265 $BTC (~$784.2M) to a fresh wallet.

— The Data Nerd (@OnchainDataNerd) August 21, 2024

Later, those $BTC could be transferred to exchanges like #Bitstamp, #BitGo, #Kraken,... for repayment.

Just now, #Mt_Gox still owns 46,164 $BTC (~$2.74B)

Address:https://t.co/dnSFWQwsP6 pic.twitter.com/0SbHpZnFtO

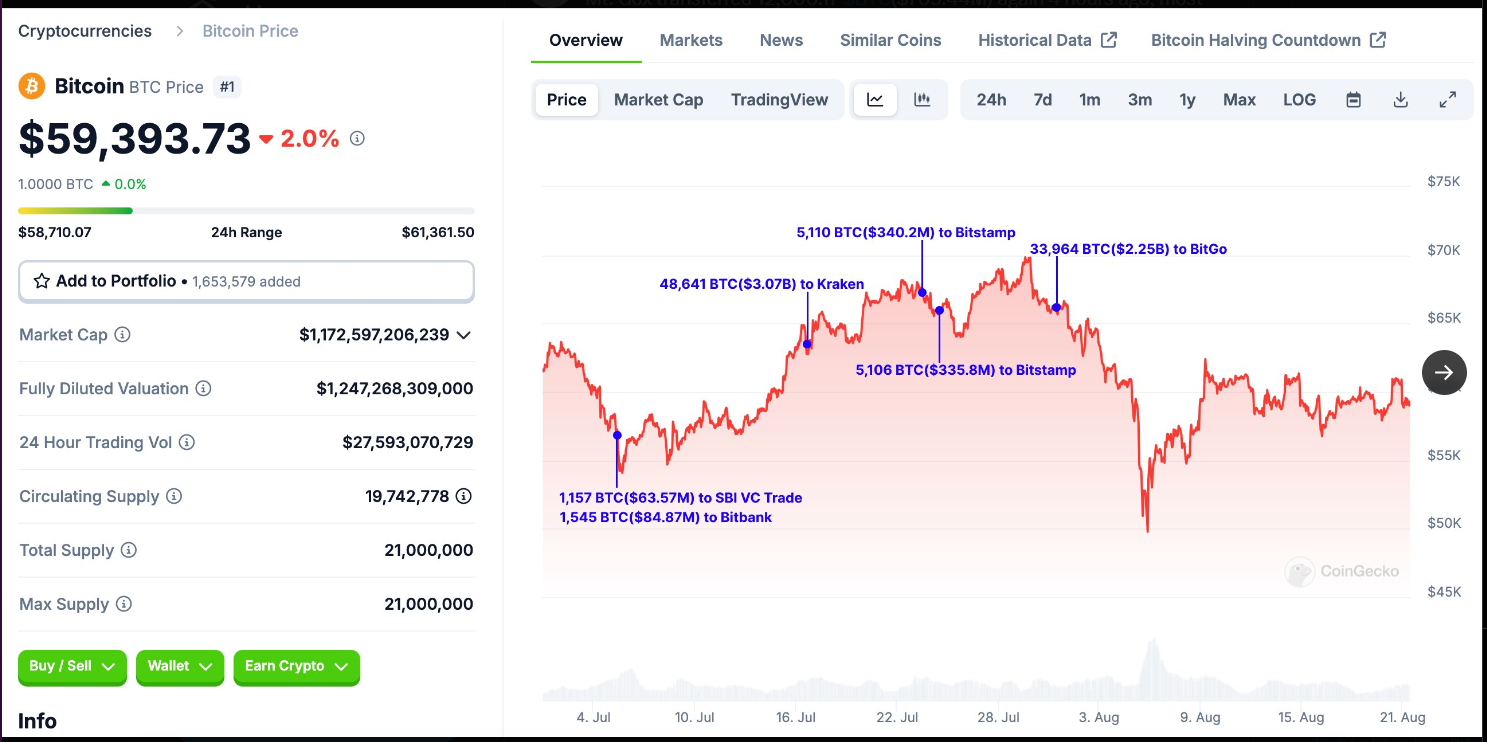

Historically, Lookonchain data shows that Mt. Gox's transfer of 33,964 BTC worth $2.25 billion on July 30 could have caused the Bitcoin price to crash from $66,700 to $54,000 in seven days.

Mt. Gox fund transfer chart

The recent activity related to Mt.Gox has not generated FUD (Fear, Uncertainty, Doubt) among traders because the funds moved have yet to be transferred to creditors. If the transfer is done, it could potentially contribute to a decline in Bitcoin’s price.

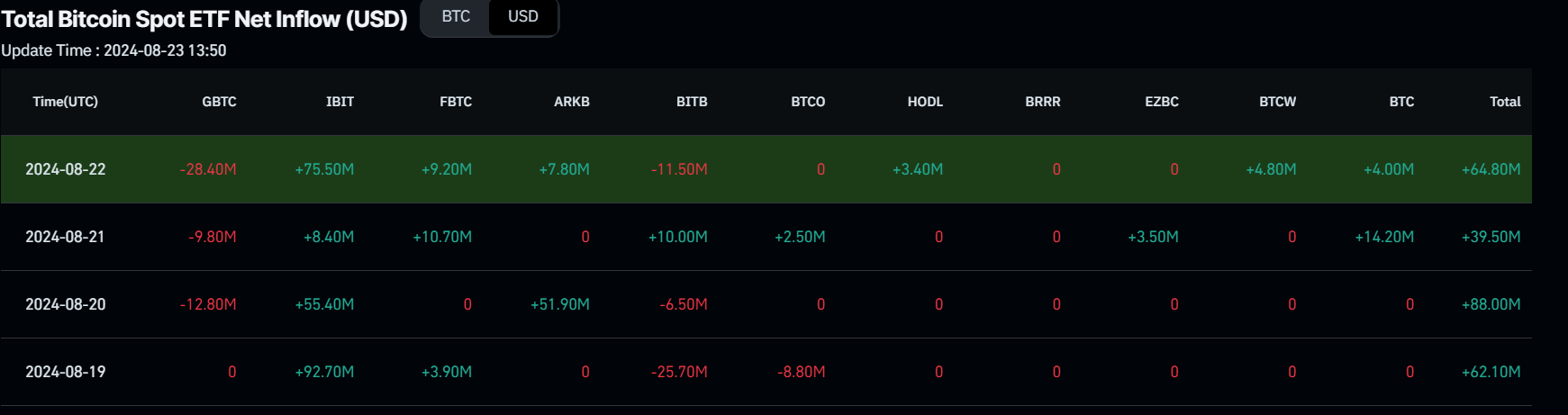

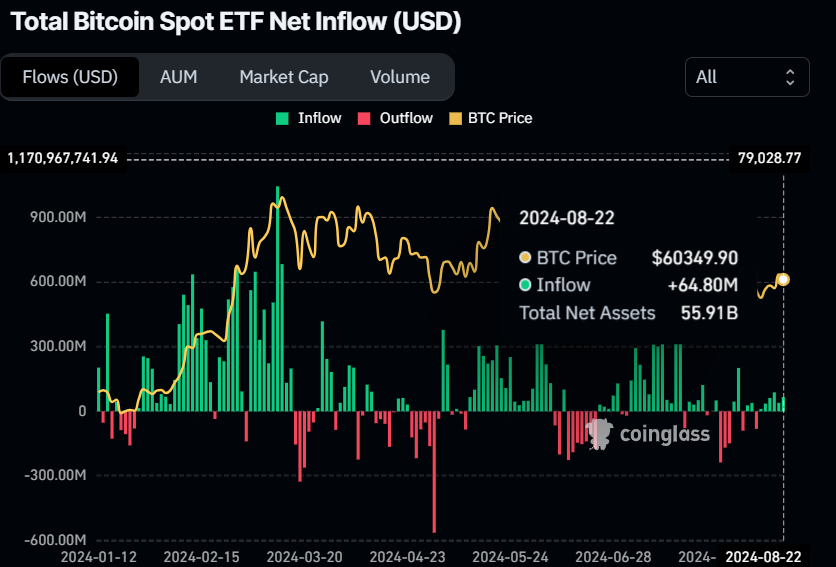

US spot Bitcoin ETFs see modest inflows

Institutional flows slightly supported Bitcoin price this week. According to Coinglass data, US spot Bitcoin ETFs experienced four straight days of mild inflows this week until Thursday, totaling $254.4 million in net inflows. Net flows can help gauge investors' sentiment towards Bitcoin, but when these are small – like this week so far – they are less significant considering that the total Bitcoin reserves held by the 11 US spot Bitcoin ETFs are at $55.91 billion.

BTC Spot ETF Net Inflow chart

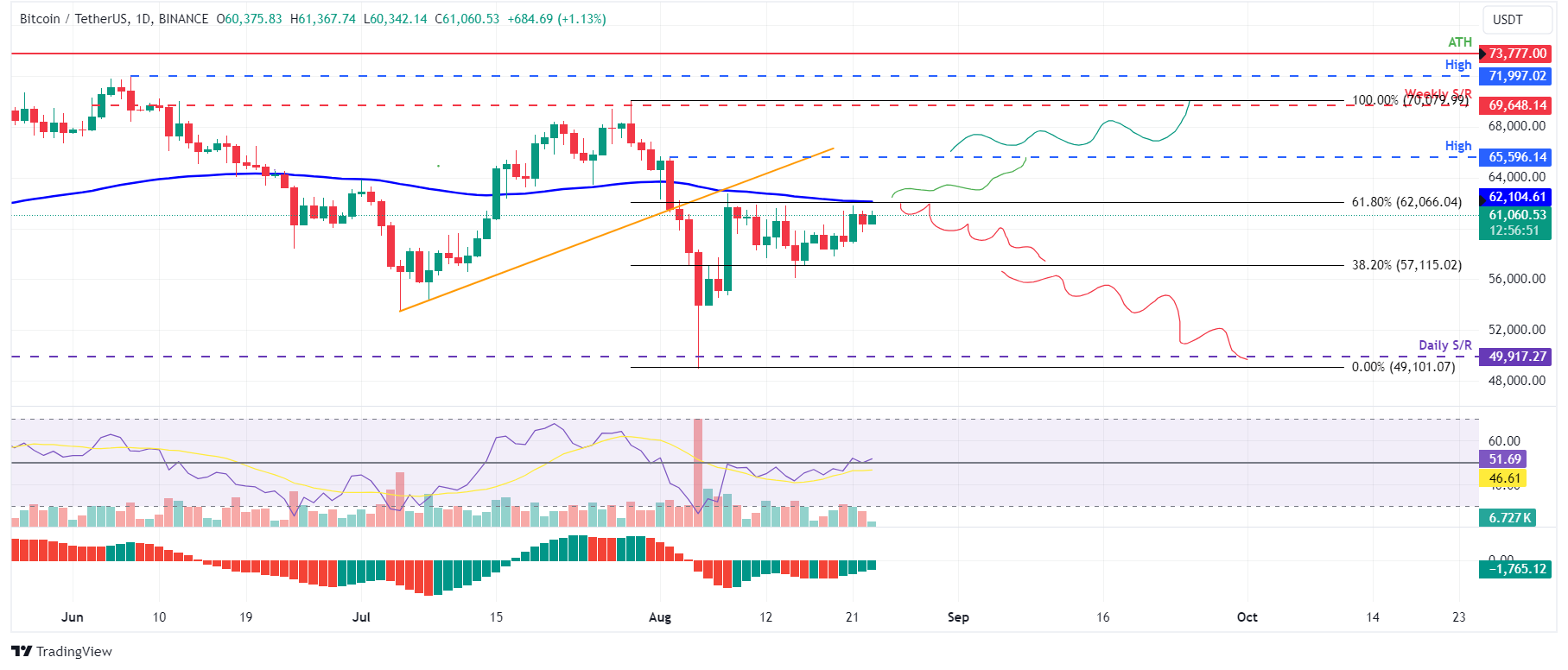

Bitcoin price to face volatility if it breaks consolidating range

Bitcoin price has remained between $57,115 and $62,066 (the Fibonacci retracement levels of 38.2% and 61.8%, respectively, drawn from the high on July 29 to the low on August 5) for the last 15 days. As of Friday, it trades slightly up by 1% at $61,060 and approaches its key resistance level at $62,066.

If BTC fails to close above the $62,066 level, it could drop to $57,115 before potentially declining by 19% to revisit the $49,917 daily support level.

On the daily chart, the Relative Strength Index (RSI) trades slightly above its neutral level of 50, and the Awesome Oscillator (AO) still trades below its neutral level of zero. Both indicators must trade significantly below their respective neutral levels for the bearish momentum to be sustained.

BTC/USDT daily chart

However, if Bitcoin price closes above $62,066, a rise towards the August 2 high of $65,596 would be on the cards as it would set a higher high on the daily chart. This could lead to a further 6% price increase to test the weekly resistance at $69,648.