- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

On May 21, 2025, millions of X users worldwide suffered an outage for hours, the latest in a string of disruptions that have plagued the company lately. Users couldn’t log in, access timelines, or send messages, hardly the hallmarks of a platform aspiring to become a “super app.”

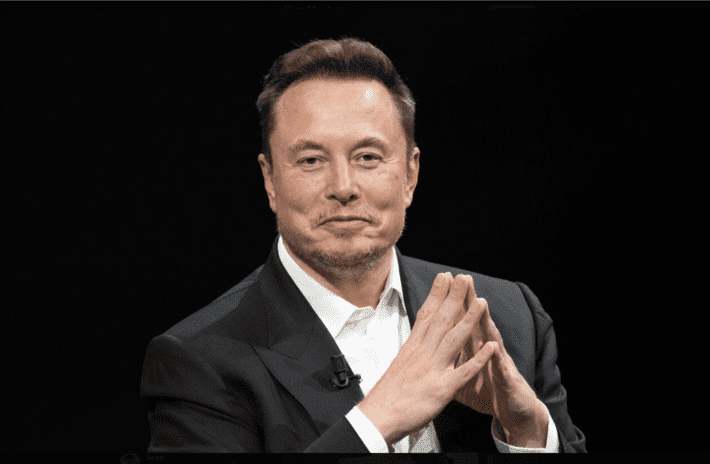

Elon Musk’s vision for X is clear: a single, integrated platform that merges social media, payments, messaging, AI services, and commerce. But so far, the execution hasn’t matched that goal. For all of X’s ambitions, the platform struggles to maintain basic functionality, let alone support a layered suite of financial and transactional services.

Building a super app requires discipline, not chaos

The super app model, best exemplified by WeChat in China, is complex. Besides a backend infrastructure capable of handling vast, interdependent functions, it requires strong regulatory alignment, cultural integration, and sustained focus.

WeChat did not evolve through improvisation; it matured under coordinated leadership, with deep cooperation from regulators and a coherent product roadmap.

X, by contrast, appears to have adopted an approach defined more by urgency than discipline. In the last year alone, Musk has announced initiatives ranging from encrypted messaging and peer-to-peer payments to AI-generated news and dating features. Yet these product ambitions have coincided with frequent platform outages and a marked decline in service reliability.

Super apps do not succeed by layering complexity onto unstable systems. They thrive on trust—technical, operational, and institutional. And trust is difficult to maintain when the platform itself appears brittle.

Stretching leadership across six companies risks systemic failure

Musk’s portfolio is without precedent in modern corporate history. He is CEO of Tesla, SpaceX, Neuralink, xAI, The Boring Company, and X. Each of these demands persistent execution, high-stakes decision-making, and deep technological engagement.

Tesla alone is navigating autonomous driving challenges, supply chain pressures, and cutthroat competition in the EV market. SpaceX is scaling Starship and managing a constellation of Starlink satellites. Neuralink recently entered human trials.

Under such conditions, even the most capable leader risks diffusion. The physical demands of running one high-growth, technologically complex company are immense. Running six is a structural risk.

Tesla shareholders have raised issues about this very dynamic. In early 2024, investor letters questioned Musk’s focus, particularly as political rhetoric and regulatory conflicts on X drew attention away from Tesla’s core innovation agenda. SpaceX insiders have reportedly expressed similar unease over reputational spillover from X.

Nowhere is the strain more visible than at X itself. The May outage, reportedly caused by delayed server patching and misconfigured fallback systems, reflects technical debt and a lack of sustained executive oversight. Such failures are less likely in environments where leadership focuses on operational resilience.

Slashing staff without a clear strategy has weakened X’s core operations

Compounding the problem is X’s dramatic downsizing. Since Musk’s acquisition, the company has shed more than 80% of its workforce, including infrastructure specialists, product leads, and compliance personnel. Many of these were responsible for platform reliability, trust and safety, and regulatory alignment.

Layoffs of this magnitude might have been manageable under a strategically phased reorganization. Instead, X has lurched from crisis to crisis. Product rollouts have lacked cohesion. Infrastructure appears brittle. Regulatory uncertainty is another concern, particularly as the company explores payments and financial services in tightly regulated jurisdictions.

To dismiss Musk outright would be premature. His track record—disrupting the auto industry, commercializing spaceflight, and vertically integrating battery supply chains—is extraordinary. The same goes for his work ethic and eye for spotting top-tier talent.

Some of Musk’s supporters argue that his model of leadership—visionary, high-leverage, selectively engaged—is sufficient if paired with strong deputies. That argument has merit. If X’s operations were led by a dedicated CEO accountable for execution and platform integrity, Musk’s focus could be confined to product vision and business alliances.

There are also potential synergies across Musk’s companies. Starlink could enhance X’s market reach, xAI accelerates AI integration for content moderation or personalization, and Tesla’s payment expertise could support its financial infrastructure.

Yet none of these synergies remove the need for consistent, hands-on leadership within X. The core challenge is not merely technological—it is managerial.

Pursuing a super app vision requires more than Musk’s ambition

Even with perfect leadership, X faces formidable barriers to super app status in the West. The regulatory environment in the U.S. and Europe is more fragmented and stringent than in China. Data privacy laws, antitrust scrutiny, and payment licensing regimes impose real constraints.

Moreover, X faces entrenched competitors: Apple for payments, WhatsApp for messaging, and Amazon for commerce. In this context, building a Western WeChat is not just difficult; it may be structurally unviable. The ambition may be sound. The execution model, however, must evolve.

X need not abandon its super app ambitions but must rethink how it pursues them. A platform that seeks to become the central hub for communication, finance, and commerce requires unbroken focus, deep operational expertise, and robust governance.

Musk has proven himself an exceptional founder and visionary. However, the role of platform steward, particularly at this stage of X’s evolution, may require different leadership. Appointing a CEO with a mandate for stability, compliance, and execution could restore confidence and increase the odds of success.

Ultimately, even the most powerful vision cannot substitute for presence. Super apps demand more than innovation—they demand constancy, precision, and trust. Unless X closes the gap between ambition and leadership bandwidth, its super app dream may remain just that: a dream.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.