Justin Sun deposits $21 million in crypto tokens to Binance

- Justin Sun is linked to the dormant whale wallet that deposited on Monday $21 million in AAVE, MKR, COMP and LQTY on Binance.

- On-chain tracker Spotonchain notes that Sun could take nearly $7 million in profits if he opted to sell the tokens.

- MKR and AAVE prices lost 2% and 1.5% on the day, respectively.

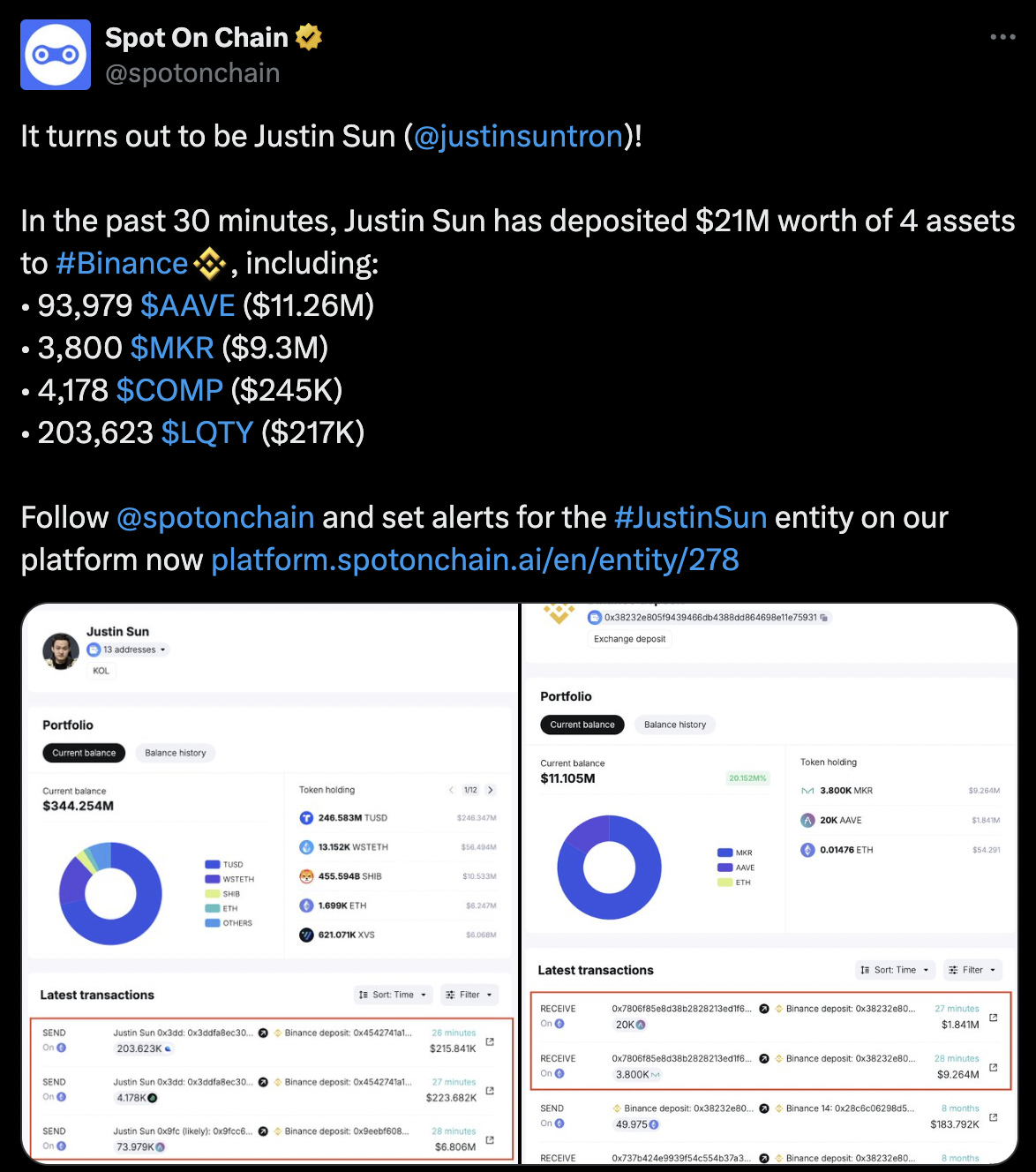

A whale wallet traced back to Tron founder Justin Sun deposited $21 million in four cryptocurrencies to Binance on Monday, according to data from on-chain intelligence tracker Spotonchain.

Maker (MKR) and Aave (AAVE) are the main assets deposited by the Tron founder, who could get a profit of nearly $7 million if he opts to sell its holdings. These two tokens have observed an increase in their supply on exchanges, on-chain data shows, a sign of increasing selling pressure as prices of both coins struggle to recover from recent losses.

Whale deposits $21 million in AAVE, MKR, COMP and LQTY

Spotonchain identified deposits totaling $21 million in crypto tokens of AAVE, MKR, Compound (COMP), and Liquity (LQTY) to Binance, one of the largest centralized exchanges. The on-chain tracker also identified nearly $7 million in unrealized gains on Sun’s MKR and AAVE deposits.

Sun’s wallet deposited 3,800 MKR and 93,979 AAVE tokens to Binance, Spotonchain data shows. Such large deposits can be a sign that the whale, in this case Justin Sun, is about the sell his holdings in the short term.

Justin Sun’s $21 million crypto token deposit to Binance

MKR and AAVE on-chain metrics support bearish thesis

Santiment data shows that MKR and AAVE’s supply on exchanges has climbed in the last ten days. MKR supply on exchanges increased by 6.9%, to 118.14K tokens from 111.24K, while AAVE supply increased by 3.5% in the same time frame to 3.18 million from 3.07 million.

Supply on exchanges is a metric used to determine selling pressure on an asset. An increase in exchange flow balance and a token’s supply on exchanges tends to provide a bearish sign for the token’s price outlook. MKR and AAVE are therefore likely to suffer a further price correction if supply keeps rising.

[13.34.04, 10 Jun, 2024]-638536132120094572.png)

[13.35.19, 10 Jun, 2024]-638536132355254719.png)

MKR and AAVE supply on exchanges climbs between June 1 and 10

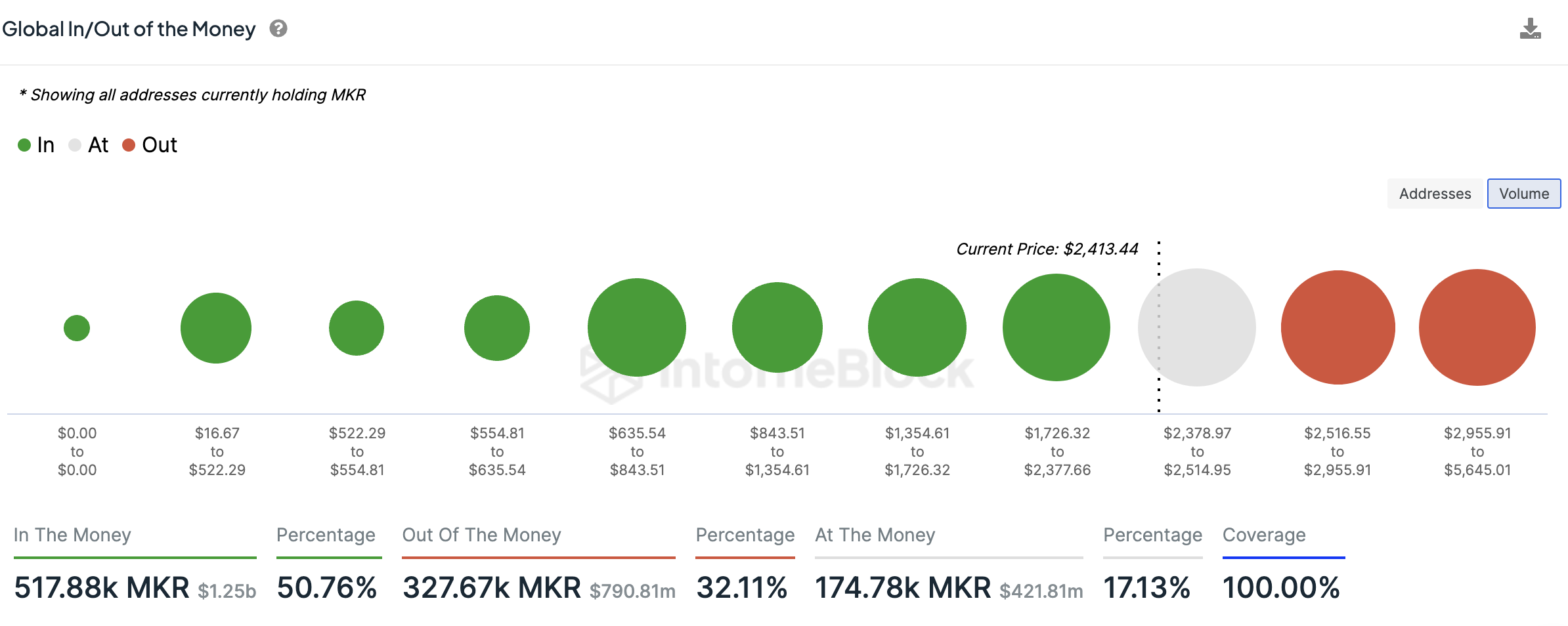

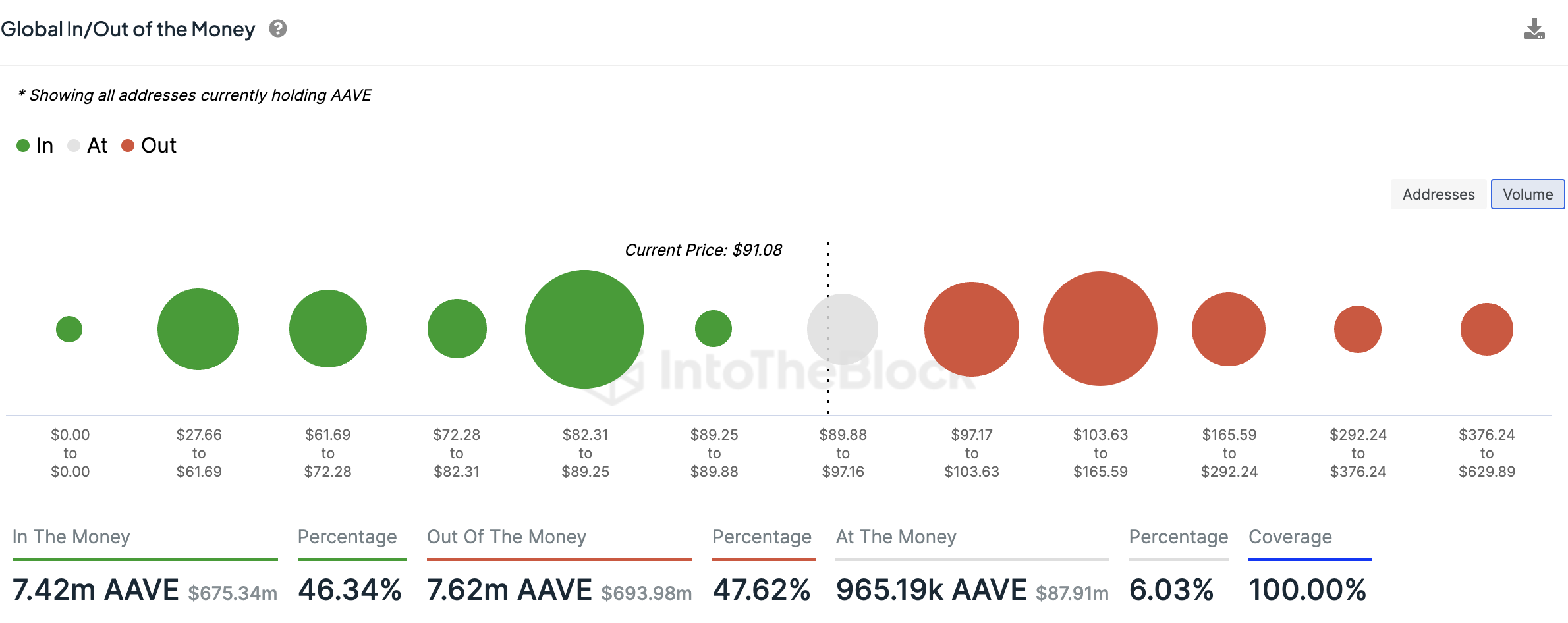

Another key on-chain metric, the Global In/Out of the Money (GIOM) map provided by IntoTheBlock, shows that more than 50% of MKR holders and 46% of AAVE holders are sitting on unrealized gains, meaning that they would take profits if they opted to sell their holdings.

If these investors choose to realize gains, it could contribute to downward pressure on MKR and AAVE prices. This supports the bearish thesis for the two assets.

Global In/Out of the Money MKR and AAVE

At the time of writing, MKR falls 2% on Monday to around $2,445, while AAVE price is down nearly 1% to $92.70.