Telegram Coin BANANA Might Find Resistance From Traders’ Skepticism

Telegram coin BANANA is observing a shift in sentiment following the recent recovery, which could initiate accumulation.

However, the investors are not particularly excited about this as they seem to be maintaining their bearish outlook.

BANANA Holders Seem Unsure

Telegram coin BANANA’s price is in the green, suggesting a slight shift in the market’s sentiment. This is also giving out bullish signals as visible on the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio assesses investor profit and loss. Currently, BANANA’s 30-day MVRV is at -13%, indicating possible selling pressure.

Historically, the Telegram coin’s MVRV between -15% and -30% signals the start of rallies, marking it as an accumulation opportunity zone. BANANA is just slightly above this line, which could still trigger accumulation.

Read More: What Are Telegram Bot Coins?

BANANA MVRV Ratio. Source: Santiment

BANANA MVRV Ratio. Source: Santiment

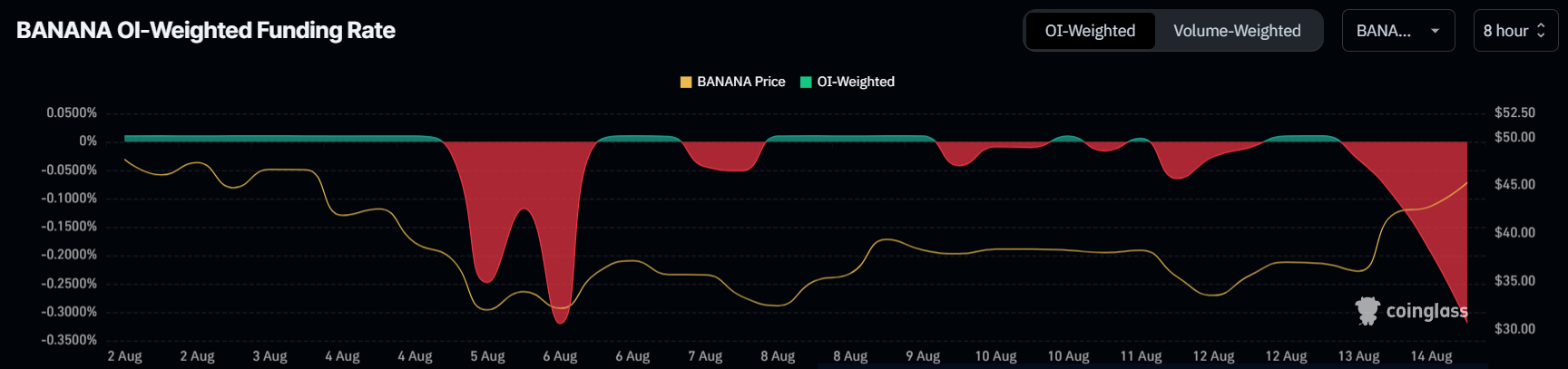

However, BANANA’s funding rate is currently showing a strong bearish trend, reflecting widespread skepticism among traders. This negative sentiment follows a recent crash, which has led to a cautious outlook and reduced confidence in the asset.

The ongoing bearish funding rate indicates that traders are hesitant and are actively placing short contracts in the market. Thus, until there is a remarkable shift in investor confidence, the asset may continue to face downward pressure.

BANANA Funding Rate. Source: Coinglass

BANANA Funding Rate. Source: Coinglass

BANANA Price Prediction: Peeling the Potential

The BANANA price, trading at $45, nearly breached the $47 resistance during the intra-day high before falling slightly. In the last three days, the Telegram coin registered a 35% rise, which is filling the market with optimism about a further rise.

If the $47 resistance is secured as a support floor, BANANA price could end up rising to $55. However, since the Telegram coin has previously noted consolidation between $47 and $55, the rally might stop here.

Read More: Crypto Telegram Groups To Join in 2024

BANANA Price Analysis. Source: TradingView

BANANA Price Analysis. Source: TradingView

But if the breach fails entirely, BANANA price will slide back to $40 and witness sideways movement here until stronger bullish cues arrive. Further, losing the support of $40 would invalidate the bullish thesis entirely.