Cardano Price Forecast: Bearish outlook strengthens as correction deepens

- Cardano price trades red on Thursday, posting two consecutive red candlesticks over the previous two days.

- Derivatives data indicates weakness, with Open interest dropping to November 2024 lows and rising short bets.

- Technical outlook suggests a deeper correction ahead, with bears targeting a level not seen since October 21, 2023.

Cardano (ADA) is extending its correction, trading below $0.29 at the time of writing on Thursday after posting two consecutive red candlesticks over the previous two days. The derivatives data shows signs of weakness, with ADA’s short bets rising amid falling Open Interest (OI), dropping to November 2024 lows. On the technical side, the outlook is bearish, with Cardano close to a price level not seen since October 21, 2023.

Cardano’s derivatives data shows bearish bias

Cardano’s futures OI at Binance exchange dropped to $90.21 million on Thursday, the lowest level since early November 2024, and has been steadily falling since mid-January. This drop in OI reflects waning investor participation and projects a bearish outlook.

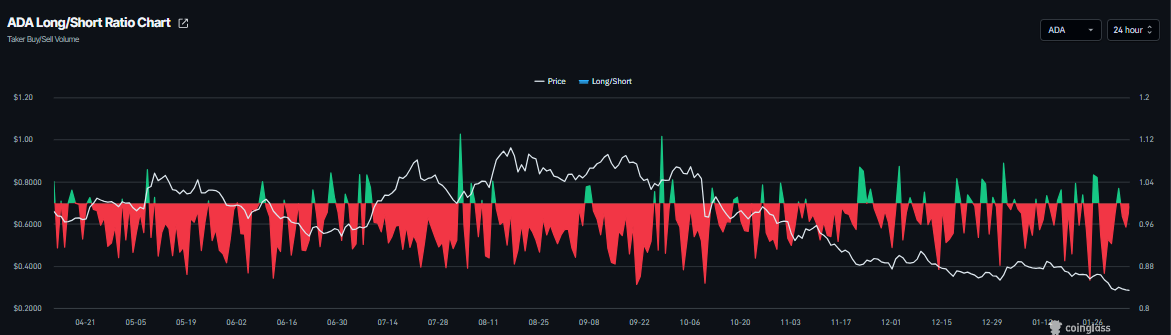

In addition, CoinGlass’s ADA long-to-short ratio stands at 0.95 on Thursday. This ratio, below one, reflects bearish sentiment in the markets, as more traders are betting on the asset price to fall.

Cardano Price Forecast: ADA bears in control

Cardano’s price declined by more than 15% last week, retesting the October 10 low of $0.27 on Saturday. ADA has traded red since Tuesday and, as of Thursday, is trading at $0.28.

If ADA continues its downward trend, it could extend the decline toward the October 21, 2023, low of $0.24.

The Relative Strength Index (RSI) on the daily chart stands near 30, pointing downward toward the oversold territory, indicating strong bearish momentum. The Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover on January 18, which remains intact and thus further supports the negative outlook.

On the other hand, if ADA recovers, it could extend the recovery toward the daily resistance at $0.32.