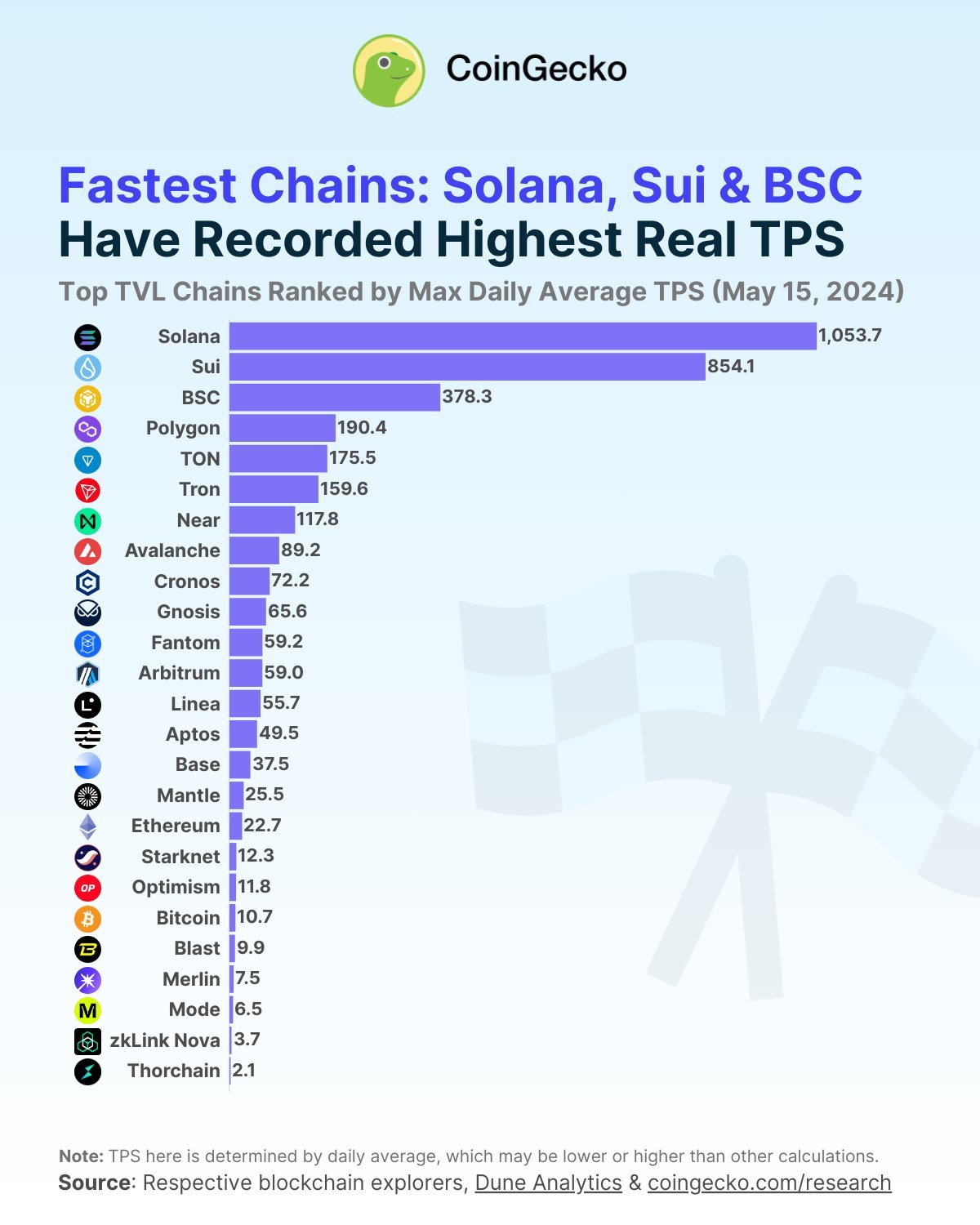

Solana, Sui and Binance Smart Chain rank in top 3 fastest blockchains

- Solana, Sui and Binance Smart Chain have recorded the highest real transactions per second among blockchain networks.

- Solana ranks first with 1,053 daily average TPS per the CoinGecko report.

- Ethereum ranks in the top 20, with lower TPS than Layer 2 chains and most Layer 1 competitors.

Crypto data tracker CoinGecko evaluated and ranked blockchains on the volume of transactions they can process. The crypto data aggregator identified the top 30 blockchain networks by total value of assets locked (TVL) and identified the maximum number of transactions processed by the network in the past year to rank them in the list.

Ethereum’s Layer 1 competitors and Layer 2 chains rank in the top 20 blockchains.

Solana, Sui and Binance Smart Chain lead the way in TPS

Blockchains can be compared for the total value of assets locked or user activity. However, comparing the volume of transactions per second (TPS) offers insight into the utility metrics of a blockchain. Higher TPS implies faster transaction processing and that the blockchain can handle a larger number of active users compared to its competitors, meaning higher adoption is likely.

CoinGecko’s report on blockchains shows that the fastest blockchain, Solana, scored 1,053 daily average TPS in 2024. This is 1.6% of the chain’s theoretical speed of 65,000 TPS. Other Layer 1 chains, Sui and Binance Smart Chain processed 854.1 and 378.3 TPS, respectively.

Fastest blockchains by daily average TPS

Ethereum ranks seventeenth in the list of blockchain networks, below most of its Layer 1 competitors and Layer 2 chains. Bitcoin failed to rank in the top 20 chains, the network processes 10.7 daily average transactions per second, ranking in the bottom 10, per the report.