Will crypto markets outperform the traditional Gold market?

- According to Northstar analysis, crypto markets could rally following a breakout.

- Presidential candidates Donald Trump and Robert Kennedy Jr. voiced their support for Bitcoin at the Bitcoin conference in Nashville.

- After Bitcoin's fourth having, the title of the scarcest asset has shifted from Gold to Bitcoin.

In yet another sign that crypto is upending the normal equilibrium of capital markets, Gold’s recent bull market is looking to give way to a coming bull market in Bitcoin, according to investment research firm Northstar.

Northstar analysis compares crypto's total market cap to Gold prices. An upward trend on the chart signifies a bullish sentiment in crypto, with investors favoring digital assets, while a downward trend indicates Gold's strength and investor preference for precious metals. Historical data shows that when the price dips below the 12-month Simple Moving Average (SMA), as seen in mid-2018, Gold has outperformed crypto.

Currently, the formation of a rising wedge pattern, marked by multiple swing highs and lows since early 2023, suggests that if prices close above the upper trendline, Ichimoku Cloud, and the 12-month SMA, this signals a bullish phase for crypto.

Conversely, a close below the lower trendline could lead to a crash in crypto prices while boosting Gold's performance.

#Crypto or #Gold? Switching between the two can be very lucrative, increasing your 'stacks' of both without needing to add more pic.twitter.com/SdXnvpQfiT

— Northstar (@NorthstarCharts) July 29, 2024

Data from CryptoRank.io highlights that Bitcoin's total market capitalization stands at $1.35 trillion, compared to the $543 billion in Gold reserves held by the US. This disparity suggests significant growth potential for the crypto market compared to traditional Gold markets.

Additionally, at a cryptocurrency conference in Nashville, presidential candidates Donald Trump and Robert Kennedy Jr. voiced their support for Bitcoin, with Trump proposing the establishment of a Bitcoin reserve and Kennedy advocating for the federal government to acquire Bitcoin equivalent to the value of the nation's gold reserves.

Top 10 Countries by Gold Reserve Value vs Bitcoin Market Capitalization

— CryptoRank.io (@CryptoRank_io) July 29, 2024

At a cryptocurrency conference in Nashville, presidential candidates Donald Trump and @RobertKennedyJr expressed their support for Bitcoin.

Donald Trump proposed establishing a Bitcoin reserve, while Robert… pic.twitter.com/fN22RkVhks

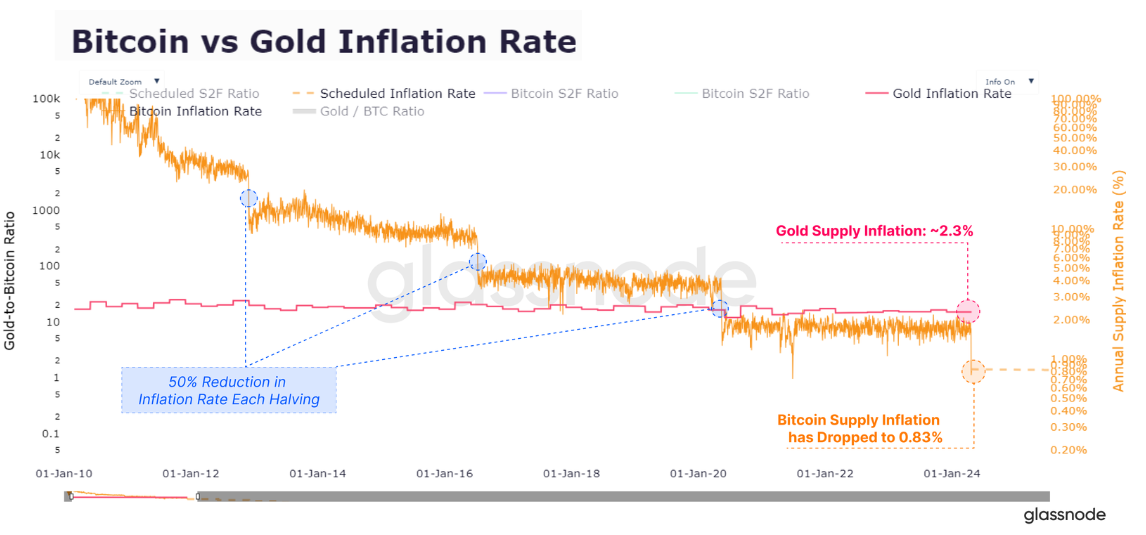

According to GlassNode data, following Bitcoin's fourth halving, Bitcoin's steady-state issuance rate of 0.83% is now lower than Gold's, approximately 2.3%, thereby transferring the title of the scarcest asset from Gold to Bitcoin.

Scarcity often drives demand. As Bitcoin is perceived as more scarce than Gold, it could lead to higher demand and potentially drive up Bitcoin's price over time.

Bitcoin vs Gold Inflation Rate Chart